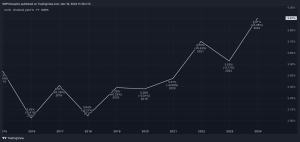

Aston Martin (LSE: AML) shares are having a shocking run in 2024. Year to date, they’re down about 50%. Could it be worth snapping up a few shares in the sports car maker for my ISA at current share prices? Let’s discuss.

Investors are buying the dip

UK investors love to buy stocks after they’ve tanked. We can see this with Aston Martin. Last week, the stock – which crashed on the back of a profit warning in late September – was the third most bought share on Hargreaves Lansdown. Clearly, a lot of investors are expecting a rebound here.

I’d never buy a stock just because it was down heavily however. Because a falling stock can keep falling (I learnt this the hard way), to manage risk, I look closely at what’s going on within the business before buying shares. This allows me to make more informed investment decisions.

Nasty profit warning

In this case, there are a few issues I’m concerned about. First, Aston Martin recently said it no longer expects to achieve positive free cash flow in the second half of 2024.

This is a problem because the company has a pile of debt on its books. So it may have to raise more capital from investors to stay afloat. This could send its share price down further.

Second, the company advised that it’s reducing its 2024 production guidance by 1,000 vehicles (due to supply chain disruptions and weak demand in China). It also said that adjusted EBITDA for the year is expected to be below market expectations.

I think these downgrades to guidance could impact sentiment towards the stock for a while. “We believe the new management team will now have to work hard to rebuild confidence around near-term financials, execution and business potential from here on“, analysts at JP Morgan wrote in a research note.

New share price targets

It’s worth noting that after the profit warning, several brokers reduced their price targets for the FTSE 250 stock. HSBC cut its target to 118p from 180p and downgraded the stock to Hold from Buy, while Jefferies cut its target price to 120p from 250p while also downgrading it to Hold from Buy.

One other thing worth pointing out is Aston Martin has been loss-making for years now. This adds a lot of risk to the investment case as companies with no profits often have volatile share prices.

Potential for a rebound?

Now, there’s a chance that Aston Martin’s share price could rebound at some stage, of course.

In its recent update, it told investors that for the first time in many years, it will be in the “enviable position” of commencing the new year with a fully reinvigorated portfolio of ultra-luxury high performance models. It believes this will support future growth.

Speaking of growth, one factor that could help the company in the years ahead is a potential rebound in the Chinese economy. In the past, China’s been one of the company’s largest markets globally.

I’m not tempted to buy this stock, however. Given the lack of profits, I think there are better UK shares to buy for my ISA today.

This post was originally published on Motley Fool