Real estate investment trusts (REITs) can be a brilliant source of passive income. Here in the UK, these companies are required to distribute at least 90% of their taxable income to shareholders in the form of dividends.

Here, I’m going to highlight two REITs that I think are worth considering for a diversified portfolio today. Both have attractive dividend yields and rising payouts, and look capable of delivering a ton of income for investors over the next decade.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice. Readers are responsible for carrying out their own due diligence and for obtaining professional advice before making any investment decisions.

Constant demand

First up, we have FTSE 250 company Safestore Holdings (LSE: SAFE). It’s a self-storage company that has facilities both in the UK and Europe.

If I was looking to build an income portfolio today, this is exactly the kind of stock I’d go for. Storage is a relatively defensive industry as demand tends to stay pretty stable throughout the economic cycle (people always need storage space for one reason or another).

At the same time, there’s growth potential as storage companies have the ability to increase their prices (most customers are likely to accept the higher prices instead of going through the hassle of moving all their gear).

As for the dividend, it’s decent. For FY2023 (the year ended 31 October 2023), Safestore paid out total dividends of 30.1p per share, 20% higher than the figure two years earlier.

For FY2024, analysts expect a payout of 30.4p, which puts the yield at about 3.7%. That translates to annual income of around £185 on a £5k investment (dividends are never guaranteed).

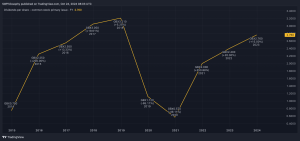

Of course, as a property company, Safestore is vulnerable to high interest rates. In recent years, the share price has come down as rates have risen.

With interest rates across the UK and Europe now (appearing to be) on a downward trajectory however, I like the setup here even if the price-to-earnings (P/E ratio) is a little elevated at around 19. I think this REIT has the potential to provide solid returns in the years ahead.

Growth and defence

Another REIT I like the look of today is Primary Health Properties (LSE: PHP). It invests in healthcare facilities across the UK and Ireland and currently has over 500 properties in its portfolio.

Like Safestore, this company offers a nice mix of defence and growth potential. On the defensive side, this company receives a lot of its rent from the UK government. So rental income’s unlikely to suddenly fall off a cliff.

Meanwhile, on the growth side, the company looks well positioned to benefit from the UK’s ageing population in the years ahead. As people across Britain get older, demand for healthcare services should rise.

Now, the dividend yield here’s very attractive. Currently, analysts expect a payout of 6.9p for 2024, which puts the yield at about 6.9%. That translates to annual income of around £345 on a £5k investment.

It’s worth noting that the company could raise money from investors in the future to capitalise on opportunities in the healthcare property market. If it was to do this, the share price could experience some short-term weakness.

Taking a long-term view however, I reckon this REIT’s capable of providing impressive returns. The P/E ratio is 14, which seems very reasonable to me.

This post was originally published on Motley Fool