If the experts are right, the Rolls-Royce (LSE:RR.) share price could increase by 4.9% over the next year. That’s because the consensus (median) forecast of the analysts covering the stock is 555p. However, this convergence close to the current (20 November) share price of 529p, disguises a significant variation in views.

One ‘expert’ believes that a fair price is 240p.

Another analyst reckons a figure of 701p is justified.

Expressed another way, the most optimistic believes the company’s 33% (£14.9bn) undervalued, whereas the most gloomy claims it’s 54% (£24.3bn) too expensive. Obviously, they both can’t be right.

And this illustrates why I find investing in the stock market so fascinating. It intrigues me that two apparently well-informed individuals, looking at the same financial information and other data, can come up with such opposing views.

Yin and yang

With a price target of 240p, Berenberg’s pessimism comes from its belief that the anticipated improvement in margin through until 2027, could reverse thereafter.

It also cites “reliability issues” for key engines as a concern. It’s worried that the company’s Trent XWB-97, which powers the Airbus A350-1000, has experienced problems. And the merchant bank’s “surprised at how sanguine the market is about the issues”. It says: “If history is a guide, this is the kind of issue that can derail medium-term margins for companies in the jet engine business.”

In contrast, others see a continued post-pandemic increase in engine flying hours as the catalyst for growth.

As the table below shows, these have yet to match their peak, achieved in 2019. But the company’s target for 2024 is 100%-110% of this number.

| Year | Large engine flying hours (m) |

|---|---|

| 2016 | 11.2 |

| 2017 | 12.6 |

| 2018 | 14.3 |

| 2019 | 15.3 |

| 2020 | 6.6 |

| 2021 | 7.4 |

| 2022 | 10.0 |

| 2023 | 13.5 |

And looking further ahead, the company’s growth prospects appear to be encouraging.

It’s making good progress with its factory-built nuclear power stations (small modular reactors). The Czech government has already chosen the British engineering giant as its partner to develop the new technology, with Sweden and the Netherlands expected to follow soon. However, significant revenue is not expected before 2030.

Anticipated earnings growth

The analysts are expecting earning share (EPS) of 29.3p by 2027. This implies a forward price-to-earnings (P/E) ratio of 18. This is not unreasonable for a rapidly growing engineering-cum-technology group.

But based on expected EPS for 2024 of 18.7, the P/E ratio increases to an expensive 28.3.

However, applying this to the forecast of earnings in 2027 would result in a share price of 829p. On this basis, the most optimistic analysts’ prediction (701p) seems very reasonable.

| Year | Forecast earnings per share (pence) | Forecast dividend per share (pence) |

|---|---|---|

| 2024 | 18.7 | 5.0 |

| 2025 | 21.9 | 7.1 |

| 2026 | 25.6 | 9.5 |

| 2027 | 29.3 | 11.0 |

Overall, 13 analysts are telling their clients to buy Rolls-Royce stock, including six who consider it to be a ‘strong buy’. Three are neutral and one is recommending selling.

My verdict

I already own shares in the company but I don’t want to increase my position further.

In my opinion, the rapid increase in the company’s share price is not likely to continue. Given the strong rebound in the flying hours, I suspect future growth will probably be more modest.

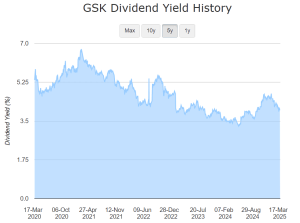

And I try not to concentrate too much of my portfolio in shares with miserly dividends. A yield of less than 1% isn’t particularly appealing. I’d rather use my surplus cash for stocks that offer a return closer to the FTSE 100 average of 3.8%.

For these reasons, I’m going to keep my holding at its current level.

This post was originally published on Motley Fool