This article provides information for educational purposes. NerdWallet does not offer advisory or brokerage services, nor does it recommend specific investments, including stocks, securities or cryptocurrencies.

Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a discussion about holiday travel.

Then we pivot to this week’s money question from Andrea, who has a number of questions about financial advisors. Here they are:

“Any recommendations on how to interview and choose a tax or retirement advisor? Are there any red flags to look for, or specific questions that should be asked? And should you have both types of advisors or can one cover both areas?

Also, at what point should a family consider estate planning? How do you know when you need this type of service?

I’m interested in locating and engaging with advisors that 1) won’t take advantage of me and 2) are willing to consider my best interests

Thank you”

Check out this episode on these platforms:

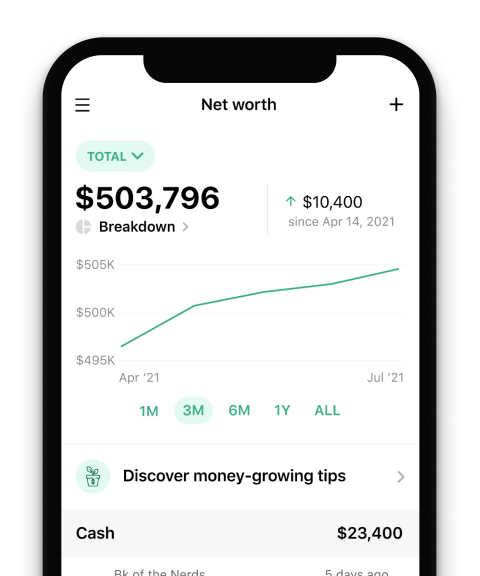

Track your money with NerdWallet

Skip the bank apps and see all your accounts in one place.

Our take

Holiday travel this year may be a new kind of chaotic, as eager travelers get back in the swing of navigating airports and road trips. The 2021 NerdWallet holiday travel report found more folks are planning to spend money on holiday travel this year compared with last year. Perhaps unsurprisingly, the vast majority of Americans traveling for the holidays are planning to take steps to save money on travel. For some, that will mean booking flights for price over convenience. Just be mindful that the more stops you have on your trip, the more opportunities there are for flights to get delayed or cancelled.

When you need to choose financial advisors, know which professionals can help you meet your goals, take steps to vet any potential expert you hire, and know the red flags. There are a variety of potential advisors you could hire. A certified public accountant can help you manage your taxes and a certified financial planner could help you get a more comprehensive financial plan to accomplish short- and long-term goals. When you’re shopping around for advisors, dig into their background and ensure that they are properly credentialed and their licenses are current. You could also “employ” a robo-advisor to manage your investments.

Understand how you’ll be charged for the services you receive. Some advisors will want payment based on a percentage of your assets. Others are fee-only, meaning you pay them a flat fee for their service. Another f-word you should keep in mind on your hunt: fiduciary. Look for advisors who carry this designation, meaning that they are legally required to put your best interests first.

Our tips

-

Know what you want. There are many different types of advisors, so look for one (or many) who can help you meet your goals.

-

Check credentials. When hiring a financial advisor, double-check that they have the right certifications. And make sure you hire a fiduciary.

-

Estate planning is important for everyone. Even if you don’t have a lot of money, preparing early could save your loved ones some heartache.

More about finding financial advisors on NerdWallet:

This article is meant to provide background information and should not be considered legal guidance.

Episode transcript

Sean Pyles: Welcome to the NerdWallet Smart Money Podcast, where we answer your personal finance questions and help you feel a little smarter about what you do with your money. I’m Sean Pyles.

Liz Weston: I’m Liz Weston. Sorry. Sean, do you want to tell people what’s going on?

Sean: I have a lot of construction going on at my house right now. So if you hear any drilling, like that or banging or glass shattering, hopefully not the latter, it’s because we’re getting new windows installed in my house this week.

