Welcome to NerdWallet’s Smart Money podcast, where we answer your real-world money questions.

This week’s episode starts with a discussion about the benefits of being boring with your money.

Then we pivot to this week’s money question from Becky, who sent us an email:

“I was wondering if you could discuss wills and trusts on your podcast? For some background info on myself: I’m married, late 40s, both myself and spouse are in good health, one minor child, one adult child. We have no major debt. The house is 75% paid off. We have life insurance and retirement accounts. What are the benefits of having a will, and what are the things I should be looking for?

Thank you.”

Check out this episode on either of these platforms:

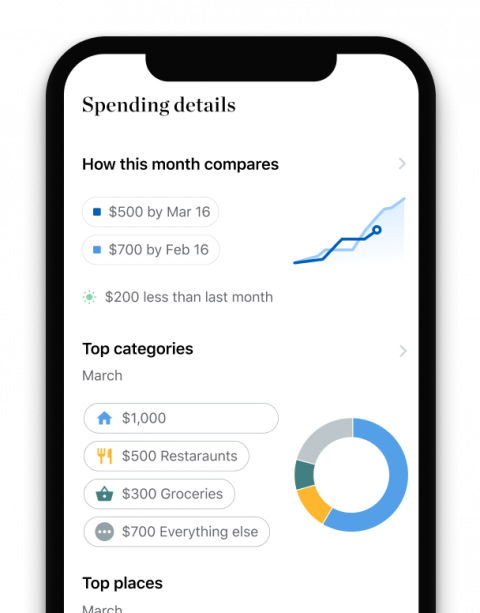

Spot your saving opportunities

See your spending breakdown to show your top spending trends and where you can cut back.

Our take

Being boring with your money management can give you more opportunities to live your life — and avoid potential financial mistakes. Unless you’re a complete money nerd, chances are that taking care of money tasks can feel like a chore. The more complicated your finances, the more time you may have to spend tending to ongoing maintenance of various accounts. With more streamlined finances, you could have more free time to enjoy the activities you love. At the same time, a “set it and forget it” approach to things like investing can save you from trying to time the market and potentially losing money.

If you’re thinking of setting up a will but haven’t already, the good news is that doing so can be simple and affordable. Many online services, like Nolo or Rocket Lawyer, can provide templates for wills. Sorting out your estate is important so that you don’t die “intestate,” a situation in which your estate is distributed according to your state’s laws, rather than your own wishes. Getting your will pinned down can also save your loved ones anguish and uncertainty after you pass.

But a will isn’t the only document you should set up to help you and your family. A living will and a power of attorney can help you have the quality of life that you want in the event you become incapacitated.

Our tips

-

Take care of business: You need an estate plan, especially if you have minor children or care about who gets your stuff. In most states, you’ll want a will. In a few states, you should consider a living trust.

-

Rest easy about taxes: Estate taxes probably won’t be an issue. Only estates worth several million dollars typically face taxes at death.

-

There’s no need to get complicated: You can DIY estate planning for simple situations, but consider an experienced attorney’s help if you have a lot of money or contentious heirs.

More about estate planning on NerdWallet:

Episode transcript

Liz Weston: Welcome to the NerdWallet Smart Money Podcast, where we answer your personal finance questions and help you feel a little smarter about what you do with your money. I’m Liz Weston.

Sara Rathner: And I’m Sara Rathner filling in for Sean Pyles — at least for the start of the episode. To have a money question answered on a future episode, call or text us on the Nerd hotline at 901-730-6373. That’s 901-730-NERD. Or email us at [email protected] Don’t forget to hit that “subscribe” button to get new episodes delivered to your devices every Monday. And if you like what you hear, leave us a review.

Liz: Sean and I are working on a special episode for the end of the year about what our listeners accomplished with their money in 2021. We want to celebrate your wins, so tell us what you accomplished. Did you buy a house? Pay off debt? Maybe you started an emergency fund or kicked up your retirement savings. We want to hear about it and help you celebrate.

