We can earn passive income by investing in dividend-paying stocks. But picking these investments can be challenging or even daunting to novice investors.

So if I had £10,000 in the bank, where would I invest? Let’s take a closer look.

Food for thought

Firstly, it’s important to understand that dividend yields and share prices are inversely correlated, meaning as share prices fall, dividend yields rise, and vice versa.

This suggests that the best dividend opportunities can be found in overlooked sectors or markets.

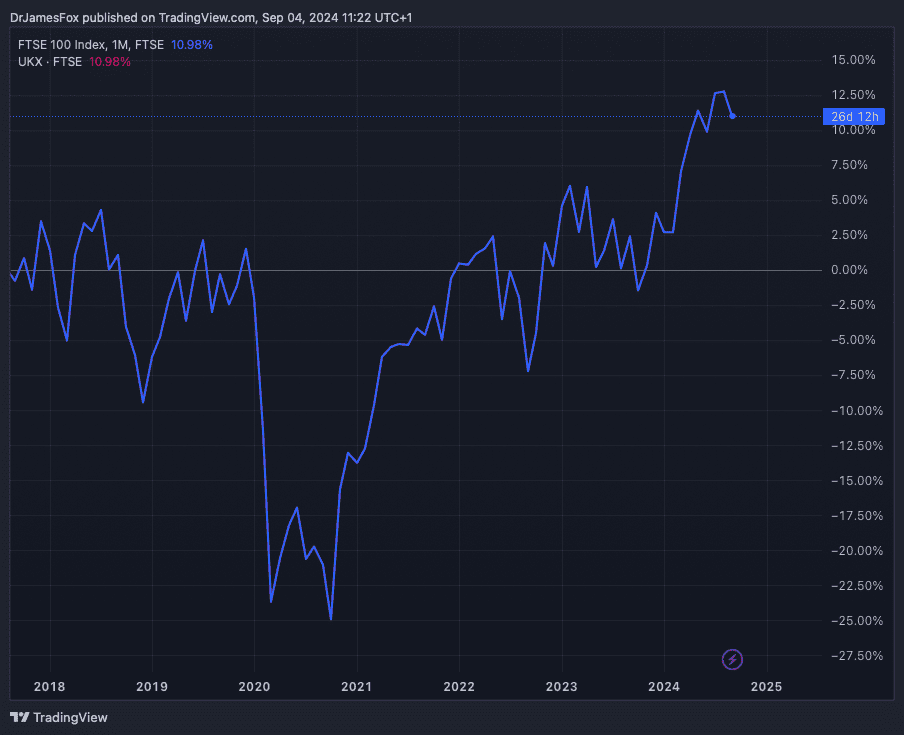

For example, many UK stocks are still cheap on a relative basis and offer large dividend yields despite the FTSE 100 nearing all-time highs. The reason? A decade of underperformance and poor investor sentiment.

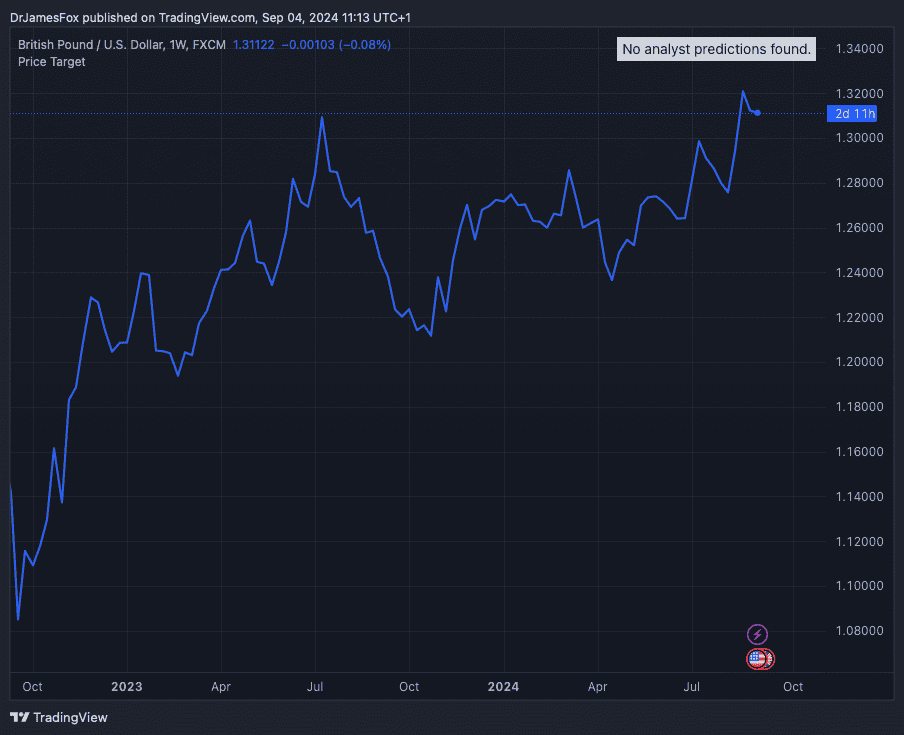

Secondly, the pound’s relative strength against the dollar could make US dividend stocks more appealing to UK investors. A stronger pound means investors can purchase more dollars, potentially increasing their buying power in the US market.