Liz: Yay. That’s a good thing. It’s just a little noisy.

Sean: Yes. So please forgive any background noise. That’s what’s going on here today.

Liz: OK, cool. Once again, I’m Liz Weston. And, to send the Nerds your money questions, call or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. Or email us at [email protected]. Hit that subscribe button to get new episodes delivered to your devices every Monday. And if you like what you hear, please leave us a review and tell a friend.

Sean: Over the past few weeks, Liz and I have asked you to share your money wins in 2021. Whether you paid off debt, got a new job or remodeled your house, we encouraged you to brag, and you have. So to those of you who have already shared your stories, I want to say thank you, but we are greedy podcast hosts, and we want to hear from even more of you about what you accomplished with your money in 2021. Share your wins with us by leaving a voicemail on the Nerd hotline by calling 901-730-6373 or sending a voice memo to [email protected].

Liz: This week, Sean and I are answering a listener’s question about how to find the right financial advisors. You really want to know how to vet your advisor because most of them don’t have to operate in your best interest. To start this week’s episode, Sean and I are talking about the return of an American tradition: holiday travel.

Sean: That is right. Liz and I are going to get into the trends that we are seeing this year around holiday travel, how you can save money when traveling and how to navigate another weird holiday season.

Liz: First off, Sean, what should people know about the trends that are affecting holiday travel this year?

Sean: Well, perhaps unsurprisingly, more folks are planning to travel this year compared to last year. For some context, around a quarter of Americans said that they intended to travel for the holidays in 2020 but didn’t because of the pandemic. That’s according to a NerdWallet survey of more than 2,000 U.S. adults conducted online by the Harris Poll. But 3 in 10 who didn’t travel last year because of the pandemic do plan to spend money on travel this holiday season. So more people are traveling to see family and friends that they didn’t see last year. I count myself among them, actually. Garrett and I stayed home in Portland for Thanksgiving and Christmas and New Year’s last year, and we eventually did a belated Christmas in January. But this year we’re planning on traveling for the actual holiday. Liz, what are you planning on doing this year?

Liz: Last year was the first year in my husband’s entire life that he missed Christmas with his family. So that’s pretty impressive. This is decades with never missing a single holiday. We are definitely going to see my father-in-law and celebrate. So we’re really looking forward to seeing everybody in person again.

Sean: It turns out that how people are traveling this year is changing too. Nearly a quarter of holiday travelers said that they are using a different means of transportation than they normally would have due to the pandemic. That’s also something that I’m kind of channeling. When we did end up going down to see Garrett’s family, we did a road trip, whereas typically we would’ve flown. I bought a car early in the pandemic, and I was very happy to have that so we could travel on our own, bring the dog, bring the presents, and I think this might be a new tradition.

Liz: We usually drive up to my in-laws’ place, but on the last two occasions when I was actually on a plane, I had completely forgotten how to do it. I wound up wearing the wrong shoes and setting off the metal detector. You really get out of practice. I would say if you have not traveled by air in a couple years, definitely go to the TSA website, make sure you’re clear on what you need to do and where you need to be at what times, because the other thing that’s happening is, I think there’s going to be a lot more congestion this year than many people are used to dealing with.

Sean: I’ve also gotten a little bit rusty with traveling, as I’ll detail in a little bit when it comes to saving money on travel. But in the process itself for a long time been a big proponent of what I call my DIY sensory deprivation pod, which is where I have a big hoodie, I have my eye mask, I have my noise-canceling headphones. I just take myself out of the environment that I’m in until I get to my destination. I forgot my noise-canceling headphones, forgot my eye mask. I was just staring at the seat in front of me like, “Oh wait. How do I actually entertain myself while traveling?” So that’s been an adjustment too, getting back in the groove of knowing how to travel.

Liz: Yes, exactly. Downloading some stuff so you have it to watch. All that good stuff.

Sean: Some great personal finance podcasts, whatever you want.