Sara: And this being a podcast, we are audio-focused. We literally want to hear about your accomplishments, so leave us a voicemail on the Nerd hotline. Once again, that number is 901-730-6373, 901-730-NERD. You can also email a voice memo to us at [email protected] And if you’re phone shy, because you’re a millennial, we will also reluctantly accept a written note of your accomplishment to that email address as well. And you’ll just have Sean or Liz read it aloud in their finest podcasting voice.

Liz: Later in this episode, Sean and I are answering a listener’s question about whether it’s actually important to put together a will. Spoiler alert, of course it is. And it probably won’t be as hard as you think, or as costly, but first in our “This Week in Your Money” segment, Sara and I are going to talk about why boring money management ends up being more exciting. Sara, you just wrote an article about this, right?

Sara: I did. I don’t know if boring money management is more exciting, but it can be more effective and leave more time for other exciting things.

Liz: Why do we think money management has to be so hands on and so difficult?

Sara: We have this mentality that anything worth accomplishing should take a lot of effort. That goes with everything. Whatever you have to practice, whether you’re learning a language or a musical instrument or becoming a bodybuilder or anything, it does take regular practice. Money’s kind of the opposite. You can manage your money effectively and even successfully by doing less. In doing that, you can keep yourself from making money mistakes, or at the very least, making suboptimal decisions with your money because you think it should be super hands on, and it doesn’t always have to be.

Liz: One of the classic examples is active management when you’re investing in the stock market. There are copious studies that say the more active you are, the more you buy and sell, the worse you do — the more that you trail the market. And yet, there’s always a new generation of investors that has to find this out on their own and they have to put their money out there. They have to keep trading and they wind up not doing as well as if they picked an index fund and left their money there.

Sara: Yeah, and honestly, all these new investing apps that are out there, you can customize your alerts on them, but they alert you every time a stock you’re following has a price change.

Sara: And it creates that phantom vibration on your phone that feeds into our smartphone addiction. And you’re constantly checking and checking and checking. And so you’re reacting to these tiny little fluctuations that are normal and happen all the time. And you don’t necessarily have to react to any of them or all of them, but our lizard brains seem to think that the second our phone vibrates, we have to do something, and that’s not necessarily an effective way to handle your investments. It’s also not necessarily a sustainable way. You just can’t do that for very long. It’s very exhausting.

Liz: And I like the point you brought up that being boring gives you more time to actually live your life.

Sara: We live in the year 2021. It’s the future now. No flying cars. But, however, as a nice compensation for that, we do have the ability to manage our money more easily than ever before from anywhere we are. I don’t know how much of my financial life I manage from my phone, but it’s most of it. And it takes minutes to complete financial tasks, where 20, 30 years ago you had to get on the phone and speak to a real live human being. You can just get on your phone or get online and set up automatic money transfers. You can pick investments. You can transfer money to friends and family. There’s so much you can do in such a short amount of time. And that frees up so much more time to do really anything else. If you just want to sit in quiet contemplation, you can do that.

Sara: You don’t have to spend all day managing your money.

Liz: Back when interest rates were higher, I had a little game of trying to ring the last percentage points out of my savings. And at one point, I had five or six different bank accounts because they were so easy to set up, so easy to send money there. And I thought I was winning the game. Kind of a good thing that interest rates have gone down so far, because it really, to me, doesn’t make as much difference where my money is if it’s just sitting there waiting for me. With my emergency fund, I want it somewhere safe. I don’t really care that it’s not earning much interest.

Sara: It’s funny that you use the phrase winning the game because who are you playing? There’s this competitive aspect. This stock is doing this. And I bought crypto and blah, blah. Nobody else cares what you do with your money like you do. I don’t know who you’re competing against, unless you have some sort of weird hyper-competitive money group with some friends, in which case get new friends. That’s not fun. I don’t know. Just deal with your money and then don’t talk about it at parties. Nobody wants to hear it. I don’t know. And I literally write about money for a living and I don’t even want to hear it. I can only imagine what most people feel like when it comes to this stuff.

