I see worrying headlines about tech stocks being overvalued, so which FTSE 100 stocks might I snap up if we see a big market correction?

I know the talk is mostly about US Nasdaq stocks. But market jitters spread.

The US growth index did fall in early August, but it’s picked right back up again. And today, AI star Nvidia is back to a market cap of over $3trn once more.

That’s about 11 times the value of AstraZeneca, the biggest company on the UK stock market.

Buy the index?

Is a Nasdaq correction inevitable? If it happens, maybe the best thing I could do is just buy the index. Or add to my holding of Scottish Mortgage Investment Trust (LSE: SMT), which would be close enough.

Scottish Mortgage holds a whole bunch of the top Nasdaq stocks, with Nvidia now up to 6.8% of the portfolio.

But I still have a fair bit of diversification in case any specific stocks hit a tough patch.

A bit of safety

The share price has lagged behind the index in the past year or so. And if I buy more shares today, I’d get them for 8.6% less than the value of the underlying investments.

Now, that’s not a big safety buffer, but every little helps if I’m thinking defensively.

I won’t buy any more Scottish Mortgage shares soon, not if tech prices stay as high as they are today.

That said, if we’re hit by anything approaching a tech crash, I might load up with as many as I can afford at the time.

Missed chances

A crash could help me put right my missed chances to buy Rolls-Royce Holdings (LSE: RR.) shares too. I really didn’t think the shares would get close to 500p so soon after the pandemic crash.

But we already saw it, with a 52-week high of 505p in August.

Rolls isn’t in the same class as US tech stocks. But I’d expect any crash to spread a chill over UK growth stocks.

We’re looking at a forward price-to-earnings (P/E) ratio of 28 now. If the forecast earnings growth for the next few years comes off, that could still be fair value.

But I don’t see much of a safety buffer in it. And if a slump should take the Rolls-Royce share price down, I might rectify my past mistakes and buy.

Cooling price

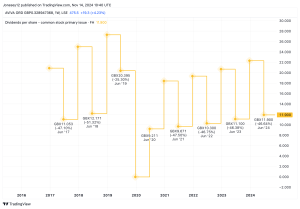

My eye has also turned to equipment rental firm Ashtead.

The big climb out of the 2020 stock market collapse put me off a bit. It’s cooled since then, though it’s still up 130% in the past five years.

Crucially, forecasts have the P/E down below 14 by 2027. And that’s in a business that I think has a defensive edge. I’d need to re-assess the risks. But it could be another one to consider in a market fall.

I’ll also re-examine any other stocks whose recent growth has taken me by surprise. Marks and Spencer springs to mind, after I missed the skyrocketing climb since late 2022.

Up 74% in five years, the best bargain time might have passed.

But, along with a handful of others, a new dip could make for some new FTSE 100 buying opportunities.

This post was originally published on Motley Fool