Liz: Yeah. There you go. Catch up on the ones you missed.

Sean: Yeah. Well now let’s talk about how travelers can save money this year. Perhaps not surprisingly, according to the NerdWallet survey, the vast majority of holiday travelers, 9 in 10, are taking action to save money on travel this year.

Liz: That makes a lot of sense because, again, prices are going up on a lot of things so you want to be careful not to overspend.

Sean: One thing that was interesting to me is that according to the NerdWallet study, more than a third of holiday travelers say that they are choosing flights for price over convenience. What are your thoughts on that Liz?

Liz: Oh, man. Well, I noticed that you don’t have as many nonstop flights to the places at least that we go. I think that’s just the fact that they’re adding flights back in bit by bit. But I would be careful how much you try to save at the expense of convenience because every time you have a stop, you have an opportunity for things to go wrong. If you’re the last flight out in the day and the cancellations start to build up, you might not be getting out at all. Wherever possible, if you’re traveling for the holiday, try to get out early or at least try to make sure that there’s several flights after you so if something goes wrong, you can get out.

Sean: One thing to keep in mind as well is every time something goes wrong, every time you have a layover, that’s another chance for you to have to spend money where you didn’t necessarily want to. Whether it’s hanging out at airport restaurant, at a bar getting a beer or two, or buying a magazine or a book, these things can really add up. I found myself spending a lot more when I was traveling recently because of things like this.

Liz: That’s a good point. I’m a huge fan of airport lounges. Some of them allow you to do a per day charge, but again, that’s $50 to $75. If you’re buying a membership, that could be hundreds of dollars. There are premium travel cards, credit cards that include various lounge memberships. But again, those are premium. You tend to have to pay for it one way or the other.

Sean: Well, I recently had a layover in Seattle when I was heading down to Dallas for a wedding, and I was hoping to hang out at the Alaska Lounge they had in my terminal, and it was closed to day passes because of the pandemic. So for a lot of people, if you’re not already in, it might not be an option right now.

Liz: Yeah, exactly. I would never count on that.

Sean: Well, another thing we should talk about for how folks can save money the time of year is just avoiding debt, which can be really hard for a lot of people, especially if they are in a cash crunch because they spent a lot on presents, they’re not making as much and inflation is getting to their budget. But avoiding carrying a balance can save you money in the long run. So right now is a good opportunity to think about setting up a savings account dedicated to travel expenses for next year because even $50 a month could add up to enough to cover some of next year’s holiday travel expenses.

Liz: Keep this in mind next year when you’re setting your financial goals. It really helps to have money set aside before the holidays in a special savings account. Online banks typically don’t have minimums, and they don’t charge monthly fees so those are a great place to stash that what we call savings bucket, but it’s labeled so you’re less tempted to dive into it.

Sean: Let’s also talk about how folks can use credit card points to save money when traveling. And Liz, this is something that you have a lot of good experience in. So can you talk about this a bit.

Liz: Like a lot of other travel rewards hounds, we wound up with a heck of a lot of free nights and points because obviously we weren’t traveling during the pandemic. It’s kind of nice to have those, but they are going to start to expire. If you do have rewards, check them out, make sure you understand the expiration dates and maybe deploy some of them over the holidays. If you need a hotel, for example, or you need a plane flight, earn ’em and burn ’em, baby. Don’t let those sit on the books for too long.

Sean: We know how complicated it can be to figure out whether you should use points or cash to book your flights. But fortunately our ingenious Nerds have built a calculator that can help you with just this problem. You can enter your airline, the cost of the ticket in dollars and in points plus any fees, and it will spit out which is the better deal, points or miles. I’ll have a link to that on the show notes post at nerdwallet.com/podcast.

