The supreme irony of investing is that a stock market crash is arguably the best possible time to buy shares.

It means all my FTSE 100 favourites are suddenly available at a discounted price. Assuming I’ve got the nerve to buy them, that is.

Yesterday, the S&P 500 fell more than 2%, as investors fretted over tech valuations, particularly AI chipmaker Nvidia. I’ve no idea whether that’s a dip, or the start of something more brutal. Either way, I plan to be ready.

It’s possible to find bargains even when markets are rising, by targeting underperforming or overlooked companies. But in a crash, I favour buying winners. Top companies that have been caught up in the sell-off along with everyone else, but are suddenly cheaper.

Alternative asset manager Intermediate Capital Group (LSE: ICG) is at the top of my hit list. Its shares have had a brilliant run, rising almost 53.44% in the last 12 months. That tempts and scares me in equal measure.

Like most investors, I dream of buying low and selling high. With a red-hot momentum stock like this one, I’m scared it’ll be the other way around.

This is where the stock market crash comes in. It may give me an opportunity to get in at a reduced price, with some of the froth removed.

Intermediate Capital Group supplies capital to growing businesses. I’m impressed that it’s done so well lately, given high interest rates and economic uncertainty.

In full-year 2024, management fees hit a record £505m, after rising 5%. It raised another $13bn of funds to invest and hiked its dividend to 79p. That’s a modest 1.9% increase from last year’s 77.5p, but still marks the 14th consecutive annual increase. A trailing yield of 3.82% is pretty good given the share price surge.

Income and growth stock

It’s enjoyed a strong first quarter amid “elevated” transaction activity. Assets under management jumped 23.7% to $101bn.

Of course, Intermediate Capital Group operates in a highly cyclical sector. Investing in smaller companies is always precarious. If the US falls into a recession and the global economy slows, it could get riskier still.

The 15 analysts offering 12-month price targets have set a median price of 2,550p. That’s a potential 23% increase from here. However, there’s a huge range of views in that, with a high of 3,036p and a low of 1,600p. I’m looking much further ahead than one year, though. My aim is to hold for a minimum five years, ideally 15 or more.

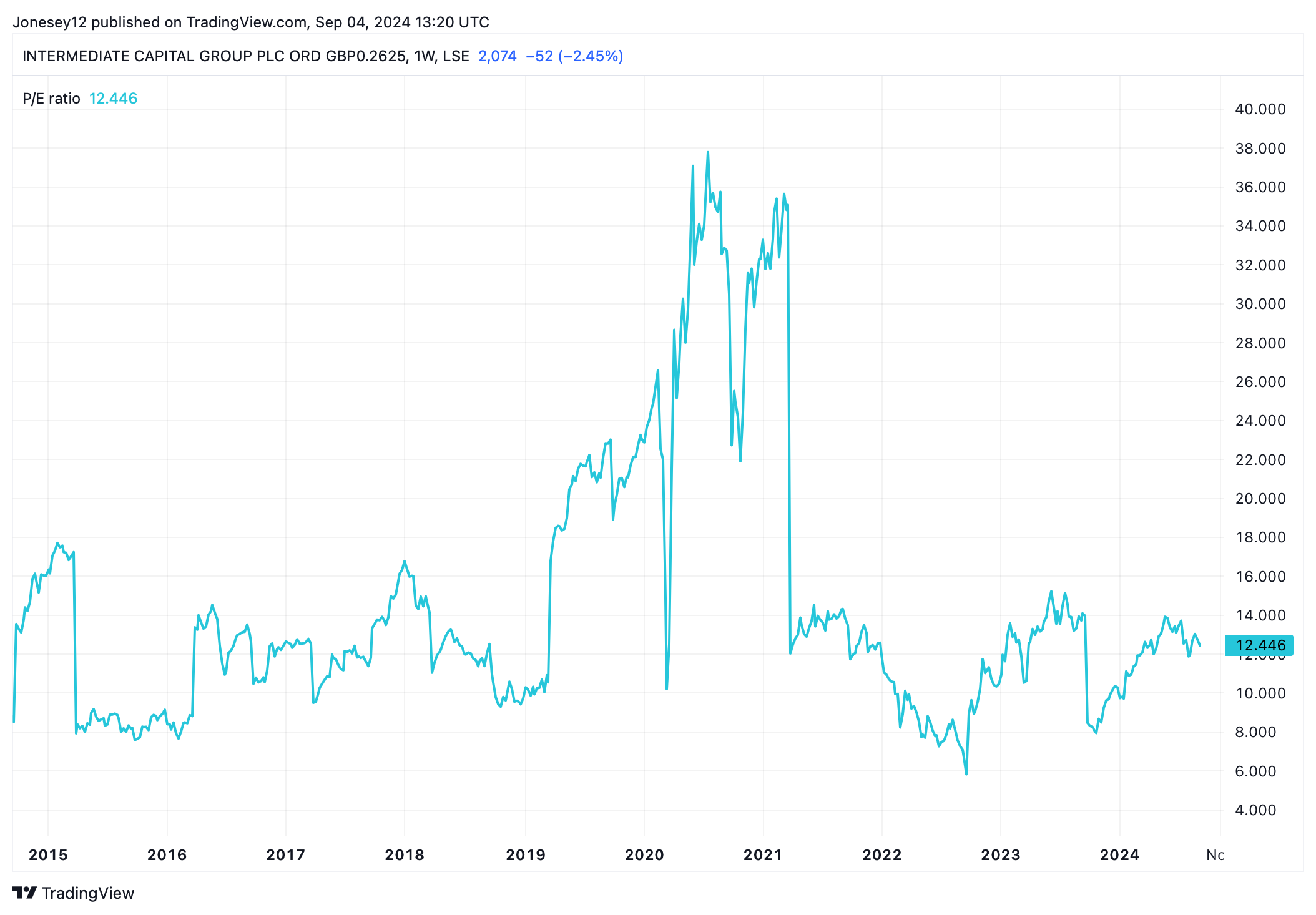

Now I’m beginning to wonder whether I need to wait for a market crash. The Intermediate Capital Group share price has been knocked by recent uncertainty, falling 9.19% over three months. It doesn’t look that expensive either, trading at 12.71 times earnings. Admittedly, that’s pricier than it was, but not too pricey. Let’s see what the charts say.

Chart by TradingView

I’ll start building up some cash so I’m ready if the market does crash. And if it doesn’t, I’ll buy Intermediate Capital Group anyway.

This post was originally published on Motley Fool