I have tracked ITV’s (LSE: ITV) progress since it was demoted to the FTSE 250 in June 2022. Following this, FTSE 100-tracker funds automatically sold their holdings in the broadcaster. Funds only mandated to invest in the most highly credit-rated firms of the leading index did the same.

To me, this meant a valuation gap between the fair value of ITV and its quoted price might have appeared. I did not act at the time, as I was happy with my other holdings. However, I was right — ITV shares have risen 58% from their post-demotion low of 53p.

Yet this dramatic increase does not mean there is no value left in the stock.

How has the company been doing?

ITV aims to be a leader in UK advertiser-funded streaming and an expanding global force in content. Its full-year 2023 results had good and bad things from my perspective.

Positively, revenue increased 4% over 2022, to £2.17bn. Its ITVX streaming service (launched in November 2022) saw revenues jump by 19%, to £490m.

Negatively, its statutory operating profit fell 54%, to £238m. This drove its statutory earnings per share lower as well – by 51%, to 5.2p. Much of this was due to peak investment in its streaming operations, according to the firm.

Promising business outlook?

ITV added in the results that it is on track to achieve its three key performance targets to 2026. One is organic revenue growth averaging 5%. Another is adjusted EBITA margins of 13%-15%. And the final one is £750m+ of digital revenues by that year.

The key risk to these targets is the huge degree of cut-throat competition in the broadcasting sector, in my view. It faces already-established streaming giants, and multiple traditional broadcasting companies also looking to diversify into the digital sphere.

Is there value left in the shares?

ITV looks undervalued on the key price-to-sales ratio (P/S). Its P/S of 0.9 compares to a peer average of 1.1.

This group comprises MFE-Mediaforeurope at 0.9, and both Métropole Télévision and Atresmedia Corporación at 1.2.

However, analysts estimate that the firm will increase its earnings by 14.5% a year to end-2026. Earnings per share are expected to grow by 17.7% a year to then.

Taking this growth into account in a discounted cash flow analysis shows ITV to be around 66% undervalued at 84p.

So, a fair value per share would be £2.47, although they may go lower or higher than that.

Good shareholder rewards?

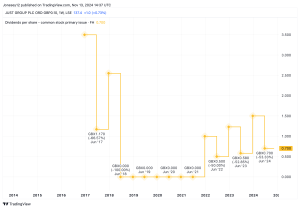

The anticipated growth in ITV’s earnings to 2026 should also help it maintain its currently good dividend yield, I think.

Last year it paid a total dividend of 5p (the same as in 2022). This yields 6% on the current share price. The FTSE 250’s average yield right now is just 3.3%, while the FTSE 100’s is 3.6%.

Additionally, the £235m made from selling its stake in BritBox International in March will be used for a share buyback by end-2025. These tend to be supportive of share price gains.

I already own some very undervalued high-yield stocks with excellent earnings growth potential, so do not need another. However, if I did not have these, I would buy ITV shares for the same three reasons.

This post was originally published on Motley Fool