Liz: I absolutely love that calculator. That’s something that I’ve needed for such a long time. It’s so great to have it. We will give you a little hint here. It’s never the best use of your points to buy merchandise. So there’s going to be a lot of offers as the holidays come — “Here, spend it here.” You’re much better off using it for travel if that’s why you’re accumulating those points. The only time I use points to actually buy something or get a gift card is when it’s an orphaned account that I’m going to shut down anyway. Sean, what else can we tell people about how to keep their spending in check while they’re traveling?

Sean: Well, this kind of goes back to what we were talking about earlier around being rusty when traveling, because I’ve been traveling a little bit more lately. I mentioned I went to a wedding in Dallas not too long ago, and I realized that I have developed a bad habit of throwing my budget out the window when I travel, because I get kind of caught up in being somewhere new, having all these experiences that I’ll only be able to have in this place.

When I was in Dallas, I accidentally spent $90 on bolo ties for the wedding I was at. I found this very cute vintage shop called Dolly’s, and I couldn’t help myself because it was like a Dolly-referenced vintage shop. They had the bolo ties I wanted for Garrett and I, and next thing I know, $100 on two pieces of thread with a little charm on them. But I have to say, we looked great. They were very fly, but I maybe shouldn’t have spent $90 on bolo ties. This is just a good reminder to bring your budget with you whenever you travel. Maybe just a reminder for myself because it can be easy to get caught up wherever you are just spending on the holidays.

Liz: Now, I would say that was a great purchase, Sean, because you are going to remember that trip every time you see that, right?

Sean: That’s true.

Liz: It’s not some piece of plastic crap from somewhere else. It’s something that’s very definitely tied to the spot and Dolly, my gosh, you’re like a Dolly Parton superfan. Why wouldn’t you get the ties?

Sean: OK, well, thank you for justifying this.

Liz: Yeah. Maybe the better approach though is to have a slush fund so that when you spend money like that, you can just pull it from the slush fund or decide in advance, “I’m going to spend X amount.”

Sean: That’s great. If nothing else, maybe I can just incorporate bolo ties into my wardrobe more often moving forward.

Liz: Well, now that we’re going to be doing some video, that’s probably a good idea.

Sean: Yeah, absolutely. Lastly, let’s talk about how to manage uncertainty this year. We’ve been dealing with a lot of uncertainty for almost two years, but it’s still a big factor when traveling for the holidays. As we’ve been saying for a while now, a lot of it comes down to being flexible and being patient. This starts with brushing up on your airline’s cancellation and change policies and also maybe looking into travel insurance.

Liz: If you’re not in the habit of buying it, you want to at least look at it or again, use a credit card that’s got some travel insurance built-in. That will help if your luggage gets lost, for example. There’s a lot of different forms of travel insurance, and this is not what the podcast is about today, but you can definitely check into that.

The other thing is to — when you were talking about being flexible and be patient — please be flexible and patient with the people you’re dealing with at the airlines, at the travel providers because they are stretched to the limit. If you’ve tried to call a customer service line lately for an airline, you’re probably quoted wait times of 15 minutes, 20 minutes. I got quoted an hour and a half the other day. So as much as possible, try to do things on the website, through the app, and don’t try to do it via the phone.

Sean: Bring a little bit of extra kindness and thoughtfulness to every interaction you have with people that are working under pretty difficult conditions.

Liz: It’s frustrating, I know. We just had a situation the other day where a flight was, let’s see, delayed, canceled, rebooked, delayed, delayed again, delayed a third time, and then I finally canceled and rebooked because I couldn’t change it on the website and I couldn’t get through to the phone line. These things happen. It’s super frustrating. I basically sent a letter to customer service saying, “I want my refund because I couldn’t get through to you.” But again, it’s something that is beyond your control so you need to mellow out a little bit even though it’s frustrating.

All right. I think we covered it. Sean, let’s move on to the money question.

Sean: Let’s do it.

Liz: This episode’s money question comes from Andrea, who has a number of questions about financial advisors. Here they are:

“Any recommendations on how to interview and choose a tax or retirement advisor? Are there any red flags to look out for, or specific questions that should be asked? And should you have both types of advisors or can one cover both areas?