Liz: Well, Sara, you made the point about getting notifications and feeling like you have to do something in reaction to that, so can you talk a little bit about how being boring can keep you from making bad decisions?

Sara: Not only do we have apps that alert us all the time at random intervals, but we’re also in the middle of the 24-hour news cycle. And that means that we are bombarded all the time with news and information that can affect the economy, which therefore can affect potentially how your finances are doing. And you hear it all the time from every direction, and it makes you react out of fear.

Liz: Yeah. Yes.

Sara: Or stress. Or some other negative emotion. And that’s not a great mindset to be in when you’re making a financial decision.

Liz: Good point.

Sara: Frankly, it’s not a good mindset to be in when you’re making any decision. You can make a mistake that you wouldn’t have ordinarily made. If you didn’t turn on the news or you didn’t pay attention to your apps or whatever. It’s not a healthy way to be for a long time. It doesn’t do you any good and it can do you a lot of bad. And also it’s good to keep in mind that what’s happening in the economy at large does not have a direct effect on what’s happening in your personal life, in your personal economy. We saw that with the pandemic. The news was super dire, and for a lot of Americans, it was very difficult. People were losing jobs, losing sources of income, making very difficult professional decisions because of what was going on. A lot of Americans had no effect because of the pandemic, or even did better economically during that time. It goes to show you that things will happen in the world, and they might affect you or they might not affect you.

Sara: You don’t have to make a decision just because the thing is happening. You should make a decision based on how it’s happening to you. And that could be different from other people in your life. It’s more important to be aware of what’s going on. Maybe watch some news, but don’t let it dominate your day. Pay just enough attention to be able to make sound decisions and recession-proof your finances, set up that emergency fund, pay attention to your expenses, have a list in your mind of which expenses you can cut right off the bat if you lose your source of income. Just have that plan B in mind, but you don’t have to think about it all the time.

Liz: Having that plan B and thinking this through is really important. I think when people feel this urge to do something they need to, as you said, pause and figure out something they can do that won’t be harmful in the long run.

Sara: This is something that I’ve heard from so many people who are more professional investors than I am. Think about what you’re investing for. You’re 27 years old and you’re investing for retirement, don’t pull all your money out at the age of 28 because the market’s tanking. You’re not retiring for 40 years. What are you doing? Ask yourself, what am I saving for? What am I investing for? Does a drop in the market today affect my goals three years from now, five years from now, 10 years from now? I think we saw during the pandemic, a lot of people’s homebuying goals changed because housing prices shot up. It became a much more competitive market.

Sara: People were forgoing home inspections and throwing cash at sellers just to remain competitive. These are instances where you might look at the situation and say, you know what? We’re not buying a house this year. We’re going to rent for a while. That’s an instance where what’s going on is going to change your decision making. But if you’re saving up and you’re like, I’m going to buy a house in 10 years, today’s competitive market is going to be irrelevant 10 years from now when you’re finally ready to sit down and make that decision. Don’t freak out.

Liz: Because panic is never a good look. It just isn’t.

Sara: No, it’s not a good look. It’s way more a good look to be calm. Your skin will look so much better. You won’t have those frown lines.

Liz: That’s true. You won’t need Botox in a few years. Mellow out.

Sara: That’s a money-saving move right there. Relax your face. I was in a yoga class. We were in the middle of a series of difficult moves, and the teacher said, the face you have on right now is the face you’ll have in your 60s. And suddenly everybody in the class just relaxed their face. It was an important lesson in not taking things too seriously.

Liz: There you go. I love that. OK. Well I think we can get on to this week’s money question.

Sara: Sounds great.

Liz: This episode’s money question comes from Becky who wrote us an email. They wrote, “I was wondering if you could discuss wills and trusts on your podcast? For some background info on myself: I’m married, late 40s, both myself and my spouse are in good health, one minor child, one adult child. We have no major debt. The house is 75% paid off. We have life insurance and retirement accounts. What are the benefits of having a will, and what are the things I should be looking for?”

Sean Pyles: Oh, Becky, I am so glad that you sent us this question because wills and trusts have been something I’ve been badgering all of my friends about lately, probably in part because I finally got mine set up recently.

