Citi’s ThankYou Points program may not be as well-known as Chase Ultimate Rewards® or American Express Membership Rewards but it’s worth giving Citi’s eclectic list of transfer partners a closer look for the right points collectors and cardholders.

You can transfer Citi ThankYou points to fly to Hawaii for just 7,500 points, fly to London for as few as 10,000 points or book business class to Europe or Africa for as few as 44,000 points. And, thanks to the high earning rates on the Citi Premier® Card and the Citi Rewards+® Card, you can accumulate ThankYou points quickly to take advantage of these sweet spots.

However, not all Citi ThankYou transfer partners have equal weight. Which are the best Citi ThankYou points transfer partners? And which ones should you ignore? We’ll break it down below.

About the Citi ThankYou point transfer partners

Currently, you can transfer Citi ThankYou points to nearly 20 airline and hotel loyalty programs. Points generally transfer to airline partners at a 1:1 ratio — although some cardholders (including those spending on the Citi Rewards+® Card) get a lower transfer rate for American Airlines or JetBlue. Points transfer to Citi’s only hotel partner, Choice Privileges, up to a 1:2 ratio.

Retail-wise, you can also transfer Citi ThankYou points to Sears’ Shop Your Way loyalty program. You’ll get 10 Shop Your Way points for every 1 Citi ThankYou Point transferred.

New Citi ThankYou points transfer partners

Slowly but surely, Citi has grown its list of transfer partners. Recent additions include:

-

AeroMexico Club Premier in October 2019.

-

Emirates Skywards in April 2020.

-

Choice Privileges in October 2021.

On Oct. 18, 2021, Choice Privileges joined as Citi’s newest transfer partner, making it Citi’s only hotel transfer partner and the only travel-related transfer partner with a transfer ratio higher than 1:1.

Citi Prestige® Card and Citi Premier® Card holders will get 2 Choice Privileges points for every 1 ThankYou Point that you transfer. Cardholders of other ThankYou point cards will get 1.5 Choice points for every 1 ThankYou point transferred.

Note that American Airlines is a temporary Citi transfer partner

In addition to these new permanent transfer partners, Citi added American Airlines as a transfer partner — but only from July 18 to Nov. 13, 2021. This is a particularly exciting development as American Airlines AAdvantage is one of the largest loyalty programs, yet, it isn’t a transfer partner of any major U.S. issuer, such as American Express or Chase.

Many point collectors are hopeful that this temporary partnership will lead to AAdvantage being added as a permanent Citi ThankYou point transfer partner.

Citi transfer partners that vary by credit card

Citi Premier® Card holders get more value from the following ThankYou transfer partners when compared to some other Citi cardholders.

-

American Airlines AAdvantage (1:1 versus 1:0.5).

-

Choice Privileges (1:2 versus 1:1.5).

-

JetBlue True Blue (1:1 versus 1:0.8).

Understanding the baseline value of Citi ThankYou points

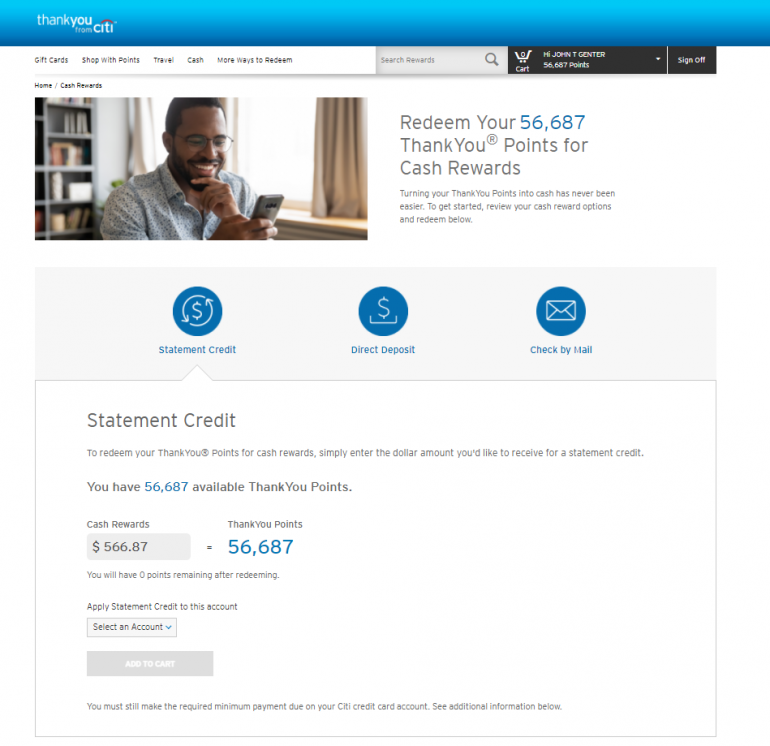

Cardholders can redeem Citi ThankYou points for 1 cent per point through the Citi ThankYou portal or when redeemed for cash back. So, 1 cent per point should be your baseline redemption rate when deciding whether or not you should transfer points to an airline or hotel partner.