Also, at what point should a family consider estate planning? How do you know when you need this type of service?

I’m interested in locating and engaging with advisors that 1) won’t take advantage of me and 2) are willing to consider my best interests

Thank you”

Sean: To help us answer Andrea’s questions on this episode of the podcast, we are joined by investing Nerd, Alana Benson. Welcome back to the podcast, Alana.

Alana Benson: Hey, guys.

Liz: Well, Alana, the good news is that it’s never been easier to find good, objective, affordable help with your finances. The bad news is that it’s still not necessarily easy to find the right financial advisor.

Sean: That is true. I think that we should maybe start off by talking about what exactly financial advisors do. At the highest level, a financial advisor is someone who helps people manage their money and reach their goals. There are many different types of financial advisors though, who have different qualifications and areas of expertise. Someone who’s a tax advisor, for example, might not be able to help you with investment advice. Alana, can you give us a quick rundown of the different types of folks that one could hire?

Alana: So there are a lot of different names of financial advisors and some mean more than other things. For example, anyone can call themselves a financial advisor. Joe Schmo down the street with no qualifications could legally call himself a financial advisor, and that’s something that you really want to look out for. At the bare minimum, a registered investment advisor is governed by the SEC [Securities and Exchange Commission] or a state securities office, and they can legally provide personalized investment advice. So at the bare minimum, someone who is talking with you about your money should have that designation.

Ideally, you could work with a certified financial planner. This means that they have a very rigorous education and they have a fiduciary responsibility, which just means that they have to work in your best interest. That really addresses what this reader is asking about. They want to make sure that this advisor isn’t going to take advantage of them, and that is so, so important.

The other designation, if you’re looking for help with your taxes is a CPA, or a certified public accountant, and they’ll be able to answer all of those nitty-gritty tax questions.

Liz: I’d also recommend enrolled agents because they’re not CPAs, but they are tax pros, and they can be a little bit more affordable than CPAs. So that’s another thing to think about if you’re looking for just strictly help with taxes.

Sean: Another type of financial advisor that folks might not think about is actually credit counselors. These work at nonprofit credit counseling agencies, and they offer free debt and credit advice for people who maybe can’t afford financial help but would benefit from it.

Liz: Another category to look into is accredited financial counselors and accredited financial coaches. These folks tend to be employed by credit unions, the military. Sometimes they’re available for free. Sometimes they have a sliding scale. But they specialize in issues that are common to middle-class folks. So it’s not just estate planning, trust issues of the high net worth. They really are on the ground and can help you with things like budgeting and debt, stuff like that.

Sean: Paying someone to manage your money is something that I think a lot of people either can’t afford or don’t think that they need. When do you think someone should think about hiring a human versus DIY-ing it or employing a robot on the internet?

Alana: This is a great question. It’s all about how complex your individual picture is. If your situation is getting very complex and, say, you got married and you bought a house and your parents are getting older and you’re having kids and trying to figure out where your money should go in the future, that might be a time to talk to a financial advisor. Say you got a new job and they offer a lot of different health care plans or an HSA [health savings account] versus an FSA [flexible spending account]. Those kinds of things are a great time to get in touch with someone so you can ask your individual questions.

If you are just looking for investment management and you don’t care at all about picking your own stocks, you just know you’re supposed to invest but you don’t really want to have to do anything, a robo-advisor will automatically invest your money for you. But it’s not going to be the same as going to someone saying, “Hey, I want to make an estate plan. Can we do that?” It just depends on what you want to do with your money and how complex your life is getting.

Liz: I also think it might be a good idea to think about hiring somebody if you are not keeping up with the DIY chores, if you are not rebalancing your account or you’re not staying up on tax law or whatever needs to be done. You can also consider hiring somebody if you’re having trouble coming to agreement with your partner. You may need a neutral third party to work things out. Also, this is kind of interesting, but it’s truly a thing. Some people hire financial advisors because they want somebody to blame if things go wrong, and financial advisors typically will have errors and omissions insurance. Basically, it gives you somebody to sue. Not the best reason, but it’s a reason. So there you go.