Liz: Well done.

Sean: Thank you. It was a long time coming, and I just feel so relieved now that I finally have it done. Anyway, to help us answer Becky’s question, on this episode of the podcast we’re joined by Tiffany Lam-Balfour, a Nerd who has covered just this subject.

Liz: Welcome to the podcast, Tiffany.

Tiffany Lam-Balfour: Thank you. So glad to be here.

Sean: Well, I want to dive in by talking about one benefit of having a will, which is that you avoid being what’s called intestate, an ugly, visceral word, which basically means that you die without a will. And your property is distributed according to your state’s laws, as opposed to your own wishes. And this can result in conflict and legal battles among your family members. Tiffany, on the flip side, can you explain what happens when you do have a will?

Tiffany: When you pass away, your loved ones will be in mourning, so it makes it a lot easier on them to handle your financial affairs if you’ve designated your preferences for various things, such as who should receive your possessions, who will watch over your children, what funeral arrangements would be fitting. With a will, you can also choose your own executor, which is a trusted person elected to carry out all of your wishes on your behalf.

Sean: And there are some pretty famous examples of contentious battles that have happened when people have died without wills, right?

Liz: Either they died without a will or the will wasn’t well drafted and caused problems. I’m thinking of the James Brown estate, the singer. It’s been in court for 15 years. Another one is Anna Nicole Smith who, you remember that name, right?

Sean: Oh yeah, of course.

Liz: Yeah. OK. She married at 26 to a billionaire who died 14 months later at age 90. And she wound up in this huge battle with his eldest son. The horrible thing is both of them died, both the son and Anna Nicole Smith died, and the state fight raged on.

Sean: Jeez.

Liz: It’s not like having an estate plan ends these problems because the billionaire did have one, but I think a well-drafted one is going to help most people make sure that their desires are carried out after they die.

Sean: And for most people setting up a will isn’t that complicated. If you’re not a billionaire, it’s often pretty simple to do. And this is why I’ve been pestering all of my friends to get theirs sorted out because to me getting a will done is like taking care of the dirty dishes that you have in the sink. It’s something where you know it’s something that you should be taking care of. It might stink a little bit, and you don’t really want to address it. But once you have it done, you feel so much better. And it probably will take you maybe 30 minutes max to get a simple one done.

Liz: I love that analogy because it really is something that feels much more onerous before you do it. A lot of us have prepaid legal services at work that can make this easier and cheaper. Nolo has the will maker software. Nolo is a self-help legal site. Even drafting a simple will with an attorney doesn’t really cost that much. It’s just the will to get the will. Excuse me. That was an unintended sound. The will to get this started. You just need to get it started.

Sean: Well, Tiffany I’m wondering who you think would be able to DIY their will and who should maybe get an attorney?

Tiffany: I think it’s similar to many other financial matters. It really depends on you. What’s your comfort level with setting up legal documents? How complicated will your estate distribution be? What is your willingness to spend on an estate attorney and get some official legal support?

Sean: It is also possible to do a hybrid approach where people can start doing a DIY will and then consult with an attorney if they think they need some professional help.

Liz: You do need an attorney in certain circumstances. If you are wealthy, for example. If you’ve got a net worth that’s seven figures, say, you definitely do not want to DIY this. I’ve heard some horror stories about people who did.

Sean: Yeah.

Liz: And the results were awful. You also want to think about getting an attorney’s help if you have a special needs child, or if you have really contentious relatives, and you think there might be an estate fight. Putting in some money upfront could really make sense in those situations.

Sean: Our listener also asked about what to look for in a will. And I think the word comprehensiveness is good, not just for their will, but also for their estate plan in general. As people put together their estate plan, it’s important to check on who you have set as beneficiaries for various accounts like retirement accounts from old jobs and savings accounts, to make sure that the beneficiaries of these accounts are who you currently want to gain access to these funds — i.e., not a long gone spouse or a sibling that you’re not on speaking terms with because wills cannot override beneficiary designations, so not having your beneficiaries in line with your distribution allocation in your will, could be a source of legal contention among your family.

