The PZ Cussons (LSE: PZC) share price has been on a downward trajectory for some time now, placing it in value stock territory.

Let’s examine what’s happened and whether there’s a buying opportunity for me.

Cleaning house!

PZ Cussons is best known for its cleaning and hygiene products with approximately 30 brands. Some of these include Imperial Leather, Carex, and more.

Over a 12-month period, the shares are down 44% from 160p at this time last year, to current levels of 89p.

Recent issues and trading

PZ Cussons released a full-year update for the period May 2023 to May 2024 last week. On the surface of things, it didn’t look great. The headline for me was that underperformance was primarily due to issues with African currency, the Nigerian naira, to be exact. Currency conversions can impact trading updates when recorded in a local currency, and this is a prime example.

Digging deeper, the business still recorded a healthy profit after tax of over £44m. Furthermore, managed to aid its balance sheet by reducing debt levels from £251m last year, to £167m in this update. If PZ’s African business is excluded from the report, like-for-like revenue only fell 2.6%, which isn’t bad considering economic volatility globally.

The market didn’t react well when the news emerged, and the shares dropped close to 15% on the day. Personally, I think this was an overreaction.

To buy or not to buy?

From a future perspective, the firm’s management team are looking at two possible solutions. The first one is the sale of the African business totally. Another is to deal in US dollars as much as possible, as this is a much less volatile currency globally. From a risk perspective, if either of these things don’t happen, I wouldn’t be surprised to see PZ Cussons’ updates look similar to the one of last week.

Another issue I’m concerned about is that of PZ’s premium brands. During times of volatility like now, consumers can move away from branded goods towards non-branded essential ranges to conserve cash. This could impact performance and returns moving forward.

On the other side of the coin, it’s worth noting PZ Cussons’ does possess defensive attributes, in my view. This is because its products are consumer staples. Everyone needs to clean their homes and themselves! Defensive ability could help the business recover from recent issues.

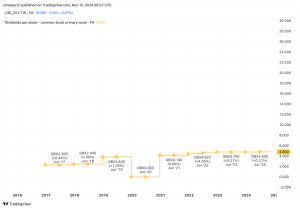

Next, the shares do offer a dividend yield of over 5% at present. I must note that this has been pushed up by a falling share price. Plus, dividends are never guaranteed.

Finally, top brokers Deutsche Bank have given PZ Cussons a ‘buy’ rating, and a price target of 130p. This is a potential 46% increase from current levels. However, I’ll always take broker forecasts with a pinch of salt.

What I’m doing now

Personally I’m not going to buy any shares until I see some tangible movement to address the issues the firm has had in Africa. This includes a sale of the business or better currency management options.

I like the business, especially its defensive traits and track record, so I’ll keep a close eye on things.

This post was originally published on Motley Fool