Another day, another achievement for Nvidia (NASDAQ: NVDA) stock yesterday (5 November). That’s because the chipmaker reclaimed its crown from Apple to become the world’s largest company.

Both have market-caps above $3.3trn! Yet Nvidia ended 2014 with a market-cap of just $11bn, meaning its meteoric rise is truly mind-boggling. Unprecedented even.

But where do the experts see the Nvidia share price heading over the next 12 months? Let’s take a look.

Consensus forecast

Now, I’d take the following predictions with a pinch of salt. In my experience an analyst’s price target can resemble a weather vane in shifting winds, constantly adjusting to follow the stock’s latest direction.

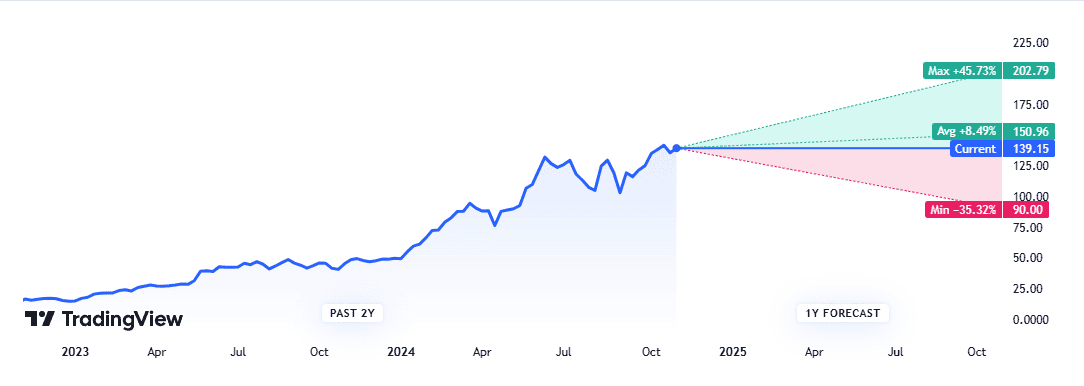

As we can see, Wall Street analysts’ 12-month Nvidia price targets cover a wide range. We’ve got a high of $202, representing potential share price growth of 46% from $139. Then there’s a low of $90, suggesting a possible 35% decline.

From the 55 analysts offering 12-month share price targets, the average figure’s $150. That’s around 8% higher than $139.

The main takeaway here is that nearly every single broker is bullish on the stock. An incredible 60 out of 65 analysts rate it as either a Strong Buy or Buy! None currently have the stock down as a Sell.

| Analyst recommendations | November 2024 |

|---|---|

| Strong buy | 51 |

| Buy | 9 |

| Hold | 5 |

| Sell | 0 |

| Strong sell | 0 |

Of course, this could quickly change after the company reports its Q3 2025 earnings on 20 November.

What are the experts expecting in Q3?

In recent years, Nvidia’s tended to smash Wall Street expectations. But this trick could get harder to repeat and spending on artificial intelligence (AI) chips becomes more predictable.

In a worst-case scenario, AI spending could start falling sharply next year as large tech firms reign in their enormous investments. It’s possible we look back in a few years’ time and see Nvidia’s revenue growth was unsustainable.

It’s also worth remembering that transformative new technologies almost always come with initial investor hype, including overestimations of their immediate world-changing applications. The internet, 3D printing, and cryptocurrencies spring to mind. All created bubbles.

As US scientist and futurologist Roy Amara famously said: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”.

Is it truly different this time with generative AI? Only time will tell. But for now at least, demand for Nvidia’s AI chips remains incredibly high and analysts expect more eye-popping growth in Q3.

| Q3 Forecast | Year-on-year growth | |

| Revenue | $32.9bn | 81.8% |

| Operating profit | $21.7bn | 87.9% |

| Earnings per share (EPS) | $0.74 | 84.5% |

Not an AI bear

To be clear, I’m not a bear that’s come out of its cave on AI. CEOs far smarter than me are predicting transformative things from the disruptive technology.

And despite selling my holding in Nvidia earlier this year, most of my portfolio’s still invested in firms harnessing AI. Axon Enterprise, for example, has developed an AI tool that creates a rough draft of a police report using body-worn camera audio. It can save each officer an hour of paperwork every shift!

Still, Nvidia stock’s currently priced for absolute perfection. So I’d be careful about investing a large amount. Instead, I’d wait for pullbacks and consider pound-cost averaging my way into a position over time.

This post was originally published on Motley Fool