Receiving and reinvesting dividends is one way of growing a passive income portfolio. Over time, this can have some spectacular results as the power of compound interest does its thing.

Even better, though, is finding a company that grows its dividend without shareholders having to put up more money. And I think Unilever (LSE:ULVR) can do this for a long time to come.

Warren Buffett

In 1994, Warren Buffett’s investment in Coca-Cola (NYSE:KO) generated $75m in dividends. In 2022, the same investment returned $704m in passive income – an increase of 838%.

Importantly, this wasn’t the result of Berkshire Hathaway reinvesting the dividends it received. It was just the Coca-Cola company paying out more in dividends per share.

I don’t think buying shares in Unilever today is going to be like buying shares in Coke in 1994. I could be wrong, but I’d be surprised if that turned out to be the case.

I do, however, believe there are some important similarities. And I expect these to mean the FTSE 100 company can grow its dividend per share for decades to come.

Share buybacks

Coca-Cola has increased its dividend per share because the underlying business has grown, but this isn’t the only reason. The company has also reduced its share count through the use of buybacks.

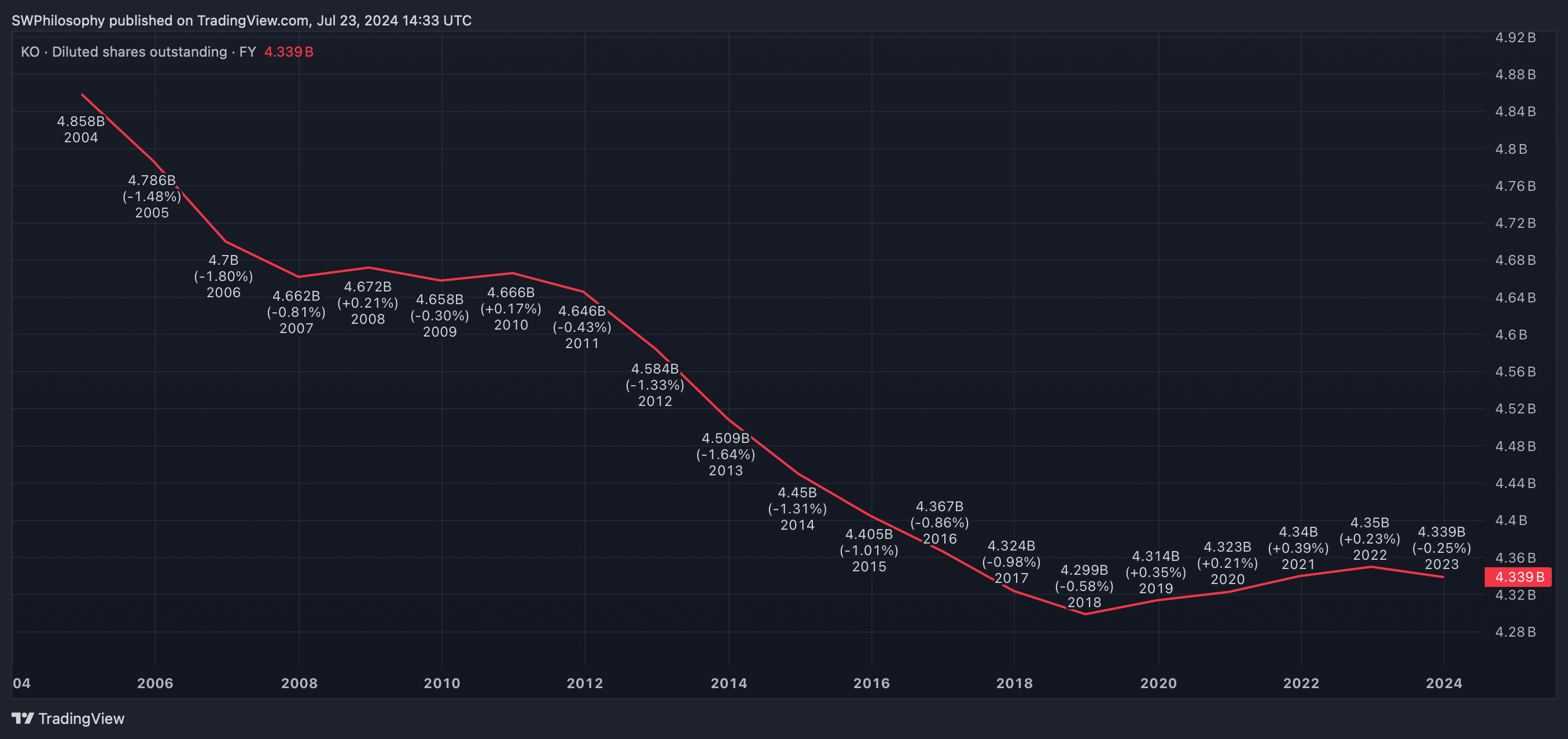

Coca-Cola diluted shares outstanding 2004-24

Created at TradingView

This is important. Bringing down the overall number of shares means it’s possible for the firm to increase its dividend per share even if the underlying business doesn’t generate any more cash.

