Warren Buffett would know if the US stock market was overvalued and due for a correction or crash. The fact that the Oracle of Omaha has been building his cash position, now at a record $277bn, could indicate that the valuation of many top American companies is currently unsustainable.

However, Buffett has also been securing Berkshire Hathaway’s legacy, including passing on the reins to new CEO-in-waiting Greg Abel. So, I think the big cash pile could be the investor’s way of allowing for flexibility and readiness for Abel’s tenure while preserving his remarkable track record.

Should I stop investing?

Firstly, I will never stop investing. I believe that there are always companies that the market is undervaluing and are worth my money, even in the hardest of times.

However, I also think that the valuation of the S&P 500, which is America’s most famous index, is potentially problematically high right now.

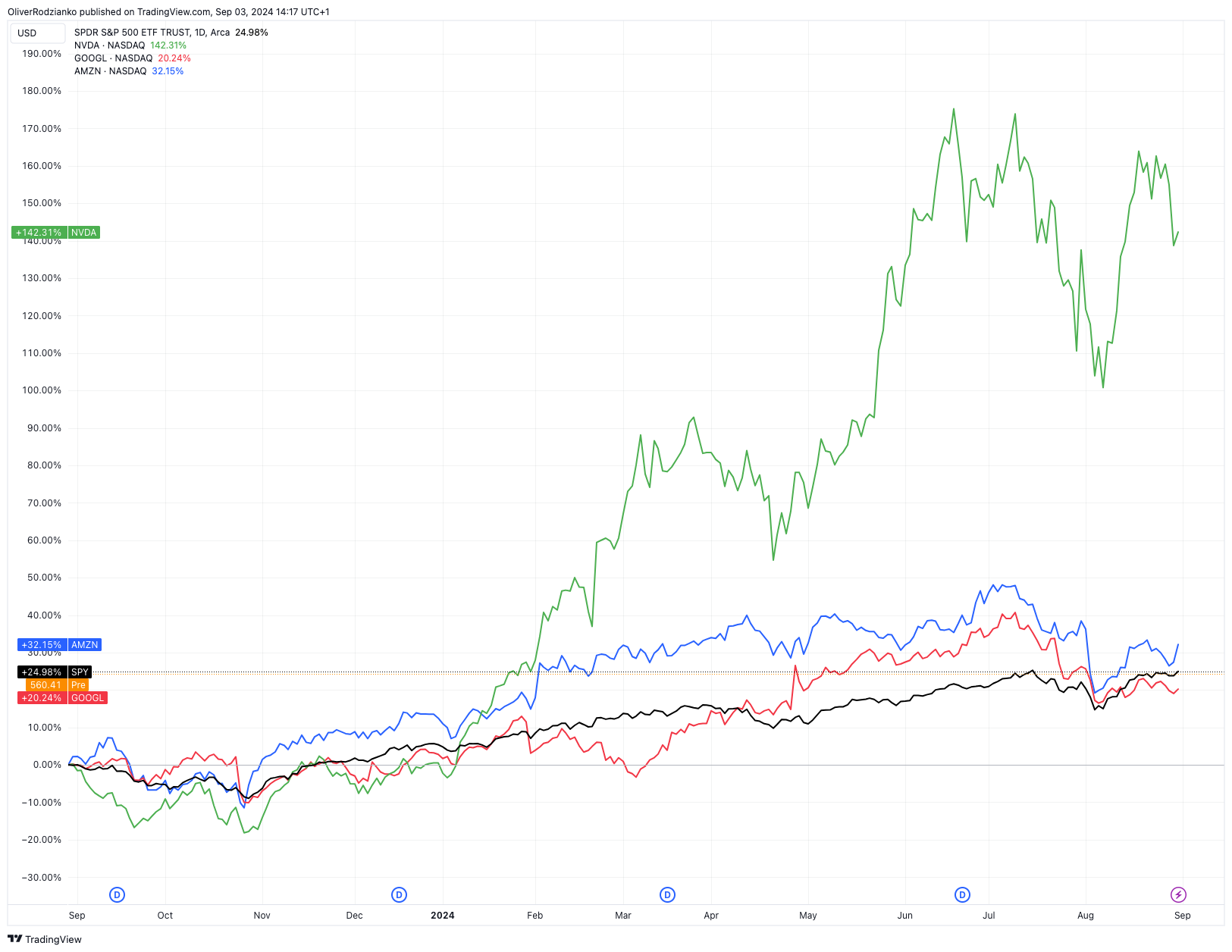

A lot of the recent growth has been in big tech firms. These include Nvidia, Alphabet, and Amazon‘s AI developments. The broader base of the 500 companies, on the other hand, has seen slower growth.

Created at TradingView

Nvidia alone has accounted for over a third of the S&P 500’s gains in 2024. Furthermore, analysts have noted that while the S&P 500 is projected to show 10% year-on-year earnings growth, this drops to just 6% when excluding the ‘Magnificent Seven’.

AI growth looks like it is going to slow down somewhat after a really bullish couple of years. So, I think the index could be in for a short-term correction.

Where should I look instead?

At the moment, I’m particularly fond of companies that have diversified well internationally. The Western markets are currently quite vulnerable to high inflation and contractions in GDP growth. However, India is now the highest growth nation in the world.

Thankfully, there are certain US-listed companies that operate in India. For example, Dr Reddy’s Laboratories (NYSE:RDY) has 17.5% of its revenue from India, 8% from Russia, and 26% from other countries. While the US is 48.5% of its total revenue base, the company still provides the good level of geographic diversification that I’m after.

Also, Dr Reddy’s has a decent valuation. Its price-to-earnings (P/E) ratio is 21, which is much lower than its 10-year median of 27. Furthermore, it has a robust three-year annual revenue growth of nearly 14% and earnings growth of 33%. So, I definitely consider this worthy of my watchlist.

However, investing in diverse markets comes with risks, especially in pharmaceuticals. A heavy concentration in India and Russia means that if policies and regulations change there, Dr Reddy’s could struggle to compete. It’s normal for global pharma companies to have to navigate diverse regulatory landscapes. However, Dr Reddy’s has concentrated more than Merck or Pfizer on specific non-Western countries, excluding China.

I’m diversifying

I’m looking to get away from some of the valuation risk and growth slowdown concerns in America. Buffett’s cash pile doesn’t mean that I should stop investing entirely. To me, it indicates a time to start assessing the risk in the US markets. After all, that’s where the investor has predominantly made his money. So, for now, I’m putting companies like Dr Reddy’s on my watchlist rather than Nvidia.

This post was originally published on Motley Fool