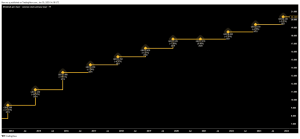

The Rolls-Royce (LSE: RR.) share price has risen spectacularly over the last two years. Since the start of 2023, it’s surged from 93p to 591p – turning a £5k investment into more than £30k.

One City brokerage firm believes the share price can climb much higher though. It’s highlighted 820p as a medium-term target price.

Lofty share price target

The broker’s Panmure Liberum, and its analyst Nick Cunningham – who currently has a Buy rating on Rolls-Royce – believes the stock can hit 820p in the next three years.

That target’s around 39% higher than the current share price. If it was to come to fruition, a £5,000 investment in the company today could grow to around £6,950.

Cunningham’s bullish on Rolls-Royce for several reasons. One is that he believes the strong civil aviation market will support growth.

Another is that the company has significant exposure to the defence industry. He anticipates that higher defence spending in the years ahead will boost profit revenue and profit margins.

Cunningham has acknowledged however, that the prolific profit growth generated by the FTSE 100 company in the last few years is unlikely to continue. His view is that profit growth’s likely to “continue to be positive, but also less dramatic.”

Not everyone’s as bullish

It’s worth noting that not all brokers are as bullish on Rolls-Royce as Panmure Liberum. Earlier this month, analysts at Citi actually downgraded the stock from Buy to Neutral.

Its view was that the stock’s now approaching ‘fair value’. However, it did raise its target price from 555p to 641p and that new target is 8.5% above the current share price.

Should I buy?

Is it worth buying some Rolls-Royce shares for my portfolio today given Panmure Liberum’s 820p target? It implies share price growth of nearly 12% a year, which would be an excellent return over the medium term.

Well, there’s a lot I like about Rolls-Royce from an investment perspective today. I like the fact that the company has exposure to several different industries including civil aviation, defence, and nuclear energy.

I also like management’s laser focused on efficiency. The earnings growth generated by CEO Tufan Erginbilgiç in recent years has been very impressive.

I just can’t get comfortable with the stock’s valuation today however. With the consensus earnings per share (EPS) forecast for 2025 sitting at 21p, the forward-looking price-to-earnings (P/E) ratio’s 28.

That’s nearly as high as the P/E ratio on tech stock Nvidia! And to my mind, it adds a lot of risk.

If top-line growth was to slow, or costs came in higher than expected, the share price could take a hit. Ultimately, there’s no margin of safety at that earnings multiple.

So I’m not going to chase Rolls-Royce shares here. With the valuation’s so high, I’m going to focus on other investment opportunities.

This post was originally published on Motley Fool