Vodafone (LSE:VOD) has announced that it will be cutting its hefty dividend yield in half from 2025.

The news follows five years of declines that have stripped over 50% off the share price. So I’m surprised it kept its high yield (currently 11%) in place and waited this long to take action.

While dividend cuts mean lower returns for shareholders, struggling companies typically benefit from reinvesting capital rather than paying it out. In the long run, this could be a win for everyone if the reinvestment helps drive future profitability.

Of course, there’s also the possibility that it scares away shareholders from an already declining investment. Vodafone seems to be placing a courageous bet on the faith of its shareholders.

It’s a careful balancing act and I fear Vodafone was tipping the scales for too long.

Could it work?

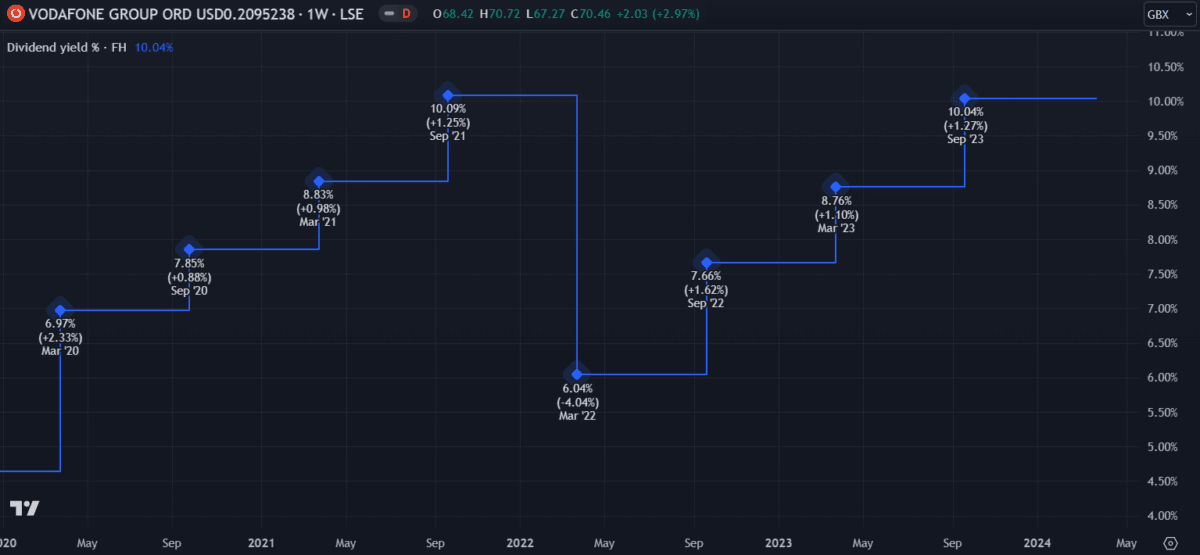

The dividend cut is reminiscent of a similar strategy that the company appears to have attempted in March 2022. In the two years prior, it had steadily increased its dividend from a low of 6% up to 10%.

When Vodafone pumped up its dividend yield to 10% in late September 2021, the share price increased 28% over the following months. However, after cutting it down to 6% the following March, the shares began declining. Despite gradually bringing it back up to 10% over the following two years, the share price didn’t recover.

Admittedly, the price has climbed 6% since the announcement but that only barely recovers this year’s losses.

So what’s going well?

What has been increasing is Vodafone’s return on equity (ROE), which has risen to 18.22% in the past three years.

ROE is a good indication of how well a company is converting shareholder equity into profits. It’s calculated by dividing net income by equity (assets minus debt). As an investor, it’s reassuring to know that the business is using its assets in the most efficient manner.

And yet…

The share price has done little to reflect this performance. Vodafone’s most recent earnings were £9bn — almost half its €19.1bn market cap. With a price-to-earnings (P/E) ratio of 2.1 it’s considerably lower than the industry average of 18.1. A cash flow analysis estimates the shares to be undervalued by almost 70%.

Earnings and revenue have also decreased. In its latest Q3 results released in February, total revenue fell 4.9% while earnings-per-share (EPS) decreased 103.15%.

I’ll admit – buying Vodafone shares hasn’t gone very well for me. It’s currently one of the worst-performing shares in my portfolio and cutting a dividend isn’t something typically associated with improvement.

Twelve months ago, forecasters thought the share price would be around £1.18 today. Now at only 70p, it’s far below expectations. More recent forecasts suggest growth of 37% in the next 12 months.

I wish I could share their optimism but with the price now the lowest it’s been in 27 years, I’m struggling to find the faith. I try to never sell at a loss so I’ll hold my shares for now. But if I didn’t have any, I wouldn’t be buying.

This post was originally published on Motley Fool