Liz: Or even worse. I had one situation where a man died, and his wife and three kids did not get the life insurance. It went to his mother, and she did not share.

Sean: Oh wow.

Liz: These things are unfortunately very common, so you do want to check those beneficiary designations. If you got a 401(k) at work, go talk to HR, log on, see who the beneficiaries are. Same with IRAs. Same with bank accounts. All these things can have a beneficiary.

Sean: What’s interesting about sorting out wills and estates like this is that there are seemingly countless ways in which distribution of assets after someone’s death can go horribly wrong and become a big fight, but there aren’t that many ways to actually make it so that your wishes are carried out after your death. It’s just a few different forms that you get sorted out with your loved ones and maybe an attorney. And then once you’re gone, hopefully everything will sail smoothly for who you love.

Liz: The most important thing is to get it done. It doesn’t have to be perfect. It doesn’t have to be the last word. You’re going to change it as you go along. But getting it done is so important.

Sean: And that’s why I think just using one of these online legal services is a great place to start because, for me, it took 30 minutes to sort out my will initially.

Liz: Yeah.

Sean: And I’m glad I have it done because it just gives me peace of mind, especially now that my partner and I, we’re saving up for our wedding. It’s not going to happen for a couple years. He didn’t want to elope despite my wishes otherwise, which I understand. But now that we have that done, I’m less worried about what would happen to either of us if the worst happened.

Liz: Tiffany, did you drag your heels when it came time to put together your estate plan?

Tiffany: I think my impetus was really having children.

Tiffany: You want to make sure that your children are taken care of, and a will can allow you to name your guardians for your minor children. I wanted to make sure that I chose who would look after my child, if both myself or my spouse weren’t around anymore. If you don’t designate who the guardian is in your will, the court can appoint someone without your input, and it might be the last person that you feel comfortable with actually raising your child.

Liz: Did you and your husband agree on who the person should be?

Tiffany: It was hard.

Liz: Yeah.

Tiffany: Yes we did. Thankfully, we seemed pretty aligned on those things.

Liz: OK because that can be a source of real contention. You want the absolute perfect person. And the reality is the perfect person is you, and you’re not there. It’s like, who is the next best who can step up and do it? And who wants to do it? Because that’s part of it too.

Sean: We should probably also talk about trusts and why people have trusts. A lot of people think that it’s something that’s only for wealthy people, but that’s not really the case. Tiffany, can you talk about things like revocable living trusts and other kinds of trusts and why they’re important?

Tiffany: Besides wills, some people, as you said, set up trusts and they’re both tools for estate planning. And while some people use one or the other, actually many people have both. Most common type of trust is called a living trust. And it’s also called a revocable living trust or a revocable trust, so it has many names. They’re all the same thing. Wills are effective upon your death, but living trusts are effective once you sign them and fund them, which means that if suddenly you become incapacitated, what you’ve mapped out in your living trust will go ahead and turn on. Besides that, living trusts are also designed to avoid probate. Even if you have a will, your estate is going to have to go through probate, which is a public legal process your executor has to go through in order to distribute your property. By public, I mean that the details of your state will be placed into public record, and anybody can go in and access that information. Depending on your state, the probate process can be costly in terms of time and fees.

Tiffany: A living trust not only helps you avoid probate, but it also helps you keep your estate details under wraps. It also moves your assets into a separate legal entity, called the trust, which makes it harder to contest and gives trust precedence over wills. But you can’t establish guardianship for your minor children with a trust, so that is one big reason why many people may have both a will and a trust. But keep in mind that there are also different types of trusts you can use besides a living trust. A living trust is a revocable trust because it can be amended. An irrevocable trust cannot be modified and it moves your assets from your taxable estate and can help minimize your estate tax burden. Trusts can be used to accomplish different goals. You can limit how much a beneficiary can spend by setting up what’s called a spendthrift trust. You can prevent a beneficiary that has a disability from losing Medicaid and other governmental benefits by using a special needs trust. You can reduce estate taxes or protect assets from creditors with many different types of irrevocable trusts.

