The FTSE 100 is up more than 12% over the last year but is still packed with great-value income stocks, many of which offer ultra-high dividend yields.

Two blue-chips yield more than 9% a year, smashing the return on cash or bonds. While dividends are never guaranteed, I think they may prove sustainable. I own both stocks and I’m keen to buy more before they go ex-dividend on 26 September.

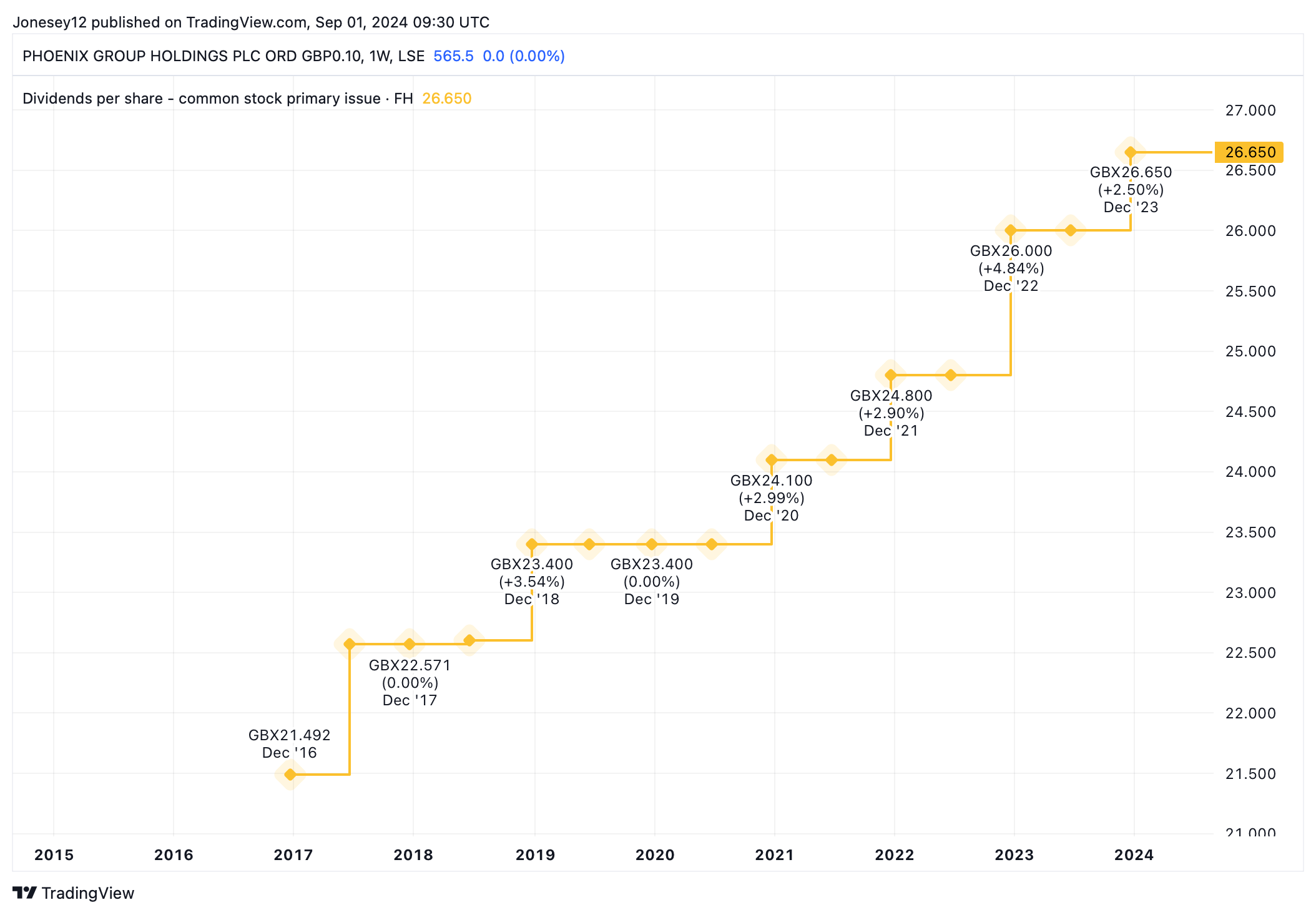

Insurance conglomerate Phoenix Group Holdings (LSE: PHNX) offers one of the highest trailing yields on the entire index at 9.36%. It also has a pretty good track record of increasing shareholder payouts, year after year, as this table shows.

Chart by TradingView

Is the Phoenix dividend sustainable?

To fund this shareholder largesse, a company needs to generate heaps of cash. Happily, Phoenix has been doing well on this front, beating its own targets to hit £2bn last year.

The share price will never fly but it did climb 4.34% in August. Over one year, it’s up 10.02%. OK so it’s hardly Nvidia-style growth , but throw in the yield and I’m looking at a potential total return of around 20% a year.

Phoenix must work hard to keep posting sales and cash flow, as it operates in the mature and competitive UK insurance market. There are new growth opportunities emerging, notably in bulk annuities, but it’s not the only one chasing them.

Trading at 17.3 times earnings, the shares aren’t super-cheap. That’s just above the FTSE 100 average P/E of 15.3 times. However, I think there’s a real opportunity here. As interest rates are cut, the income from cash and bonds will inevitably fall. That will make high-yielders like this one appear even more attractive.

