The BT (LSE: BT.A) share price has been gaining serious momentum recently. Despite a slow start to the year, the stock’s kicked into life in recent months. Its total year-to-date rise now sits at 17.8%. But in the last six months, the stock’s soared 40.8%.

While this rise is impressive, that has me wondering whether BT has peaked, or if right now’s too good to pass. That’s what I’m here to answer.

To help with that, I think it makes sense to take a closer look at what’s been driving BT’s performance in recent months. The first factor is its full-year results released back in May.

In the update, CEO Allison Kirkby highlighted how BT had “reached the inflection point” for its long-term plan. Alongside this, Kirkby announced the business had achieved its £3bn cost and service transformation programme a year ahead of schedule.

A good price?

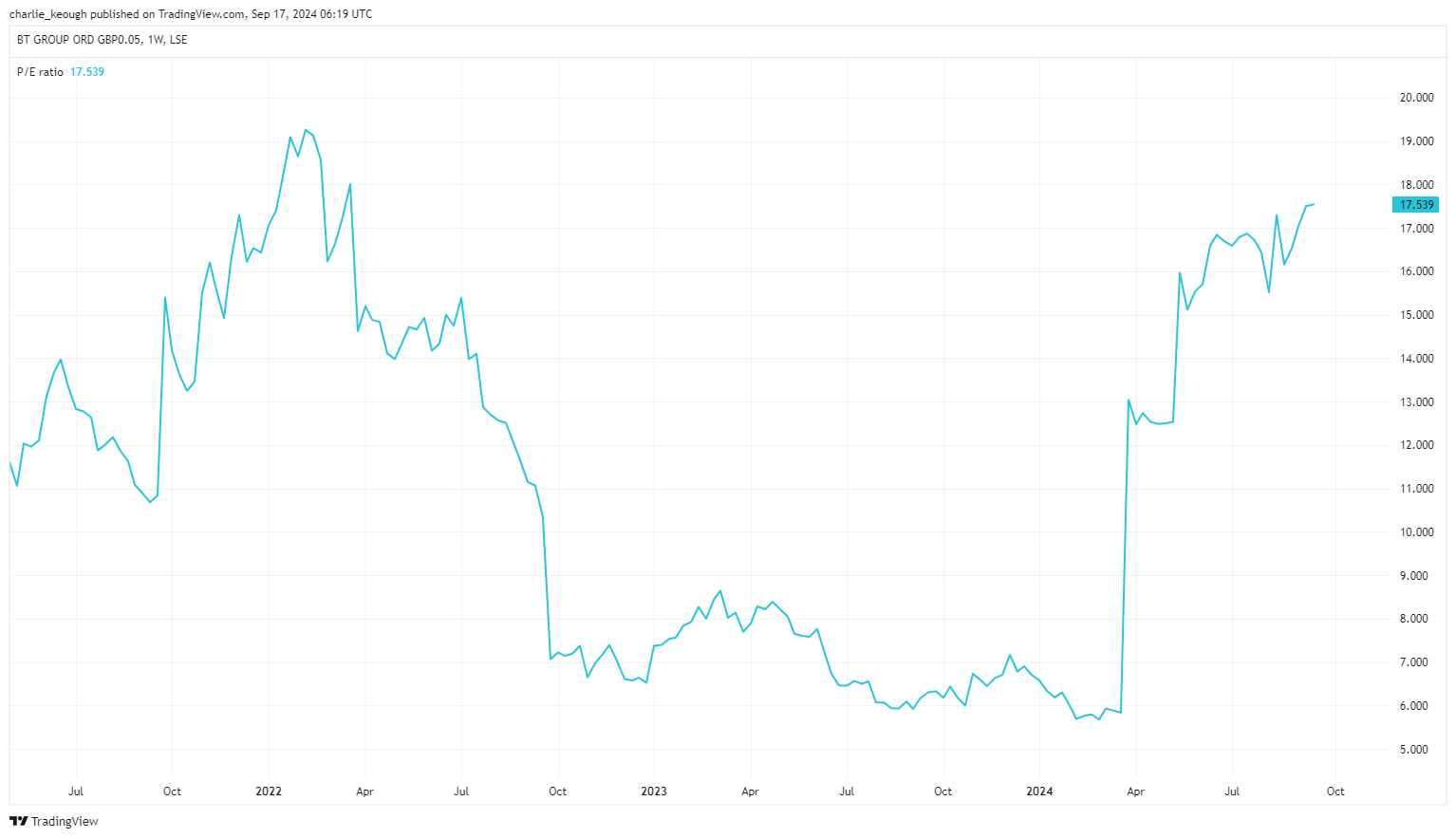

But at its current price of 147.4p, does that leave any value in the stock? A key valuation metric I always use is the price-to-earnings (P/E) ratio. As seen below, BT currently trades on a P/E of 17.5.

