Many stocks on the FTSE 100 have had a good 2024. But down 49.4% year to date and 67.6% in the last 12 months, it’s safe to say Burberry Group (LSE: BRBY) isn’t one.

Its steep decline now means the stock has lost 69.1% of its value in the last five years. But at its lowest level since 2010, would I be mad not to consider buying some shares?

A dire spell

On 15 July the business reported its first-quarter results covering the 13 weeks to 29 June. There’s no sugarcoating it, the update was bad. The group saw comparable store sales fall 21%, including 23% in both Asia Pacific and the Americas.

That came on the back of multiple profit warnings the business had already issued. Demand for luxury goods across the globe has slowed, especially in China, one of Burberry’s largest markets. The business now expects to post an operating loss in the first half of the year.

Axing its dividend

As they say, every cloud has a silver lining. For Burberry, it was that its dwindling share price had been pushing up its dividend yield. It currently sits at 8.6%.

But that doesn’t matter. That’s because the business has announced that it’s halting its payout. Dividends are never guaranteed, so this was always a known threat. That said, it doesn’t mean it won’t sting any less for shareholders.

Not alone

However, it’s worth considering Burberry isn’t alone in its struggles. For example, yesterday (23 July) LVMH posted disappointing earnings. Similarly to Burberry, the group saw a decline in China, where sales plunged 14%.

Many businesses operating in the luxury goods sector have experienced a downturn. So, while Burberry’s performance has been far from encouraging, it’s not necessarily specific to the firm.

We should begin to see spending pick up again as interest rates are cut in the months to come. That should ease some of the pain the sector has been feeling.

Valuation

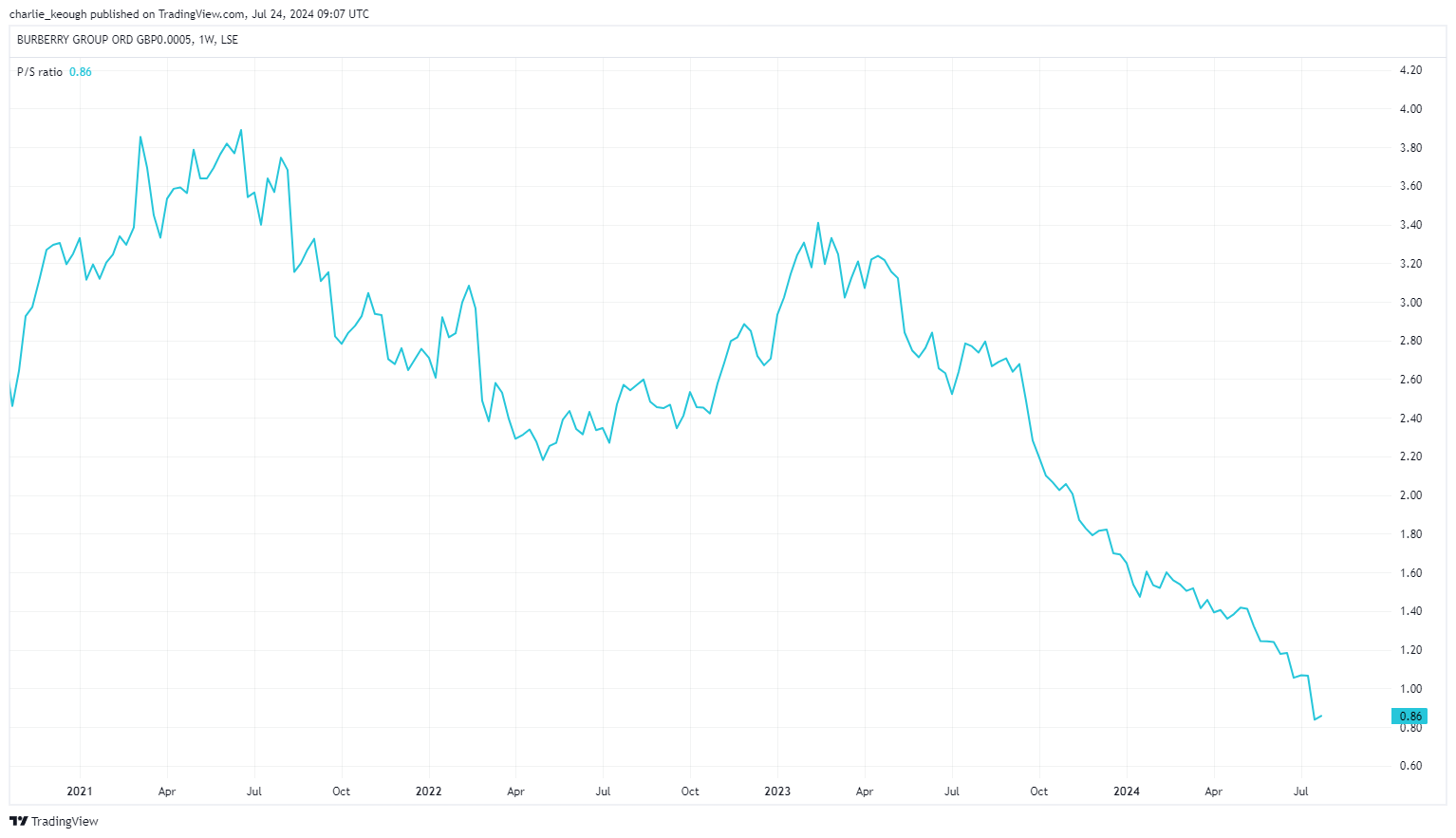

What’s more, with its share price nosediving the stock looks very cheap. As seen below, its price-to-sales ratio has tanked. It’s now just shy of 0.9.

Created with TradingView

The same can be said for its price-to-earnings (P/E) ratio, which now comes in at just 9.7. For context, its historical average is 22.6.

Created with TradingView

Should I buy?

So, would I be crazy not to consider buying some shares today? I reckon so, given the stock looks dirt cheap.

The risk attached to Burberry is that its share price continues to slide. But it’s a quality business that has lots of attributes I look for when investing. It has incredibly strong brand recognition. And despite its struggles in Asia, the region still has long-term growth potential as wealth continues to rise.

As such, I’m tempted. Spending will eventually pick up again and that should see the Burberry share price rebound.

I’ve always liked the look of Burberry for its combination of turnaround potential and meaty income. Granted, part of that is now gone. But even so, it’s a stock I’m strongly considering.

Don’t get me wrong, it will by no means be a quick turnaround. It’s going to be a slow burner. But as a Fool, that suits me rather well.

This post was originally published on Motley Fool