Having some portfolio exposure to S&P 500 stocks has really paid off this year. Over in the US, a lot of stocks have soared in 2024.

In 2025, it’s highly likely that the US stock market will throw up more opportunities for investors. With that in mind, here’s a look at a S&P 500 stock that Goldman Sachs believes could rise nearly 60% next year.

A well-known name

The stock I’m going to zoom in on today is Uber Technologies (NYSE: UBER). It’s a major global transportation and food delivery company.

Its share price has been volatile in 2024. In October, it surged to $86, however, recently it has pulled back to $61 on the back of concerns about competition from Tesla.

Goldman Sachs says Buy

Goldman’s analysts see this weakness as a major buying opportunity.

It has a Buy rating on the stock and a $96 price target – roughly 57% above the current share price. It has also named it as a top internet stock pick for 2025, stating that it has an attractive risk-reward skew.

Goldman’s number crunchers expect Uber’s gross bookings and adjusted earnings before interest, tax, depreciation, and amortisation (EBITDA) to grow at compound annual growth rates (CAGRs) of 16% and 39%, respectively, from 2023 to 2026. In other words, they see significant growth in the years ahead.

I’m buying

I like this call from Goldman Sachs. I’ve held Uber stock for a while now and I bought more shares last week near the $60 level. There are a number of reasons I’m bullish.

One is that I see plenty of growth potential. This is a company that’s continually expanding into new areas of travel (train rides, boat rides, car rental, bike/scooter rental, alcohol delivery, etc) and I reckon it will do well as the travel industry grows. I see the company’s instantly recognisable name as a major competitive advantage. When people need to get from A to B, Uber is usually the first name that comes to mind.

Another is that earnings are rising rapidly. This year, earnings per share (EPS) are projected to rise 98%. For 2025, analysts forecast EPS growth of 28%. That’s a higher level than most ‘Magnificent 7’ companies are forecast to generate.

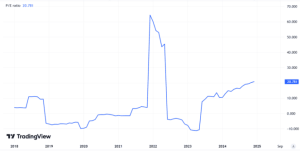

Then there’s the valuation. Currently, the price-to-earnings (P/E) ratio here is only 26. I think that’s a steal given the company’s brand power, market dominance, and growth potential.

My view on the risk from Tesla

Now, there are risks here, of course.

The big one that a lot of investors are concerned about right now is competition from Tesla. Many investors seem to believe that Tesla’s self-driving taxis (which probably won’t be on the road for a few years) are going to disrupt Uber’s business model.

Personally, I think this risk has been overblown. Looking ahead, I believe that many automotive companies will have self-driving taxis, and I reckon Uber will be the platform that connects these companies with consumers.

So, while Tesla’s goals do add some uncertainty, I continue to see a lot of potential in this stock and believe it’s worth considering.

This post was originally published on Motley Fool