Comparing that to the FTSE 100 average of 11 may make its shares look expensive. However, it’s cheaper than competitors such as Vodafone (21.4) and Deutsche Telekom (25.9).

Created with TradingView

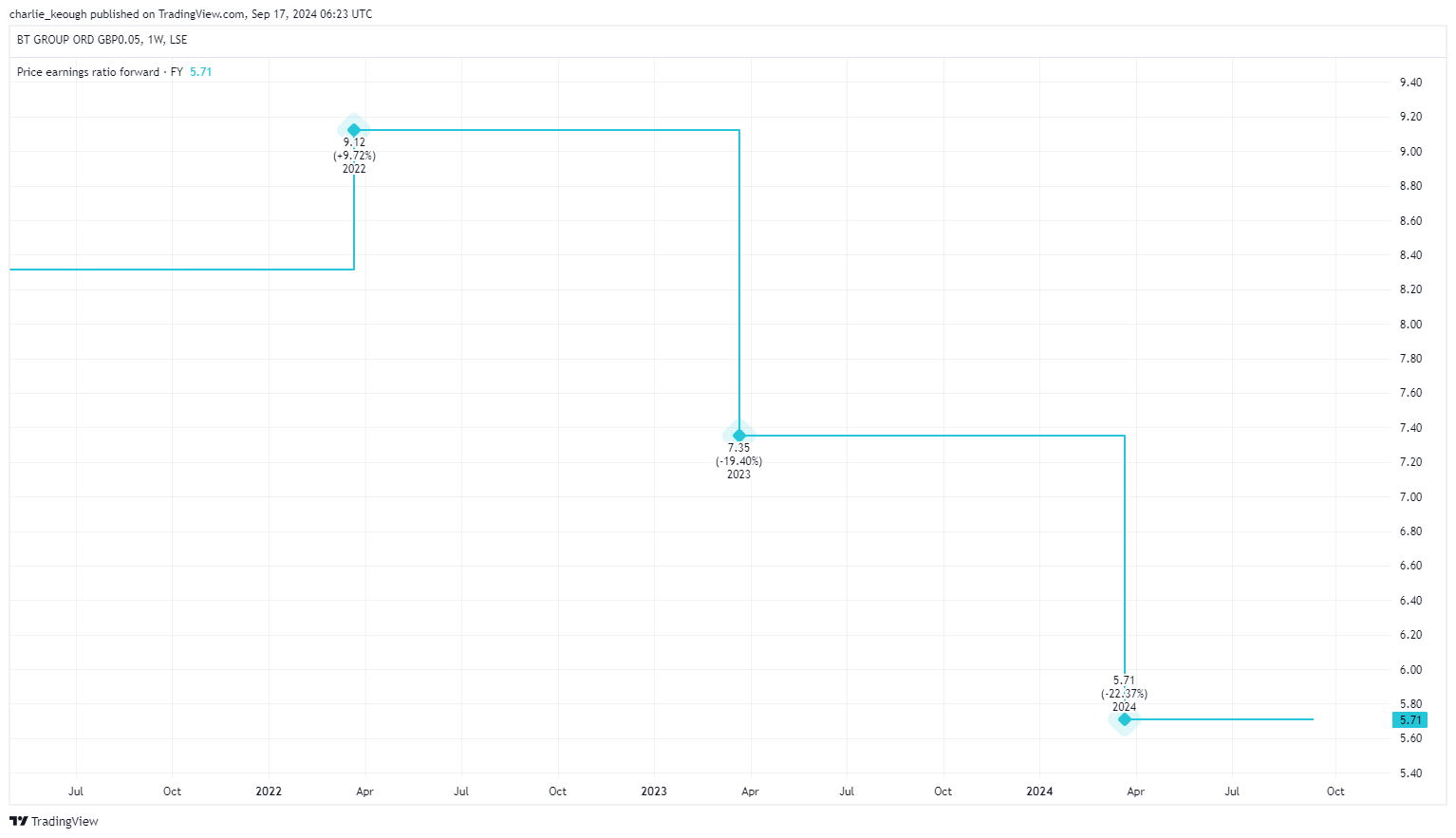

To go with that, as my chart below highlights, its forward P/E is a mere 5.7. That looks dirt cheap.

Created with TradingView

Dividend

So going off that, it seems like there’s still growing room for BT moving forward. But there’s also its meaty payout to consider.

The stock boasts a 5.4% dividend yield, covered comfortably by earnings. That’s fallen over the last couple of months due to the surge in its share price. Even so, it’s still above the Footsie average of 3.6%.

Last year, the firm upped its payout by 4% to 8p. Looking ahead, analysts predict that its payout could rise as high as 6.1% in 2027 and 6.5% in 2029.