Sean: Who do you think should consider a living trust?

Tiffany: Well, I think those who want privacy. They want to avoid probate, especially if the state has high probate costs. If you want to protect against incapacity. Now, this speaks really close to my heart because my mom has Alzheimer’s. But as we age, we can potentially deal with health issues. The Alzheimer’s Association projects that by 2050, 12.7 million Americans age 65 plus will have Alzheimer’s dementia. So if you’re concerned about future memory loss or any other issues, I think a trust is really important because you can designate a successor trustee that can help handle your affairs if you’re not mentally capable of doing so. I think it’s important to note that a trust is typically more complicated to set up than a will. It requires more paperwork and usually the help of an estate attorney. But this cost at the outset, even though it might be more costly than a will, if you consider the cost of probate for your heirs later on, it probably evens out. You just have to think through all of the benefits and the pros and cons to decide what’s right for you.

Liz: And if you are in a state like California, where it can take 18 months typically for probate, it’s incredibly expensive. Basically if you own any property in California, you probably should have a living trust. Sean, when you moved to Washington state, you moved to one of the states that has updated its probate code. It’s less of an issue where you are. If you do have just a will and not a living trust, you also can get powers of attorney that will allow other people to make decisions for you. In some cases you may want to go through probate. If you want a court to supervise, to make sure that your wishes are carried out, you should go through probate. Or if you have a lot of creditors, because probate has a cutoff for creditor claims. Again, there’s a lot of different permutations to this. And if you’re not sure, you can always talk to an attorney to see what might be best for you.

Sean: We should also probably touch on estate taxes and who should and shouldn’t worry about estate taxes. What are your thoughts here, Tiffany?

Tiffany: If you have a large estate, estate tax is definitely something that you should be considering. Currently, federal estate tax applies to individuals with assets over 11.7 million. But historically, that has been closer to 5 million and it may be revised back down as this is one of the tax issues currently being discussed by Congress. If you have an estate of that size, or you expect that your estate will grow to that size, your heirs could pay up to 40% in taxes upon your passing, which is why many people use irrevocable trusts and other estate tax planning strategies to minimize their future tax burden.

Liz: The limits that you talked about are the federal limits. Some states have even lower limits. Sean, I’m thinking of your former state, Oregon. They have a $1 million limit. If you basically own a house and some other property, you could meet that limit pretty easily.

Sean: Oh, interesting.

Liz: Once again, if your estate could trigger estate taxes, you want to talk to a lawyer. Tiffany, you mentioned funding a living trust. Can you explain what that means and why it’s so important?

Tiffany: Yes. When you set up your trust, you have this legal document, but it really doesn’t have anything in it, or it doesn’t really do anything until you actually put your assets in the name of the trust. You’ll have to go through a process. It can be a little daunting taking your different investment accounts or your bank accounts and putting them in the name of the trust. However, if you work with an estate attorney, a lot of times they’ll give you a step-by-step list of things that you’ll need to do, who you need to contact. And when I did it, they even had a letter that was very easy for me to fill in a few details and send it to the different banks and credit unions to get everything sorted out.

Liz: I also used an attorney to put together our living trust. And one of the benefits was I could pay them to do all that for me, which was great. The paralegal went out, took care of retitling everything, so to me it was worth paying a little extra money to get that done. Because I know there’s a lot of people who do exactly what you were talking about, Tiffany, they set it up and then they never fund it.

Tiffany: Right. And then that’s a horrible thing to realize later on because you’ve spent all this money and time, and nothing is ready. You do have to be careful with some things like if you have a home in your trust, and then you refinance it. I know some banking institutions may ask you to retitle it back into your own name, to do the refinance, and then you have to put it and the trust, but you can deal with those things as they come.

Liz: Lenders who deal with anybody in California are going to know how to do that. It’s not a big deal here.

