Over the past year or so I’ve become accustomed to seeing bullish broker forecasts for the Lloyds Banking Group (LSE: LLOY) share price.

But looking at the latest January summary from the London Stock Exchange Group, I’m surprise to see the consensus downgraded to Neutral. Just three months ago we had a solid Buy consenus.

And of five analysts out of 17 who had the stock as a strong Buy three months ago, only two of them still rate Lloyds so highly. What should private investors make of this?

Mixed reaction

Firstly, I think we need to sit back a bit and take this kind of stuff in our stride. After all, contrarians are always looking for the ones the City folk get wrong, right?

Short-term uncertainty weighs on the professionals. And it’s the kind of uncertainty that long-term Foolish investors are better able to overlook. But at the same time, I’d never ignore what the City is saying about any stocks I’m interested in. It’s very much a part of my strategy to consider all opinions before I make up my own mind.

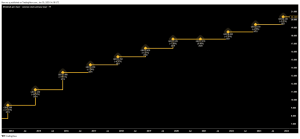

A number of recent events have changed the short-term landscape for Lloyds. Not the least of which is the share price, which has risen 48% in the past 12 months, though not close to the doubling achieved by Barclays. Maybe Lloyds was a screaming buy a year ago, but the shouting seems quieter now.

The consensus price target at the moment is still only around 65p. That’s just a few pennies above the current price, so that alone might be all that lies behind the softening stance.

Threats

Lloyds has been in the news recently for what many might see as a disturbing reason. It’s planning to close another 136 branches. That’s about 10% of the UK total, and it makes the term ‘high street bank’ seem increasingly historical.

It’s not such bad news for shareholders though, as it’s really just part of the growing shift from cash to digital transactions. If anything, it should cut costs and hopefully help maintain profit margins. It doesn’t make the stock any less attractive for me.

The ongoing car loan mis-selling investigation is more worrying. The recent intervention from Chancellor Rachel Reeves has settled my nerves a bit, however. She’s urged the Supreme Court that “any remedy should be proportionate to the loss actually suffered by the consumer and avoid conferring a windfall“.

That could help ease fears that Lloyds could be hit for as much as £1.5bn.

Why buy?

We’re looking at a forecast price-to-earnings (P/E) ratio of 10, on the low side by FTSE 100 standards. But in the current economy, I think that might be about right. There’s a forward dividend yield of 4.6%, which I rate as decent for a bank. It’s not the best though, with HSBC Holdings on a predicted 5.8%.

But considering my optimistic view of the long-term outlook for banks and mortgage lenders, I’m holding my Lloyds shares. And I could see myself topping up in the future.

This post was originally published on Motley Fool