The chips that Nvidia (NASDAQ: NVDA) designs continue to power the ongoing artificial intelligence (AI) revolution. Remarkably, its stock has surged by around 24,000% over the past decade.

This means a £5,000 investment made in September 2014 would now be worth over £1m!

While it’s impossible to predict with certainty which stock will become the next ‘millionaire-maker’ — I wish it was that easy — there are certain characteristics that often accompany such investments.

Here are some main ones:

- Secular trends: the firms are in industries that are experiencing rapid growth or disruption.

- Non-stop innovation: high research and development (R&D) spend reflects a focus on innovation.

- Founder mode: founders often think in years (or decades) rather than quarters like some hired CEOs.

- ‘Overvalued’: big winners almost permanently look overvalued by conventional metrics.

A founder-led innovator

Unsurprisingly, Nvidia ticks all these boxes. Its graphics processing units (GPUs) have powered high-growth industries like gaming, crypto mining and, more recently and most significant of all, AI.

The chipmaker spends a tonne on R&D and product innovation. Last year, it allocated $8.6bn to R&D, up from $1.8bn in FY18.

A decade ago, the stock was overvalued by most traditional metrics. Surprise surprise, it is today too. That’s why it’s more important, in my view, to focus on whether the firm’s growth engines are still firing.

Finally, Nvidia is led by visionary founder Jensen Huang. He had the moral authority to risk pivoting the business towards AI computing a few years ago. In contrast to this, manager-led Intel has been slow to capitalise on the AI revolution.

Today however, Nvidia’s customers are highly concentrated among large tech firms. If these pull back on AI spending, growth could quickly stall.

Similarities

A stock that I think will also be a big long-term winner is Shopify (NYSE: SHOP).

The company’s platform lets users effortlessly create online stores in minutes. It offers built-in tools for inventory management, payment processing, shipping, and more.

While many e-commerce firms have struggled post-Covid, Shopify is still growing. Last year, revenue jumped 26% to $7.1bn. In the first six months of 2024, it climbed 22%. The growth engine is still purring.

Crucially for me, the management team is very innovative and long-term oriented. Indeed, Shopify says it’s “building a 100-year company“.

Last year, CEO Tobias Lütke sold off the firm’s capital-intensive logistics division. Not only is this improving margins, it’s allowing Shopify to fully concentrate on developing AI-powered tools.

In the second quarter, brands including Toys ‘R’ Us, Mas+ by Lionel Messi, and Dios Mio Coffee by Sofia Vergara launched on the Shopify platform.

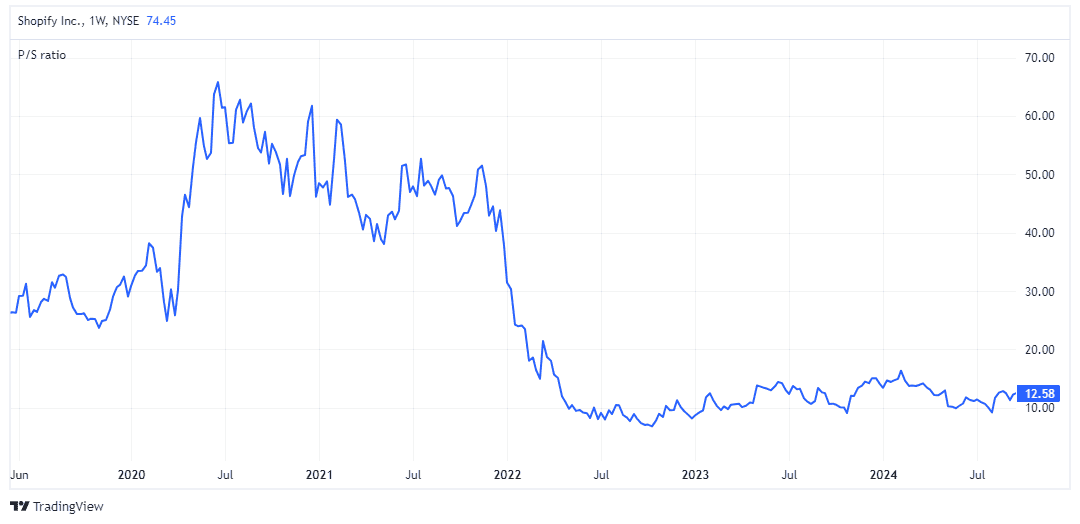

With a price-to-sales (P/S) ratio of 12.5, the stock isn’t cheap. But it’s a sizeable discount to previous years.

One risk to Shopify’s growth is weak consumer spending amid stubbornly high inflation. Another would be a recession in the US, its largest market.

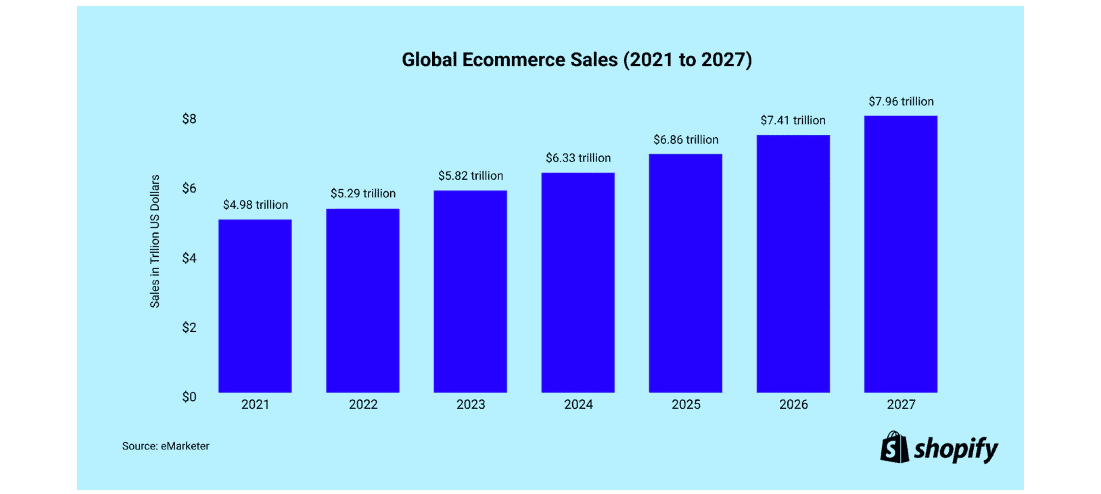

However, global e-commerce sales are still projected to reach nearly $8trn by 2027, up from $5.8trn in 2023. So the secular trend of online shopping continues apace.

As the clear leader in e-commerce software, the firm stands to benefit directly.

Ultimately, we don’t know where the next millionaire-makers are hiding. But to me, Shopify shares many similar traits to Nvidia, which is why it’s my third-largest holding today.

This post was originally published on Motley Fool