The best Citi ThankYou points transfer partners

Here are NerdWallet’s picks for the best Citi transfer partners. In many of these cases, you can get significantly more value than 1 cent per point with these Citi points transfer airlines.

1. Turkish Airlines Miles&Smiles

2. Singapore Airlines KrisFlyer

We’ve covered the many Singapore Airlines sweet spots, but Singapore Airlines also releases more award availability to KrisFlyer members. KrisFlyer miles are the best way to book premium cabins on Singapore — and a good way to get outsized value from your Citi ThankYou points.

Nerdy tip: For a once in a lifetime flight and airport experience, consider saving up enough points to fly first or business class with the airline. With the right flight, your premium cabin airfare will get you access to world class lounges.

3. Virgin Atlantic Flying Club

4. Air France/KLM Flying Blue

The combined loyalty program for Air France and KLM, Flying Blue, utilizes a quirky point-to-point award pricing scheme. But, it can be worth digging through for 21,500-mile economy flights or 53,000-mile business class awards to Europe or Northern Africa.

5. Avianca LifeMiles

Use Avianca LifeMiles to book travel on United, Lufthansa and other Star Alliance carriers to Europe from 20,000 miles each way in economy or from 60,000 miles each way in business class. Or fly to southern Africa for 40,000 miles each way in economy or 78,000 miles each way in business class.

6. Etihad Guest

Etihad’s rewards program offers some shockingly low award rates. For example, you can fly Royal Air Maroc business class to Africa or Brussels Airlines business class to Europe for just 44,000 miles each way. Etihad Guest also still utilizes the pre-2016 award chart for American flights, which includes gems to Europe, Japan, South Korea and South America.

Best of the rest: Other solid Citi transfer partner redemptions

The following Citi transfer partners may provide some value, depending on what airline you’re hoping to book and where you want to go.

-

Cathay Pacific Asia Miles: The Asia Miles program can offer solid redemption rates, but only if you have time and patience. The airline will require you to fill out a web form to request a mileage award booking for many bookings — which can make booking flights with Asia Miles frustrating.

-

Choice Privileges: You can get excellent value from Choice points in Europe and Japan — especially after factoring in the 1:2 transfer ratio. However, hotel redemption rates can change throughout the year, making it hard to find value reliably.

-

JetBlue TrueBlue: In a recent NerdWallet analysis, TrueBlue points were found to be the most valuable U.S. airline currency. However, JetBlue points have a relatively fixed value. So, you can’t get outsized value through this transfer partner.

-

Qantas Frequent Flyer: Qantas has a distance-based redemption chart, with flights under 600 miles costing only 8,000 miles to book. That makes Qantas worth considering for short flights.

-

Qatar Airways Privilege Club: In a rare move, Qatar has slashed redemption rates and fees on awards over the past few years. Now, Qatar is an excellent option for award flights to Doha or onward to India or the Maldives.

The worst Citi transfer partners that should be ignored

The following Citi transfer partners generally do not offer a great value for Citi ThankYou point redemptions.

-

Aeromexico.

-

InterMiles.

-

Malaysia Airlines.

-

Thai Airways.

If you want to exceed the baseline value of 1 cent per point, you’d be wise to transfer your ThankYou points to one of the other dozen transfer partners and avoid these options. However, for the right flight and in the right circumstances, even some points’ value is better than none.

Make a judgment call on which flights are right for you to book with your ThankYou points, but keep in mind that those same ThankYou points can also be redeemed as cash back at a rate of 1 cent per point.

For instance, if you have 50,000 ThankYou points to burn and want to buy a flight on Thai Airways, you may be better off getting the $500 cash back. Then, simply pay for that same flight in cash. This may be more optimal than redeeming your ThankYou points for a worse rate.

If you’re considering transferring Citi ThankYou Points …

Remember that Citi ThankYou Points can be cashed out or used for travel at 1 cent per point. So, make sure that you’re getting at least 1 cent per point in value before transferring ThankYou points to an airline, hotel or retail partner.

Thankfully, Citi’s wide-ranging airline transfer partners — and now one hotel program — generally provide plenty of value. That said, some ThankYou partners are much more lucrative, while other partners can be safely ignored.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2021, including those best for:

This post was originally published on Nerd Wallet