Given recent policy actions from the Bank of England (BoE), I believe that further interest rate cuts are coming over the next year. As a result, the ability for an investor to make high levels of passive income from a normal savings account should diminish.

Here’s why I feel that buying dividend stocks as an alternative second income source is soon going to become very popular.

Moving lower

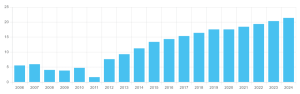

In the November policy meeting, the committee at the BoE decided to reduce interest rates again, down to 4.75%. Based on current market expectations, three more cuts are expected next year. This would bring the base rate down to 4%. Of course, this isn’t guaranteed. But the direction of travel for interest rates is definitely lower.

This means the income an investor can earn from simply leaving money at the bank should fall as well. Given that the banks take a profit margin too, if the base rate is 4% the actual interest rate to a client is probably 3.5%.

I refer to it as a once-in-a-decade opportunity to flip to another passive income source because this is the usual timeframe of an interest rate cycle. If an investor can shortly move away from excess savings earning interest before the rates drop more, it could be a smart move. It could be another decade before we see interest rates rising again back to the current level.

Snapping up options

The other side of the opportunity is buying dividend stocks. This too could be time sensitive. Typically, when interest rates fall, the economy’s performance improves. This in turn helps to fuel a stock market rally. Dividend yields can fall in this scenario, as the calculation factors in the dividend per share relative to the share price. So if the share price rises but the dividend stays the same, the overall yield will fall.

Therefore, an investor might want to consider buying top dividend stocks while the yields are still attractive. One example to research might be Zigup (LSE:ZIG). The vehicle rental and fleet management firm has a current dividend yield of 6.88%. Over the past year, the stock’s up 3%.

The financial year for the company runs from April to April, so the results released in late July include a portion of 2024. It showed a 23% increase in revenue, with underlying profit before tax up 8.9% from the previous year. The dividend per share was also bumped 7.5% higher.

Zigup has paid out dividends consecutively for the past decade. I think it’s sustainable enough to continue in the future. There’s constant demand in the sector from both commercial and private clients. Further, there’s large potential for growth in Europe outside of current Spanish operations.

One risk with Zigup is that is needs to pay attention for almost constant de-aging of the fleets, as older vehicles need to be swapped out. This represents high capital expenditure.

Pivoting from one to the other

By swapping out funds in savings accounts that will likely be getting lower income and buying dividend stocks like Zigup with good yields, I feel investors may be interested in the opportunity in coming months.

This post was originally published on Motley Fool