There’s undeniable evidence that some S&P 500 stocks offer better short-term growth potential than UK stocks. But when it comes to passive income, my FTSE 100 stocks typically provide me with more consistent and reliable returns.

That must be why I regularly find myself coming back to the UK’s main index when the economy is shaky. There’s a calm but stubborn resilience to some UK stocks that exhibit evidence of secure defensiveness. Maybe it’s just the familiarity of companies I know and trust – but I suspect there’s more to it.

With a large base of companies, some operating for over 200 years, the UK market has deep roots. It’s the type of foundation that remains firm and steadfast while economic shockwaves send other markets tumbling.

That’s just one of several reasons I’m a fan. Here are some others.

Dividends

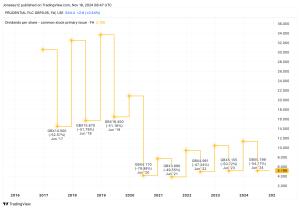

Take Legal & General (LSE: LGEN), for example. The 188-year-old insurer is well-known for maintaining a consistently high dividend yield. Typically ranging between 7% and 9%, it’s significantly higher than the S&P 500 average, which hovers around 1.5% to 2%.

Growth-oriented companies like those in technology (Apple or Amazon, for instance) focus on funnelling profits into the company rather than to shareholders. Subsequently, they often pay low — or no — dividends.

Defensive nature

As mentioned, I find a high degree of resilience – or ‘defensiveness’ – in UK shares. This improves the chances of maintaining a stable passive income stream. I like adding some defensive stocks to a portfolio for stability.

Legal & General isn’t the most defensive of stocks. It may have grown 447% in the past 30 years but it has been very volatile. It crashed 81% in 2008 during the financial crisis and 49% during Covid.

Better examples of truly defensive stocks are Unilever or AstraZeneca. Both pay less in dividends but experience far less volatility. The S&P 500 also has some less volatile stocks like Procter & Gamble or Lockheed Martin but with less attractive dividends.

Risks

While defensive dividend stocks can offer reliable income they don’t necessarily provide optimal returns in all cases. It’s possible to get better returns by actively trading the highs and lows of growth stocks but this is risky.

Also, dividends aren’t guaranteed — they can be cut or reduced at any time. Legal & General reduced its dividend in 2008 and again in 2009. An economic downturn or market crash could lead to more cuts in future. A drop in earnings can also lead to dividend cuts if the company needs to save money for daily operations.

With tough competition from insurers like Aviva and Prudential, L&G is always at risk of losing its market share. Of particular concern is its high debt load of £28.2bn, which can put a strain on operations and hinder expansion.

Identifying value

Some high-yield dividend shares are misleading and can be nothing more than a value trap. Legal & General looks good to me at the moment because while the price is low, earnings are forecast to grow at a rate of 28% per year.

That gives the stock a forward price-to-earnings (P/E) ratio of 10.6, exhibiting strong value. So long as it can manage its debt, I think it will do well in the coming years and is worth considering as part of an income portfolio.

This post was originally published on Motley Fool