The majority of City analysts rate AstraZeneca (LSE: AZN) as either a Buy or a Strong Buy, and there may be further long-term gains ahead for the share price.

Meanwhile, today’s (25 July) half-year report from the science-led biopharmaceutical company’s encouraging.

An upgrade to full-year guidance

In the first six months of 2024, constant currency revenue rose by 18% year on year. That filtered down to a 5% increase in core earnings per share over the period.

Looking ahead, the directors are optimistic about the outlook and raised their guidance for the full year. They now expect total revenue and core earnings per share to grow by mid-teen percentages. Previously, the expectation was for low double-digit to low-teens percentages.

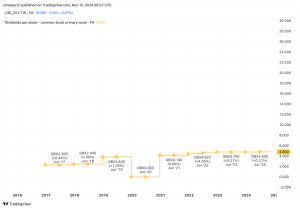

So it’s ongoing steady progress from the business after what has already been a long multi-year advance in revenues and earnings. The outcome for shareholders is clear in the share price chart — and it’s been good!

The company rewarded shareholders with an increase in the interim dividend of about 7.5%.

Chief executive Pascal Soriot is upbeat in the report saying the company has an ambition to hit $80bn of total annual revenue by 2030. To put that goal in perspective, the firm achieved just under $46bn in 2023, so it’s a stretching target.

However, the directors see “substantial” growth potential from approved medicines and those in the late-stage pipeline.

The year’s going well and AstraZeneca has already announced five “potentially practice-changing” Phase III studies. Soriot thinks they will “meaningfully” contribute to growth ahead.

Long-term growth potential

There’s been progress with several “disruptive” technologies and Soriot believes each has the potential to drive growth beyond 2030. For those with a technical mind, we’re talking about things such as antibody drug conjugates, bispecifics, cell & gene therapies, radioconjugates, and weight management medicines.

It looks like the growth trajectory of the business is set to continue for some considerable time. So why is the share price weak today? As I type, its down almost 4% in early stock market trading.

This often happens on results day for companies, even if the news is good. Part of the reason might be investor expectations. If some shareholders anticipated an even better outlook statement than what has been delivered, they might have sold shares this morning.

After all, AstraZeneca stock’s staged a long, multi-year run higher, driven by increases in revenue and earnings. Part of the outcome is a valuation that looks ‘up with events’.

City analysts expect normalised earnings to increase by a triple-digit percentage this year and a further 15% in 2025. With the share price in the ballpark of 11,774p, the forward-looking price-to-earnings rating is just over 16 and the anticipated dividend yield is almost 2.2%.

One risk for shareholders is the company may not meet its growth expectations, perhaps because of disappointing outcomes from the research & development pipeline. If that happens, the share price may decline as the valuation adjusts lower.

However, despite the risks, the long-term growth forecast’s encouraging. I’d be inclined to use weakness in the share price as an opportunity to research the company as a potential long-term investment.

This post was originally published on Motley Fool