Shares of Micron Technology Inc. are up nearly 2% in Monday trading after analysts suggested that recent disruptions to production resulting from an earthquake could help pricing for the memory industry.

Following a 6.5-magnitude earthquake that struck Taiwan over the weekend, Micron

MU,

confirmed to MarketWatch that its workers are safe but that the quake impacted production at the company’s facilities in Taoyuan. “Micron is evaluating the impact and determining the appropriate steps to return to full production,” the company said in a statement.

As with past impacts to memory fabs, analysts expect that the disruption could temporarily limit output at the fab, thereby lowering industry supply and boosting prices due to a new supply-demand balance.

“Any meaningful production hit would most certainly lead to a much more tight supply environment and could pull in a DRAM pricing inflection sooner than current consensus expectations of 1HCY22,” Evercore ISI analyst C.J. Muse wrote.

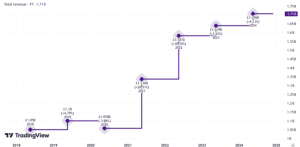

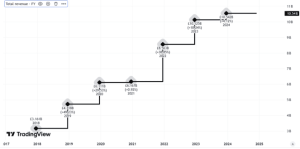

Micron shares are down more than 9% over the past three months amid concerns about a weakening price environment for DRAM, or dynamic random access memory. Muse estimates that the Taoyuan fab accounts for about a third of Micron’s DRAM capacity and he wrote that “the potential for a pricing trough to come sooner than expected certainly make for a very interesting risk/reward.”

He rates Micron’s stock at outperform with a $100 price target.

Meanwhile, the PHLX Semiconductor Index

SOX,

has gained 3.8% over the past three months and the S&P 500 index

SPX,

has tacked on 3.5%.

Read: Why Micron can still ‘shine’ despite its downbeat earnings forecast

Wells Fargo’s Aaron Rakers wrote that “fabs typically go through a shut down process when earthquakes occur and thus resulting in a disruption in production and requiring a certain amount of time for restarts.” This dynamic usually leads to a “quick increase in prices,” he wrote, though he also noted that a 2020 earthquake in Taiwan “resulted in minimal production loss.”

He has an overweight rating and $115 price target on Micron shares.

Unrelated to the earthquake news, Bernstein analyst Mark Li took a negative view of memory stocks as he initiated coverage of Samsung Electronics Co. Ltd.

005930,

SK Hynix Inc.

000660,

and Micron at underperform, writing Monday that he doesn’t think the current “downcycle” will end until late next year.

“Supply discipline should make it shallower and shorter than before, but price fall is inevitable,” he wrote.

Li set a $58 price target on Micron shares, matching the lowest target listed on FactSet.

This post was originally published on Market Watch