Sean: I do have to say it is pretty mind-blowing to me that the beneficiary designations, where you can just log in to whatever your account and designate them, are taken ahead of all of these very complicated legal documents. If you’re feeling especially lazy, that might be an OK way to have some of this sorted out if you don’t really want to go through the process, which again, isn’t that complicated, of making a will.

Liz: Also, if you do use beneficiary designations, if it’s a payable on death account, transfer on death account, whatever, that also avoids probate, so there are ways to avoid those court costs without having a living trust. Nolo has some great information on its site about how to do that and when you want to do that. It typically works better with smaller estates, but a lot of states even have a transfer on death deed for real estate. There’s a lot of ways to get around probate if you want to avoid it.

Sean: Another topic that’s related to estate planning are things like living wills, and then also powers of attorney. Liz, can you talk about what each of those are and why they’re important for people to sort out?

Liz: People get these terms confused all the time because I think the states use different terms. A power of attorney for finances for example, is the document you want. Somebody else can pay your bills, make decisions about your estate if you’re incapacitated. Another document you need is some kind of power of attorney for health care. In some states, this might be known as an advanced health care directive. Basically, this names someone to make decisions for you in terms of health care. This is the person who will pull the plug, or not, depending on what you want. And you really want somebody who is just a little honey badger. That really will stand up for you and what you want with doctors and with the medical establishment, even with your family.

Liz: You really want to pick that person carefully. Now, a living will is the document where you describe what you want to happen in those cases. This can be really hard to do, to think about these issues and to come up with these decisions. One of the places I really like to send people to is called Prepare for Your Care, and they have advanced care directives for all the states. They have some information there to help you make some of these decisions and that can get you started on the road to getting these documents in place.

Sean: And what I found really helpful was that the online legal service that we have access to through our benefits at NerdWallet had these three documents sorted out together: a will template, a power of attorney and an advanced health care directive. I was able to sort all three of those out for myself and for my partner, Garrett. And that way, even though it’s a little ways off until we’re going to get actually married, I feel like we have all of our ducks in a row legally in case something does happen.

Liz: Well, and honestly, I think those powers of attorney and the advanced health care directive are more important than a will because a will just deals with your stuff after you’re dead, particularly if you don’t have kids. The powers of attorney have to do with your quality of life while you’re alive.

Sean: Right.

Liz: So even if you can’t make decisions about your will, get those other documents.

Sean: All right, well, Tiffany, do you have any final thoughts?

Tiffany: I think just echoing what we’ve said before. It does sound pretty scary — all of these different terms and things that we’ve thrown at you, but if you get started and read some of the articles like we have on NerdWallet, I do think it will give you some peace of mind once you start taking care of it. And it’ll seem not as scary once you start doing it.

Sean: Well, thank you so much for talking with us.

Tiffany: Sure. Thanks for having me.

Sean: Well with that, I think we can get on to our “Takeaway Tips” and Liz, do you want to kick us off?

Liz: Absolutely. First, take care of business. You need an estate plan, especially if you have minor children or care about who gets your stuff. In most states, you’ll want a will, but in a few states, you should consider a living trust.

Sean: Next step, rest easy about taxes. Estate taxes probably won’t be an issue. Only estates worth several million dollars typically face taxes at death.

Liz: Finally, there’s no need to get complicated. You can DIY estate planning for simple situations, but do consider an experienced attorney’s help if you have a lot of money or contentious heirs or a special needs child. And that’s all we have for this episode. Do you have a money question of your own? Turn to the Nerds and call or text us your questions at 901-730-6373. That’s 901-730-N-E-R-D. You can also email us at [email protected] Also visit nerdwallet.com/podcast for more information on this episode and remember to subscribe, rate and review us wherever you’re getting this podcast.

Sean: And here is our brief disclaimer thoughtfully crafted by NerdWallet’s legal team. Your questions are answered by knowledgeable and talented finance writers. We are not financial or investment advisors. This Nerdy info is provided for general educational and entertainment purposes, and may not apply to your specific circumstances.

Liz: And with that said, until next time. Turn to the Nerds.

This article is meant to provide background information and should not be considered legal guidance.

This post was originally published on Nerd Wallet