Sean: For me, I think a lot of personal finance management comes down to understanding specific products which are often tied up with different acronyms and the way that these products intersect with your financial goals and often tax liabilities. This can get extremely complicated. So for me, I am trying to get help from a team that I’m building is one of my financial goals for next year, that can help me understand all of these different products that I should be leveraging, how I can use them in the most efficient way tax-wise and also in a way that can help me meet my personal goals.

Liz: Yeah, exactly. That’s really smart to think about who can help you. A lot of times it’s the tax person who’s the gateway financial advisor. It’s like, we look at taxes and go, “Oh, I really don’t want to deal with this,” so that’s the first person that we hire.

Sean: Yeah. Well, Liz, I actually want to talk for a minute about your situation because interestingly, you are a certified financial planner yet you have a team of folks that help you manage your money. Can you talk with us a bit about how and why you decided to outsource some of your money management?

Liz: Yeah. When I started getting the CFP credential, I thought, “Well, a reasonably intelligent person can handle her own money,” and by the time I’d finished the education, I had my tax person lined up, I had an estate planning attorney and later I added all kinds of other people, including I have a terrific insurance agent now. And, the last part of it was hiring our own CFP. Part of it was that thing about the cobbler’s children having no shoes is that I was advising everybody else and I wasn’t taking care of my own business. So things weren’t getting done that needed to be done.

Another part of it is it’s just really nice to have somebody to bounce ideas off of. My CPA lives and breathes taxes so that I don’t have to. To me, that is just amazingly freeing. It’s well worth the money that I pay her. Same thing with the insurance agent. We just had an issue and I was able to go to her and say, “Can you help us out with this?” She moved mountains, got things done. It really is nice to have people on your side.

Sean: I think it’s really telling that in the process of going through the various courses you have to take to get the CFP certification, you saw just how complex all these different areas of money management are and you decided to get someone who can handle this for you to take that weight off of you.

Liz: Exactly. Because you don’t know what you don’t know. That’s what really trips people up, particularly I think if you are heading towards retirement, you really, really, really need another set of eyes on your plan because you’ve never retired before. A good financial planner will have many, many clients who have been retired and they know all the things that can come up, all the ways that you can screw it up. Again, this is your money for the rest of your life. You need to make sure you’re making the right choices.

Sean: Well, now I think we should probably talk about how and where people can find financial advisors for tax retirement or general money management advice. Alana, where do you think people should go for that?

Alana: You definitely want to work with a CPA for taxes, as Liz said, that they really live and breathe that sort of thing. They’re the person to talk to. A CFP for financial advice. One note on this is it’s really, really important to do your due diligence and double-check their certifications. Some people could have a delinquency on their designation, maybe they had a violation. There are websites where you can go and check these designations and make sure they’re up to date, make sure they haven’t had any lawsuits and make sure they’d be a really good person for you to work with. So definitely before you work with anyone, double-check that their designation is what they say it is, and you’ll save yourself a very big headache by doing that small amount of work upfront.

Liz: We should also mention that there are financial planners who have a tax background. Those are CPA/PFS. So the PFS stands for personal financial specialist. If you want to get a tax person but also want financial advice, there is that all-in-one designation you can look for.

Alana, there used to be a pretty wide divide between the people who worked in person and then the people who only worked online or robo-advisors. That’s kind of blurred a little bit with the pandemic, but can you talk about online versus in-person financial advice?