In 2004, for example, Coca-Cola distributed $2.43bn in dividends. With 4.82bn shares outstanding, that amounts to roughly 50 cents per share.

With the share count now at 4.31bn, the same $2.43bn would amount to just over 56 cents per share in 2024. That’s a higher dividend per share even if the business as a whole doesn’t pay out more.

Unilever’s growth prospects

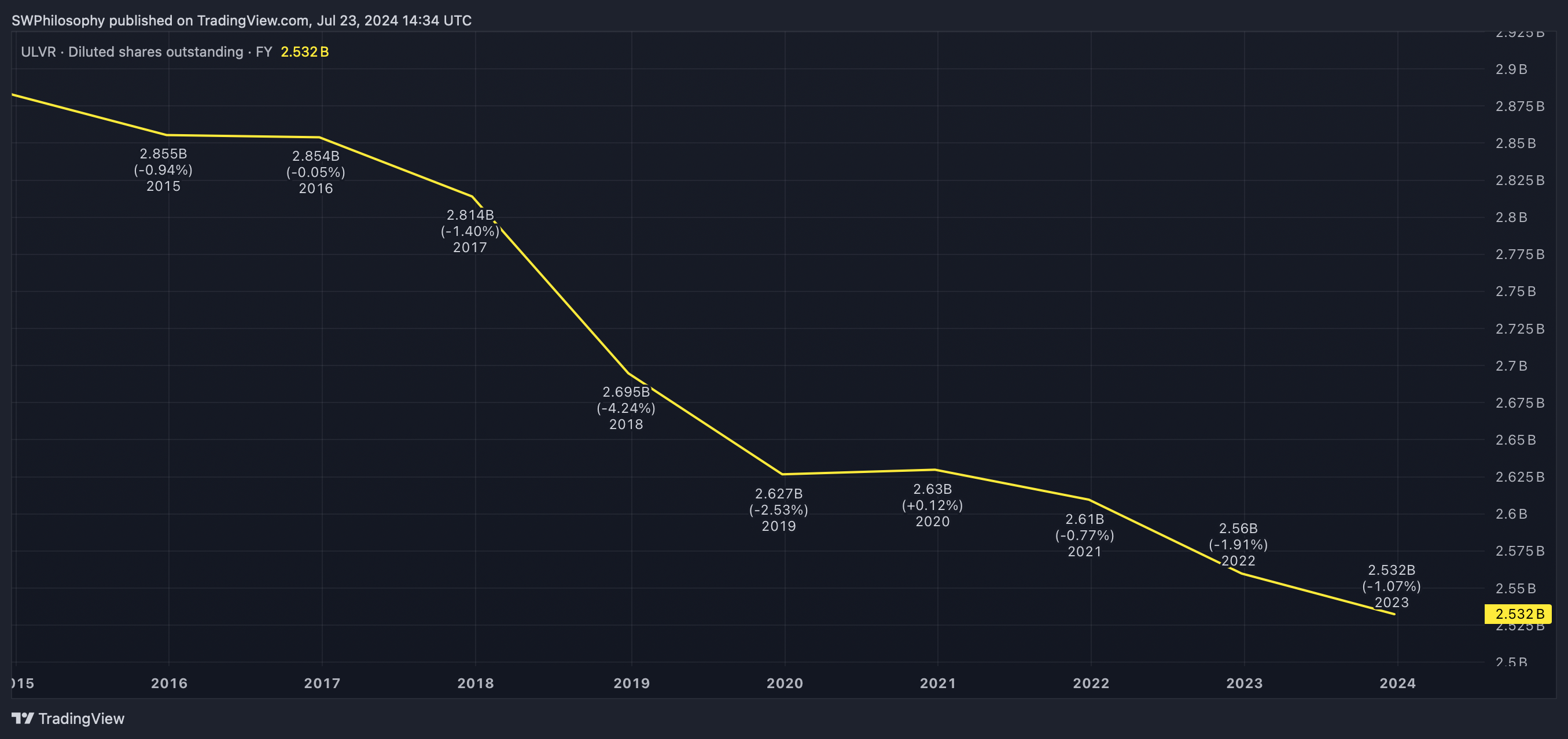

Unilever doesn’t have Coca-Cola’s record when it comes to buybacks. But over the last 10 years, the company has been steadily reducing its outstanding share count.

Unilever diluted shares outstanding 2004-24

Created at TradingView

I’m not expecting this to generate explosive growth by itself. But I think it can be a durable boost for shareholders in a business operating in an industry where demand should grow steadily.

The risk with Unilever is the possibility of consumers switching to cheaper alternatives, especially in a difficult economic environment. This is something investors should keep an eye on.

The company’s brand portfolio and the scale of its distribution give it an advantage over competitors, though. And I think this makes the outlook promising for dividend investors.

Should I buy Unilever shares?

I think passive income investors should take a close look at Unilever shares. Long-term growth should come from incremental gains, rather than a dramatic boost, but these can add up over time.

It’s easy to underestimate the effect share buybacks can have. Demand might fluctuate from year to year, but reducing the share count should keep the dividend growing consistently.

This post was originally published on Motley Fool