The best share to buy isn’t always the one investors are desperate to add to their portfolios. Often, it’s the one nobody likes. Which brings me to FTSE 100-listed hotel chain and restaurant group Whitbread (LSE: WTB).

The Whitbread share price is down 18.18% over the last 12 months. On Tuesday (20 August), it touched a 52-week low of 2,768p. Investors hate it. I’m already tempted.

The stock has climbed slightly since then to 2,810p but faces a long journey to recover its lost value. I fancy getting in at the start of it.

Whitbread buying opportunity

Whitbread boasts a strong raft of brands, led by Premier Inn, which operates both in the UK and Germany. It also owns Beefeater and Brewers Fayre, and several lesser-known names including Cookhouse and Pub.

The hotels industry is highly cyclical and Whitbread’s chains are mass market rather than high-end. That left it exposed during the cost-of-living crisis.

Yet I’ve just been poring over 2024’s results, and they don’t look bad at all. Group statutory revenues rose 13% to £2.96bn, “driven by strong growth in the UK and progress in Germany”. Adjusted profit before tax jumped 36% to £561m. Earnings per share rose 27%. Group return on capital jumped from 10.5% to 13.1%.

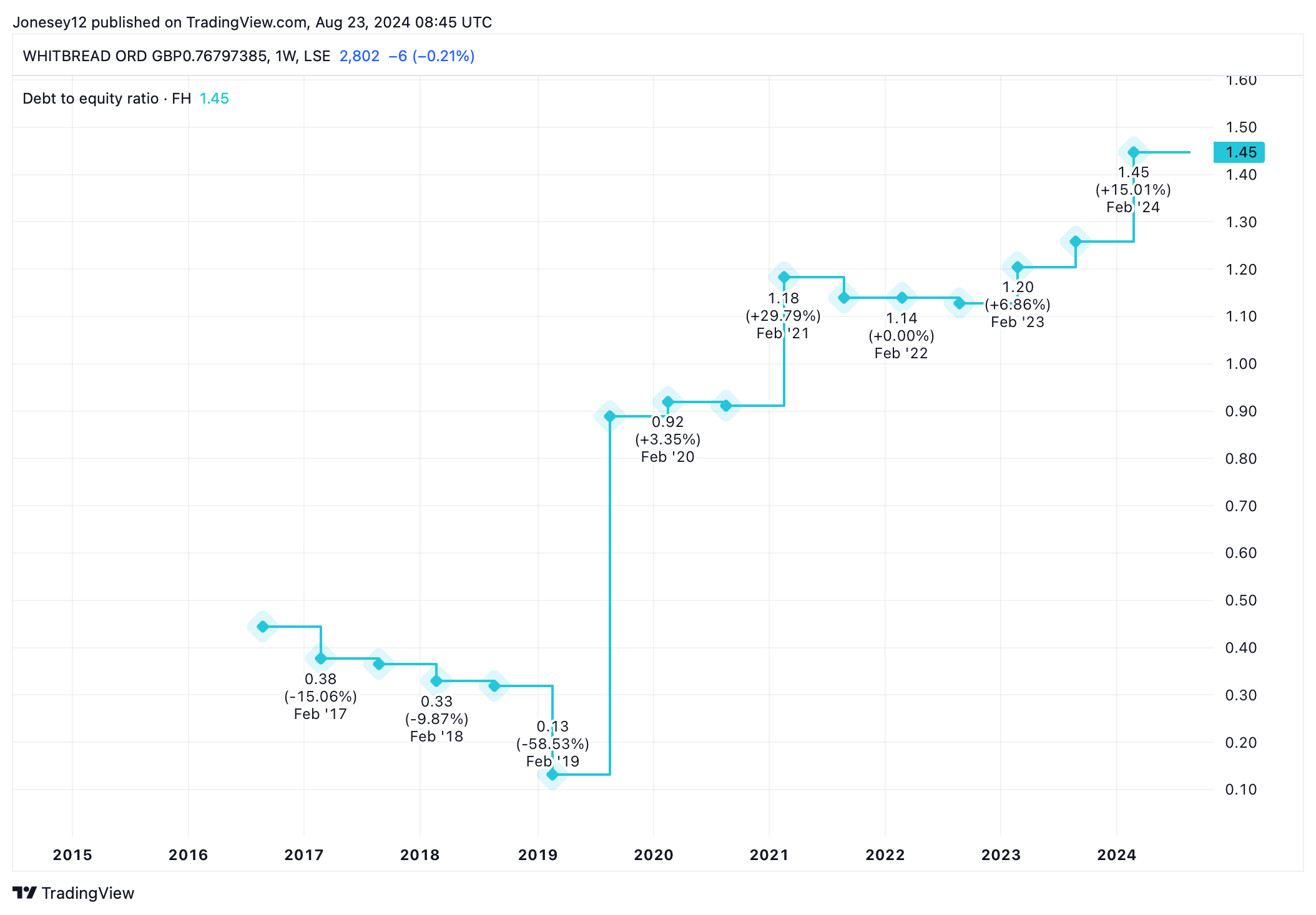

Whitbread nonetheless ended the year with net debt of £278m, a reversal of its 2023 net cash position of £173m. The group’s debt-to-equity ratio has climbed to a slightly worrying 1.45, as this chart shows.

Chart by TradingView

Yet the board still felt able to return a whopping £756m to shareholders in 2024, via dividends and share buybacks. That’s up from £119m in 2023. I’m surprised investors aren’t more grateful.

Top UK value stock

Whitbread started 2025 with a 26% hike in the final dividend per share to 62.9p and a further £150m share buyback for the first half. Its trailing yield is just 2.44%, but it’s forecast to hit 3.53% in 2025 and 3.9% in 2026. That’s more like it.

I think Whitbread has been oversold and the 18 analysts offering 12 month price targets seem to share my view, setting a median target price of 4,050p. That’s up 44% from today’s price.

The UK economy is picking up, even if Germany is still in the doldrums. The board remains upbeat about its full-year outlook and plans to add another 3,500 rooms across the UK, which should boost revenues.

Whitbread isn’t quite as cheap as I expected after its bad run, trading at 13.55 trailing earnings. That’s still below the FTSE 100 average of 15.4 times, though. The sector remains cyclical and if the UK recovery proves a false dawn, the firm could be in for another tough year. German GDP has flatlined and it could prove a drag.

Yet Whitbread is in a much better stronger position than I expected. I think there’s a real opportunity here, and I’m going to add it to my Stocks and Shares ISA this month.

This post was originally published on Motley Fool