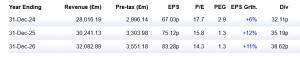

Global private equity and infrastructure investment manager 3i Group (LSE: IIII) is the most successful FTSE 100 stock in my self-invested personal pension (SIPP).

It’s one of the first shares I bought after taking charge of three legacy company pensions last summer. I invested £2k in August, October and November. Today my stake is worth almost £10k, including reinvested dividends. Over 12 months, the 3i Group share price is up almost 65%.

This isn’t a flash in the pan. It’s up 193% over five years. Only Frasers Group (269%) and Diploma (197%) have done better. I’m thrilled but now I’m wondering whether to take the money and run. Or rather, reinvest it.

3i Group is a winner but…

I see myself as a long-term buy-and-hold investor. Selling goes against the grain. It makes even less sense when I consider 3i Group’s stellar track record, which dates back to 1945. It floated in 1994 and now manages assets worth more than £22bn.

3i is an investment trust and a rarity, in that it trades at a premium to its the underlying net value of the assets it holds. After the volatility of recent years, many trusts trade at a 30% discount or more, but it’s at a whopping 43.96% premium.

That’s a sign of success, obviously. In 2024, net asset value per share rose almost 20% to 2,085p, despite a 33p per share foreign exchange loss.

Its private equity business delivered a 25% gross investment return of £4.059bn, albeit down on the previous year’s 40% increase. Now here’s my concern. That return was mostly driven by the performance of its biggest holding by far, Dutch discount retailer Action Group.

3i took a 45% equity stake in 2011 for a mere £134m. Today, Action is Europe’s fastest-growing non-food discount retailer with more than 2,300 stores and €8bn of annual revenues. 2024 was another very strong year as 3i pocketed value growth of £3.61bn, dividends of £375m and a further £762m via a pro-rata share redemption.

Sell my winner

Action’s storming success offset softer performance from other portfolio holdings, which are “working through adverse phases of their market cycles”. 3i’s infrastructure business also floundered. It looks like a one-trick pony.

It doesn’t want to let go of Action. In fact, it increased its equity stake from 54.8% to 57.6% in the latest first quarter. And why not? Q1 earnings rose another 23% to €843m, although 9% sales growth was down from 22% year on year. It’s still rolling out stores but inevitably at a slower pace.

Action is now 72% of 3i’s entire private equity portfolio. I’m making an expensive play on a single European discount retailer whose growth will inevitably slow.

Also, where’s the exit strategy? Private equity companies have struggled to find buyers amid economic uncertainty and higher interest rates. 3i has done a brilliant job with Action. That may continue for a while but the ceiling is looming. I’m planning to sell half my stake before it hits it. I can’t bear to let go of all of it, though. I owe it some loyalty.

This post was originally published on Motley Fool