Since 11 October 2022, the Next (LSE:NXT) share price has been the fourth-best performer on the FTSE 100. Beaten only by 3i Group, Marks and Spencer and Rolls-Royce Holdings, the retailer has managed to deliver exceptional share price growth by selling mass-market-to-premium clothing and homewares.

Insider transactions

However, over the past three weeks, two of the company’s directors have been reducing the size of their shareholdings.

In late September, Lord Wolfson, the chief executive, sold 290,000 shares for £29.23m (£100.08 a share). On 9 October, Jeremy Stakol (and his wife) disposed of £2.6m of stock. The CEO of its Lipsy unit sold at an average price of £98.79.

As a shareholder, I try to ignore the commentary surrounding such sales.

There are many personal reasons why someone might want to dispose of their shares. And I don’t think it’s unreasonable for an individual who has a large proportion of their wealth tied up in one investment to — periodically — convert some of it into cash. After all, you can’t spend shares.

But as with so many things in life, timing is everything.

These disposals occurred after the company issued its half-year results for its 2025 financial year (FY25). It issued another earnings upgrade and now expects to record a FY25 profit before tax of £995m.

That’s probably why — as I write (11 October) — the company’s share price remains above £100. Investors don’t appear to be too alarmed by these insider transactions.

Inside the boardroom

Like me, I suspect they have confidence in the leadership of Lord Wolfson. When he took over the running of the business in August 2001, he was the FTSE 100’s youngest CEO.

Back then, the company’s share price was around 940p. An investment of £10,000 at the time would now be worth more than £107,000. No wonder his total remuneration package was £4.52m last year.

Of course, nothing is guaranteed when it comes to investing. History doesn’t necessarily repeat itself.

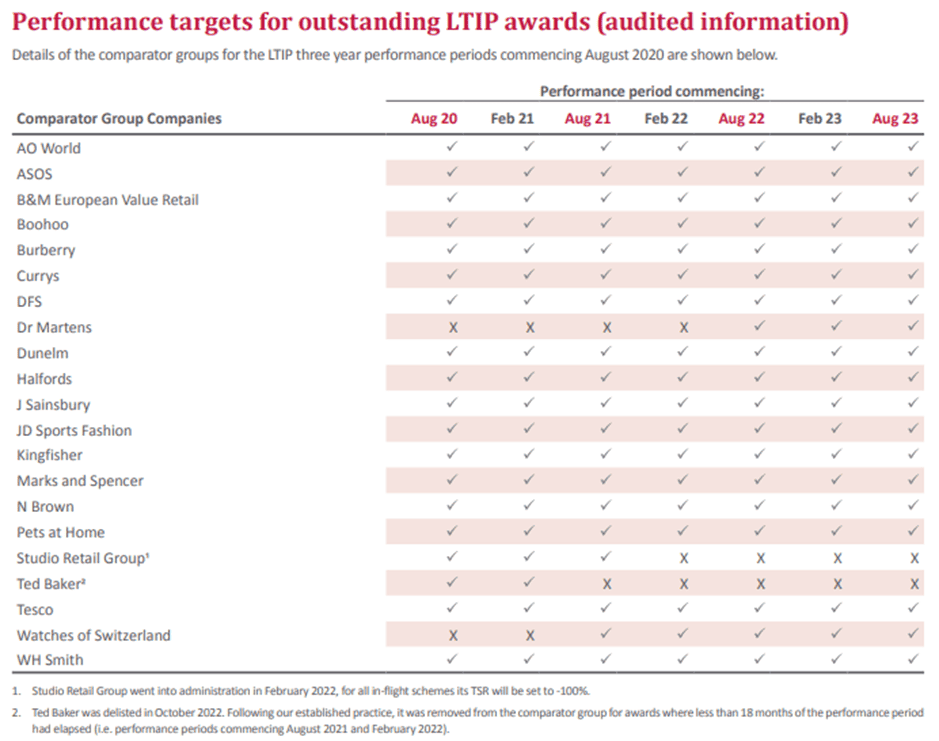

However, all of Next’s directors are participants in the company’s long-term incentive plan. They receive 100% of their bonus if the retailer can deliver total shareholder returns — over three years — greater than 80% of 20 other listed “broadly comparable” businesses.

This seems like a sensible metric for measuring performance. And it means the interests of the directors are closely aligned with mine.

As the table below shows, since August 2020, very few have done better than Next.

Despite the impressive growth in its share price and earnings, the stock trades on a reasonable forward price-to-earnings ratio of 14.2.

Okay, it’s not in bargain territory — it’s broadly in line with its average over the past 20 years — but it suggests to me that the shares aren’t unreasonably priced.

Possible challenges

However, keeping its clothing relevant is a constant challenge. It’s also vulnerable to the rise of ‘fast fashion’ and others producing cheap imitations.

In addition, it’s heavily exposed to the domestic economy — 84% of its revenue came from the UK in FY24. A fall in disposable incomes would affect its sales and earnings.

But over the past two decades, under Lord Wolfson’s stewardship, the company’s overcome many challenges. It’s done better than many of its rivals and I see no obvious reason why this can’t continue.

This post was originally published on Motley Fool