It goes without saying that the last five years have been extremely disappointing for Vodafone (LSE: VOD) shareholders. During that time, its share price has fallen by 51.2%.

But after underperforming in recent times, could we see the stock stage a recovery? With that in mind, what could the next 12 months have in store for Vodafone? Let’s take a closer look.

Broker forecasts

Well, one way to assess what the stock may do is by looking at broker forecasts. It’s worth noting these can be wrong. Nonetheless, I think they offer a good guide.

Eleven analysts offering a 12-month target price have an average price of 87.2p. That represents an 11.9% premium from its current price. Of those, the highest target is 140.4p. The lowest is 65p.

What’s more, of the 14 analysts giving stock ratings, six think the stock’s a Strong Buy, six Hold, one a Sell, and one a Strong Sell.

Valuation

Overall, analysts seem fairly bullish on the stock’s potential performance over the next year. With that, I want to take a closer look at why that could be.

One way to do this is to look at its valuation and the key price-to-earnings (P/E) ratio. As seen below, Vodafone trades on a P/E of 21.4. In my opinion, that looks a tad expensive. The FTSE 100 average is 11.

Created with TradingView

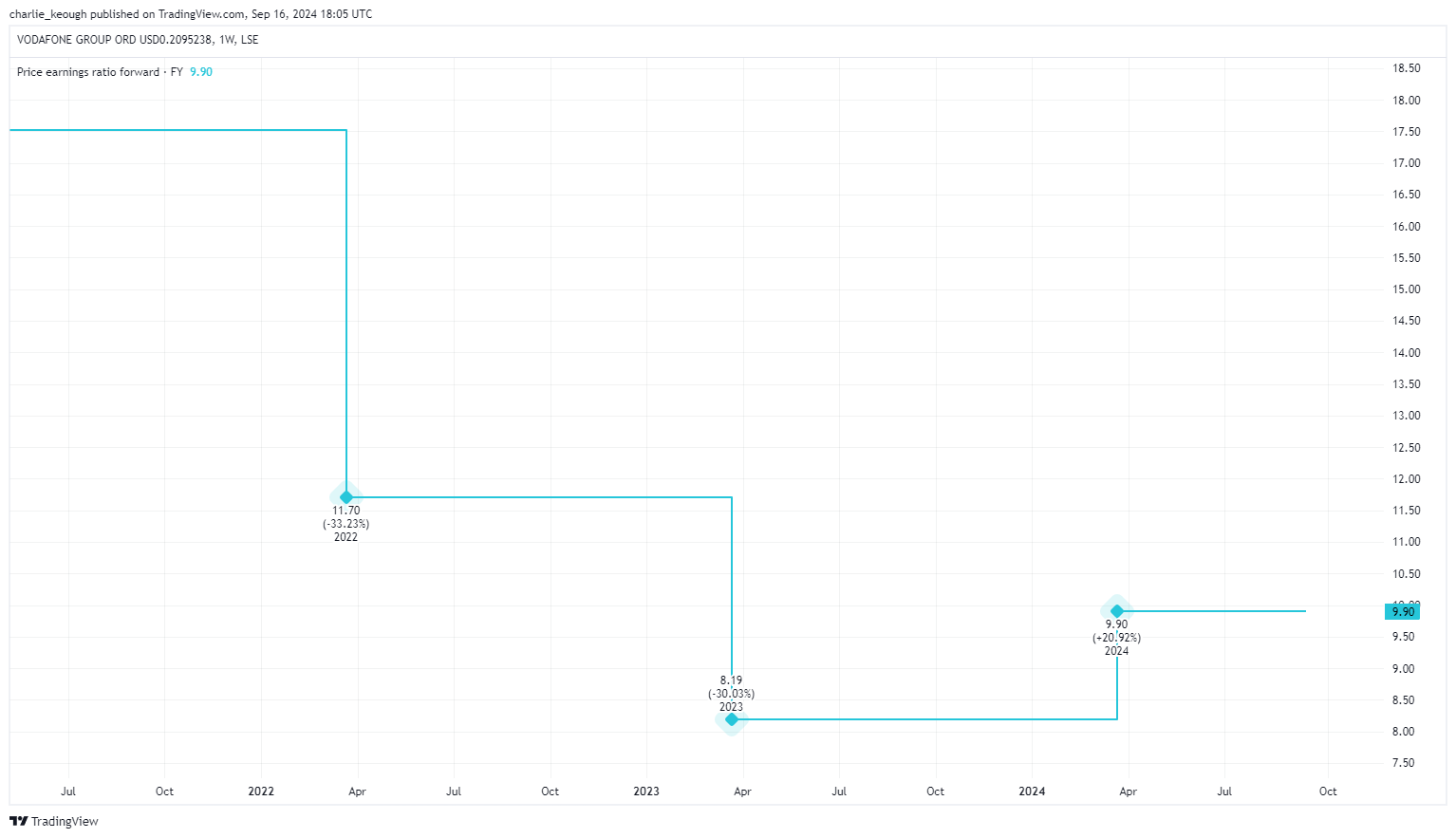

However, looking ahead makes for a better reading. As the chart below highlights, its forward P/E is just 9.9.

Created with TradingView

The business itself

But forecasts and fundamentals only paint part of the picture. How’s the business shaping up moving forward?

Under the leadership of Margherita Della Valle, who was appointed CEO in January 2023, the firm’s been on a streamlining mission.

As part of this, Vodafone has exited unprofitable regions such as Spain and Italy, offloading its businesses for €5bn and €8bn respectively. In tandem with that, the firm’s placing more emphasis on growing markets, such as in Germany.

Moves like this are part of Vodafone’s wider plan to boost its return on capital employed (ROCE). For the year ended 31 March, its post-tax ROCE stood at just 4.5%.

Furthermore, the firm’s outlined its intention to slash its dividend in half from next year. Its current payout of 9.8%’s unsustainable. By reducing it, the firm will save €1bn. That sounds like a smart move.

But for me, there’s one snagging issue. Vodafone has a €33.2bn pile of debt sitting on its balance sheet. That’s a massive amount and I think it could hinder growth moving forward. What’s more, that’s without considering that higher interest rates will make it more expensive to service.

What’s next?

Overall, while analysts believe that Vodafone has the potential to rise over the next year, I won’t be buying any shares right now.

The stock’s too expensive for my liking right now. And, more concerningly, I see its debt as a big issue.

As an investor who focuses on income, its falling yield also reduces its appeal. For now, Vodafone will be staying on my watchlist.

This post was originally published on Motley Fool