The same goes for my second high-income pick for September, wealth manager M&G (LSE: MNG). This also has a bumper trailing dividend yield, only marginally behind Phoenix at 9.19% a year.

Can M&G afford its sky-high dividend too?

When M&G’s last dividend hit my trading account on 13 May, I certainly knew about it. My 3,289 shares paid me £406.77, which I reinvested straight back into the stock, thereby picking up another 196 M&G shares. They’ll pay me dividends too, in future, and I’ll reinvest every penny to build up my stake.

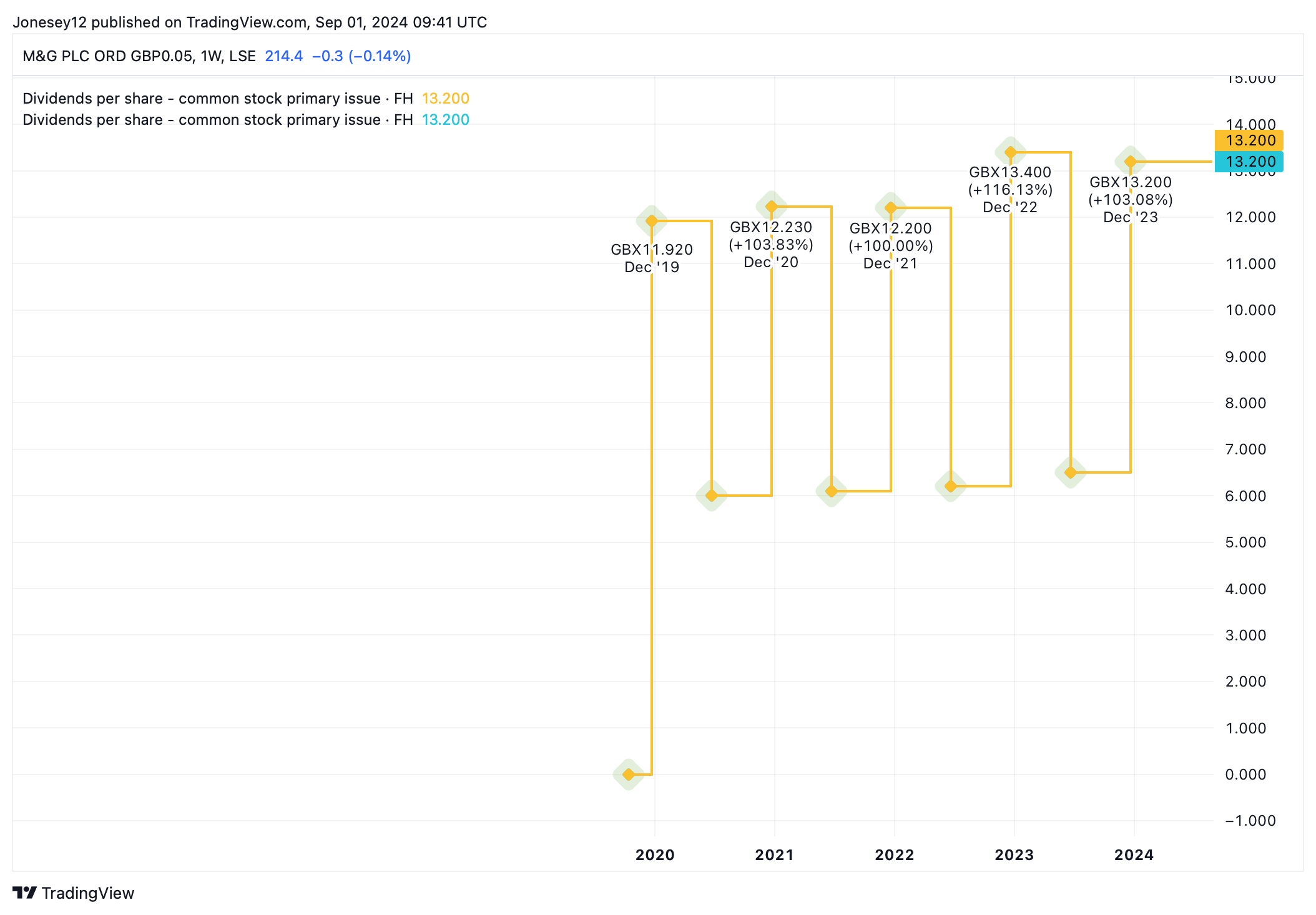

The downside is that I don’t expect rapid dividend growth going forward, given that M&G only lifted the 2023 payout by a measly 0.1p to 19.7p. Let’s see what the chart says.

Chart by TradingView

The M&G share price is actually up 12.93% in the last year, so again, I’m heading for a 12-month total return of more than 20%. The shares have underperformed since the group was spun off from insurer Prudential in 2019, but I’m hoping for better days when economic and stock market sentiment picks up.

Again, M&G shares were cheaper when I bought them. Today they trade at 16.8 times earnings, just above the FTSE 100 average. That won’t stop me buying them though. I just need to scrape the money together before they go ex-divi on 26 September. Otherwise I’ll kick myself for missing out on yet more dividends.

This post was originally published on Motley Fool