Greggs (LSE: GRG) shares are up 22% so far in 2024 and are now selling for £32 a pop. That’s only 5% or so off an all-time high.

Given this, would now be an opportune time to add to my holding. Or is this FTSE 250 stock priced for perfection? Let’s dig in.

Double-digit growth

Firstly, why has the share price been heading higher lately? Well, the food-to-go retailer continues to grow its sales and profits in double digits.

In the first six months of 2024, the firm reported that total sales had risen 13.8% year on year to £961m. Underlying pre-tax profit was up 16.3% to £74.1m.

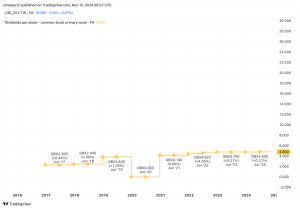

This strong showing enabled it to raise the interim dividend by 18.8% to 19p. The forward yield is 2.1%.

Greggs opened 51 net new shops in the period, bringing the total to 2,524. It remains on track to achieve 140 to 160 net new shop openings in 2024, moving it closer to its eventual target of 3,000+.

Looking ahead, one risk here would be a return of high inflation, which could eat into profit margins and compel the firm to raise prices. This is something that would likely make customers — and therefore investors — jittery.

Ticking all the boxes

The market values Greggs like a quality growth stock. This means it passes a few fundamental tests. Here are four of them:

- Strong financials: low debt levels and high returns on capital.

- Competitive advantage: a unique market position or ‘moat’, which protects it from competitors.

- High margins: strong profit margins that indicate efficiency and pricing power.

- Earnings growth: a history of reliable earnings growth, even in challenging economic conditions.

Greggs passes these with flying colours. It ended last year with net cash and cash equivalents of £195m. Its return on capital employed or ‘ROCE’ (a measure of a company’s profitability relative to the capital it invests) was 22%. That’s a very strong number.

The Greggs brand is unique. Indeed, it’s the UK’s leading food-to-go brand, according to YouGov. Earlier this year, it claimed 19.6% of the UK’s breakfast takeaway market, knocking McDonald’s off its perch.

Additionally, the company’s vertical integration (controlling much of its supply chain) helps maintain quality and cost efficiency. Its operating margin is around 8%-10%, which is strong for the industry.

Finally, the firm has continued to grow its earnings even when consumers have been feeling the pinch.

Priced for perfection

The problem with quality growth stocks like this is that they’re rarely cheap when the company is performing really well. Right now, Greggs is buzzing along splendidly and the stock reflects this.

At 3,176p, the forward-looking price-to-earnings (P/E) multiple is 23.7. That’s a hefty premium to the wider FTSE 250. Given this, I’d rather keep holding my shares for now while I explore other options.

However, if there was a correction (a decline of 10% or more from its recent peak), I’d happily consider investing more money. It’s one of my favourite UK stocks.

The firm boasts a powerful brand, excellent management, and solid balance sheet. The corporate culture is also very healthy. With a clear growth strategy in place, I see Greggs as a FTSE 100 stock in the making.

This post was originally published on Motley Fool