Alana: So traditional in-person financial advisors often charge around 1% of your money that they manage for you. The more money you have under management, the steeper that fee is going to be. Some people just want to meet with someone in person, and that is totally fine if that is your comfort zone and you want to pay for that. That is a personal choice. But online, you are able to find services that will help you connect with an online financial advisor, and they often charge a much lower fee of the percentage of assets that they manage for you. They can do just about everything that a traditional in-person advisor can do. And a lot of times these services will also have access to tax help and tax preparation. Those are a nice in-between if you don’t want to necessarily pay the 1% fee of meeting someone in person and you can pay a cheaper fee.

A lot of these services now do video calls. So you can still meet with someone and talk to a human being. It’ll just be over Zoom or over video conferencing. There’s also a lot of one-time services that can be offered. I know Ellevest is a provider that you can purchase one-on-one sessions with a CFP or you can even do career counseling. Some other providers offer these one-time services as well. If you need help with something very particular, that might be a good option.

Then there are some providers that even do a mix of robo-advising, so managing your money with a computer algorithm and access to human advisors for less as well. There’s a lot more flexibility than there used to be, and there are more affordable options. So, you don’t just have to be this very wealthy person to go and get help with your finances. There’s all kinds of options for every financial threshold.

Liz: In addition to that 1% all-around fee, you can find people who charge by the hour, for example, or maybe have a monthly retainer fee. That can be a more affordable way to get help.

Sean: Choosing a financial advisor is a pretty serious decision. You want to make sure that this is someone that you can trust, that you can have a healthy, open and ongoing relationship with. While there are a lot of options, choosing the one that’s right for you can be a little bit of a challenge. When someone is vetting a potential financial advisor, what questions do you think they should ask?

Alana: So, first and foremost, the most important is to ask them if they are a fiduciary. Again, that just means that they are legally obligated to work in your best interest. They won’t offer you products because they’ll make a commission on them, they will offer you things that are truly the best option for you.

Another important thing is to ask how they get paid. Advisors can use that “assets under management” structure I was talking about, but people use a variety of fee structures. So it’s really important to upfront understand how you’re going to be paying them so that down the road, you’re not saying, “Well, wait, I thought it was going to be a lot less than this.” You definitely also want to again ask about those qualifications.

Then you can also ask about how you’ll communicate. Make sure that you’re comfortable talking with them in the way that you would prefer, whether that’s over the phone or over email. Make sure you know how frequently you’ll get to speak with them. Maybe it’ll only be four times a year or maybe you’ll have unlimited access and that’s going to be a really important distinction. If you need a lot of help, you want to make sure you have unlimited access to your advisor so you’re not just holding out for those quarterly phone calls.

Liz: There’s also the issue of are you going to be talking with the same person each time or could your case be handed off so that you’re talking to a different CFP or different advisor every time? With the less-expensive services, you may not have one dedicated person to talk to.

Alana: It’s really important to figure that out upfront, because that is the difference of developing a long-term relationship with one person who gets to know you as a person and gets to know the things that you really care about and maybe even gets to know your family background a little bit. If you develop that relationship over time, that can be a really, really valuable asset versus speaking to a different person every single phone call.

Sean: Our listener is also wondering about red flags to look for when vetting an advisor. What do you guys think about that?

Alana: I think one of the biggest things is that they can’t answer your questions clearly. If they’re giving you really vague answers about payment or what you’re going to be invested in, that is definitely a red flag. Another thing is to just make sure that you click with them. Do you feel comfortable communicating your concerns or are you kind of holding yourself back? Really trust your gut and see if this can be a person that you can have a really solid relationship with.

Liz: You don’t want to be the first time that they’re dealing with certain issues like stock options or small-business issues, retiring or being a government employee, being a military employee. You don’t want them learning on you. So if they have other people who are like you in that situation, they’re likely to have a deeper knowledge of what you need and how to get you to your goals.

Alana, how can people decide if they’re better off having one advisor doing a lot of things or having specific advisors for different purposes?