Issues with BT

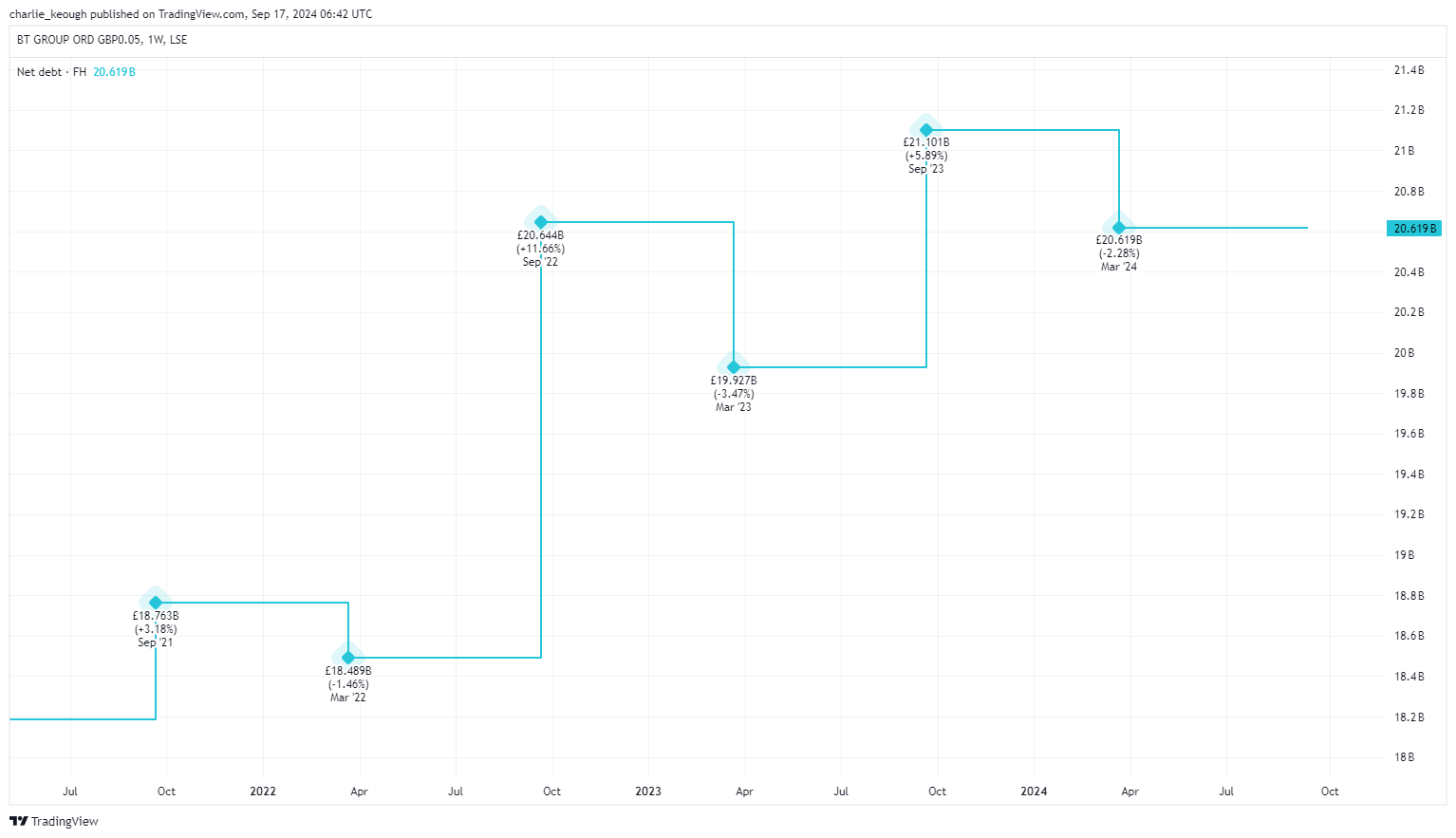

Its attractive valuation and source of passive income’s enticing. But I do have my concerns with BT. For one, I find its high levels of debt worrying.

The chart below shows how its net debt currently sits at £20.6bn. That’s alarmingly high and almost one and a half times BT’s market capitalisation.

Created with TradingView

To go with that, the actions it’s taken over the last couple of years have been impressive and clearly have investors excited. However, the business has struggled to grow its top line in recent times. For example, revenue climbed just 1% last year.

Should I buy?

Put that alongside the threat of rising competition, and I’m not sure BT’s all it’s made out to be on the surface.

While I certainly think the stock has attractive qualities, I see issues with it that deter me from snapping up some shares today.

The biggest risk is that BT’s a business in transition and the path to prosperity isn’t guaranteed, which is a factor I must consider. That said, it’s a stock I’ll be keeping on my watchlist for the time being.

This post was originally published on Motley Fool