As older investors — both approaching 57 — my wife and I are planning for retirement. Currently, we both work, but will eventually exit the working world. Hence, we aim to build up our passive income to replace our earnings over time.

What’s our target income?

It would be tough to replace our earned income without hard work and good fortune. Still, our first goal is a passive income of £100,000 a year — easily enough to live on, even after tax.

How much capital generates £100k a year before tax? This table shows a range, based on investment returns:

| Yearly return | Pot required |

| 4% | £2,500,000 |

| 6% | £1,666,667 |

| 8% | £1,250,000 |

| 10% | £1,000,000 |

| 12% | £833,333 |

With a long-term return of 10% a year, we need £1m to generate £100k a year of investment income. History suggests that such high returns rarely persist, so our pot — and passive income — might start shrinking.

This table also doesn’t factor in the rising cost of living. For example, with inflation of 3% a year, the buying power of £100k today would drop to £74,409 after 10 years. Therefore, we must ensure that our income can weather stock-market storms and higher inflation.

I’ll play it safe

Based on historical data, I’m aiming to withdraw, say, 4% a year, regardless of our future investment returns. History suggests that this withdrawal rate is realistic and prudent over many decades. Indeed, such a modest withdrawal rate might allow our capital to outlast us.

Accordingly, to generate a passive income of £100k a year based on a withdrawal rate of 4% a year, we need £2.5m in income-generating assets. But this won’t be as much of a problem as it looks, because we already have some guaranteed pensions.

Pensions are passive income too

My wife and I started work in the late 1980s, building up pensions over 35 years. We should both receive the full State Pension at age 67 in 2035. By then, this will be worth over £25,000 a year between us.

My wife also has a company pension paid since 2021. This is around £25,000 a year, boosting our guaranteed retirement income above £50,000 a year. This leaves us with £50,000 a year of passive income to find elsewhere, which we can achieve.

‘Free’ money from shares

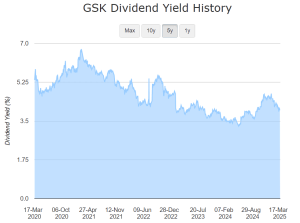

My favourite form of passive income is the cash dividends from certain shares. Though future payouts aren’t guaranteed, most FTSE 100 firms pay regular dividends. And one Footsie stock we hold for passive income is investment manager M&G (LSE: MNG).

Founded in 1931, M&G launched the UK’s first unit trust that year. It has since grown to manage financial assets worth around £350bn. After peaking at 241.1p in 2024, the M&G share price now stands at 211.6p. This leaves the shares down 3.9% over one year and 11.7% over five years.

Today, this share delivers a delicious dividend yield of 9.36% year — one of London’s highest. Furthermore, M&G’s yearly payout has risen from 15.77p a share for 2019 to 19.7p for 2023 (up 24.9%) and might keep climbing.

Of course, as a wealth manager, M&G’s success depends on (sometimes volatile) financial markets. During turbulent times, its profits have been battered by falling asset prices, most recently in 2020 and 2022. But we’re happy to own this stock for powerful passive income!

This post was originally published on Motley Fool