Alana: I think it really depends on the person. It’s more important to have a team that all works together if you’re going to work with a team. I know a lot of advisors will work with your finances and then call your tax person and make sure that everybody plays together nicely and kind of let you live your life. In terms of whether it’s better to have one for everything, again, I think it just depends on the person. If you find an advisor who also has a background in tax and they can kind of take care of everything for you, that might really, really work for you. But just like you were saying, Liz, not everyone can be an expert in everything. If your financial picture gets more complicated or you have to deal with stock options or you have to deal with estate planning, you may want to bring in a specialist who really, really knows their stuff in that field. Then they can work with your existing team. But again, it depends on the person.

Liz: Good people tend to know good people. That was the case when we hired our financial planner. She knew the insurance person that we have now, and she knew the CPA that we have now. Recommended them both, and we’ve been really happy. So if you do find one of these professionals and want more, maybe go to them for recommendations,

Sean: Our listener’s also wondering about when to consider estate planning. I will start off by saying we covered this in an episode a couple weeks back so if you have not listened to that, I highly recommend it. But the short answer is ASAP. You should probably have an estate plan yesterday, and it won’t take that long to sort out. It’s very important, but it’s especially important if you have kids that you want to take care of.

Alana: Much better to have those things ready and in place versus to not have them.

Liz: There’s two documents, actually, everybody needs even if you decide not to have a will, which I can’t imagine why you would. But you do need to have an advanced directive so that somebody can make decisions for you if you are incapacitated for health care and you need a power of attorney for financial decisions. So those are about quality of life. That’s not what happens to your stuff after you die. That’s while you’re still alive. And as Sean said, if you have minor children, really, you need to name a guardian. You don’t want them to go through the court or the foster care system, heaven forbid. So do that because you love them. Get it done.

Sean: Right. There are a lot of resources available online, like Rocket Lawyer, a service people can pay for, some have as a benefit from their employer. Also, websites like nolo.com. They have templates for certain documents like this that help you get started.

Liz: Even if you decide to go to an attorney later if your situation gets more complicated, at least the online stuff will put something in place for you. So you have it in case of emergency.

Alana: Estate planning may be one of those things that you could pay a one-time fee for, and then just go speak to someone who could help you draw up those plans. It’s not a fee that you’re paying on an ongoing basis. You could just pay it once, get those documents squared away, and then they’re done.

Sean: All right. Well, Alana, do you have any final thoughts for Andrea or anyone else that’s in the market for one or a team of financial advisors?

Alana: I really think the biggest thing is to trust your gut. Know that this is a relationship that you’re starting to form. If you’re working with a person, whether it’s online or if it’s face-to-face, make sure you feel comfortable with them because at the end of the day, you are paying them for a service, and it’s your money. You don’t owe anybody anything upfront. A lot of these advisors will offer free consultations. So just make sure that you feel comfortable. I think that’s the most important thing.

Sean: Well, thank you so much for talking with us.

Alana: Yeah. Thanks for having me.

Sean: With that, let’s get onto our takeaway tips. I can kick us off. First up, know what you want. There are many different types of advisors so look for one or many that can help you meet your goals.

Liz: Next, check credentials. When hiring a financial advisor, double-check that they have the right certifications and make sure you hire a fiduciary.

Sean: Lastly, estate planning is important even if you don’t have a lot of money, and preparing early could save your loved ones some heartache.

Liz: That’s all we have for this episode. Do you have a money question of your own? Turn to the Nerds and call or text us your questions at 901-730-6373. That’s 901-730-NERD. You can also email us at [email protected]. Visit nerdwallet.com/podcast for more information on this episode and remember to subscribe, rate and review us wherever you’re getting this podcast.

Sean: Here is our brief disclaimer, thoughtfully crafted by NerdWallet’s legal team. Your questions are answered by knowledgeable and talented finance writers, but we are not financial or investment advisors. This nerdy info is provided for general educational and entertainment purposes and may not to your specific circumstances.

Liz: With that said, until next time, turn to the Nerds.

This post was originally published on Nerd Wallet