Estimates suggest there were around 4,000 Stocks and Shares ISA millionaires in the UK last year. It’s a financial dream that many Brits have – not just for the freedom it brings, but because it keeps their hard-earned gains safely out of reach of HMRC. UK residents can invest up to £20,000 per year in an ISA without paying tax on the capital gains.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Finding out what kind of shares these millionaires choose to invest is interesting. After all, if it works for them, replicating their holdings might seem like a financial fast track. But before jumping to conclusions, it’s worth considering whether their options are truly a one-size-fits-all recipe for success.

Top picks among ISA fat cats

The knee-jerk reaction would be to assume they’re all invested in top growth stocks like Rolls-Royce and AstraZeneca. But according to data from top brokers, the most popular stocks are well-established blue-chips like Shell and Lloyds.

Naturally, US giants like Apple and Microsoft are also common, but less so than big UK dividend payers like Legal & General and HSBC (LSE: HSBA). This is because most ISA investors are focused on earning passive income for retirement.

A strong dividend payer

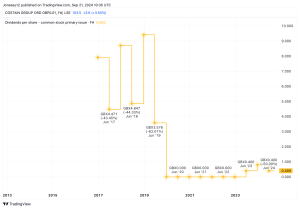

Let’s take HSBC, for example. Up only 6.8% this year, the stock isn’t exactly killing it. But at 7.2%, its current dividend yield is attractive. Last year, shareholders earned an extra 48p for each share held. That’s a decent return – even if the share price remains sluggish. And by reinvesting those dividends, the compounding returns can really add up!

However, while the bank has paid dividends for over 20 years, they’ve fluctuated significantly – particularly during times of economic turmoil. Remember, dividends aren’t guaranteed. A company can reduce or cut them entirely at any time. But barring Covid, HSBC’s yield has remained above 5% for most of the past decade.

Strong financials

Performance-wise, the bank’s been doing well compared to rivals. In its recent Q1 earnings report, revenue increased 24%, beating analyst expectations, and net income grew 2.5%. The positive results helped push the price up to a yearly high of 720p in early May.

But things have slowed since.

The price dipped 2.7% in June to 673p. Economic uncertainty ahead of the election combined with the holiday season slowdown may be one reason. But recent staff cuts and a pause in hiring may point to a wider concern. The cost-cutting drive also includes limits on travel and entertainment expenses for investment bankers.

Another reason may be falling inflation. The Bank of England (BoE) is expected to reduce interest rates at the next monetary policy meeting on 1 August. Barclays has already introduced a 4.23% five-year fixed rate for mortgages, prompting HSBC to cut its rates too.

The right choice?

HSBC is an example of a long-term hold for me with an aim to keep it for retirement income. Those looking for more rapid gains might be less enamoured by it. But overnight millionaire status doesn’t come easy. As the saying goes, “slow and steady wins the race”.

A diversified portfolio of shares with reinvested dividends and compounding returns is a proven method of wealth accumulation. Remember, 4,000 ISA millionaires can’t all be wrong!

This post was originally published on Motley Fool