If the pound were to depreciate from here, investors would be receiving more dollars than if they bought today.

The caveat is that investors may have to search harder for big and sustainable dividend yields in the US. Because US stocks have outperformed their UK counterparts over the last decade, dividend yields are typically smaller.

Ticking both boxes

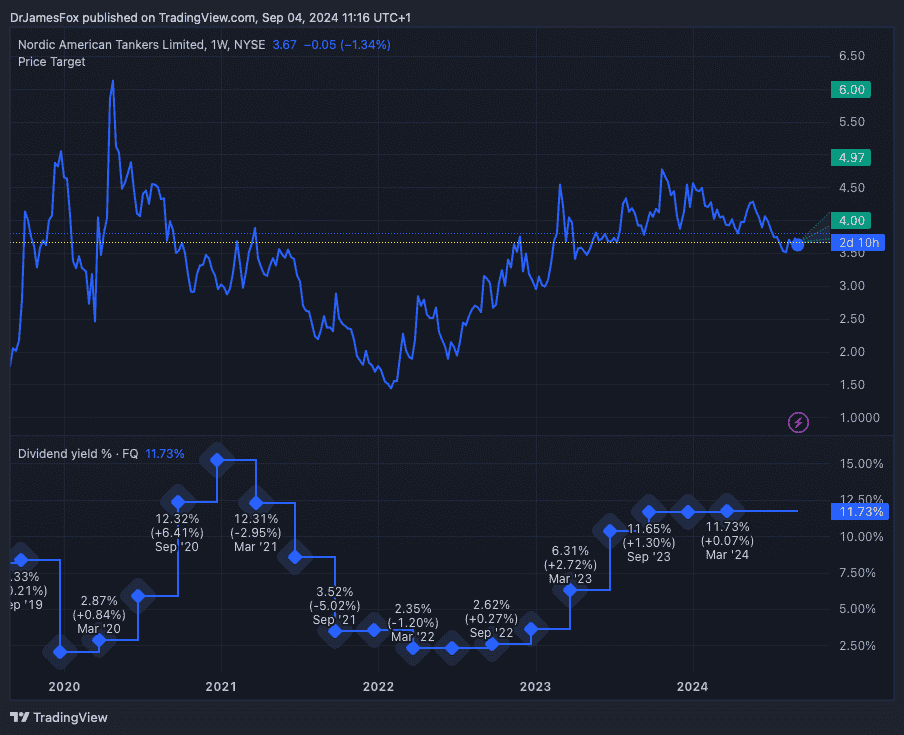

One dividend stock worth considering is US-listed Nordic American Tankers (NYSE:NAT), which currently offers a 12.9% dividend yield.

The company operates a fleet of 20 Suezmax oil tankers and has been reporting healthy EBITDA margins and cash flows due to strong day rates — the cost of leasing its vessels.

Day rates have surged as a result of a lack of supply and due to rerouting following attacks on vessels in the Red Sea.

With average time charter equivalent rates above $35,000 a day and daily operating costs of $9,000 a ship, you can see why I’m bullish.

Moreover, industry trends suggest sustained demand and limited supply growth through 2026, supporting the likelihood of continued high day rates.

Nonetheless, I appreciate that the stock could be easily rocked by economic data, such as weak Chinese or US economic growth and oil demand.

However, analysts estimate total returns of 15-20% over the next 12-15 months, making Nordic American an attractive option for income-focused investors.

The below chart shows the share price — along with the median, high, and low target price — and the dividend yield history.

Diversity is key

As much as I like Nordic American, it’s vitally important to maintain a diverse portfolio, so investors should consider a variety of stocks across different sectors.

This could include, say, Greencoat UK Wind in renewables, Phoenix Group in insurance, Lloyds in banking, Rio Tinto in mining, BT Group in communications, and GSK in pharma.

These are just ideas, but if I were to invest in these six stocks, plus Nordic American, I’d have a relatively diverse portfolio of dividend-paying stocks.

Collectively, these investments, if spread equally, would return around 6-7% annually. That’s certainly not a bad return.

This post was originally published on Motley Fool