The easyJet (LSE: EZJ) share price has dropped back ever since tensions flared up in the Middle East.

One question now is whether this is a good time for me to buy or not?

The company stopped flying to and from Tel Aviv, Israel, in April. It plans to resume flights on 30 March 2025, a spokesperson for the company said.

However, the share price has dropped since late September as the hostilities in the region intensified. That doesn’t mean the conflict has affected the firm’s business any further. However, it might show the market fears the war may spread causing further disruption to the business.

For example, easyJet has operations in neighbouring Egypt. But my assumption is that the great majority of the company’s operations will be able to carry on as usual. That’s despite those harrowing events in the troubled region.

Trading well with a robust outlook

It’s unclear though, how the tragic conflict will affect consumer enthusiasm for flying and holidaying abroad. In one scenario, it’s possible that demand will lessen as people choose to remain home.

Another possibility is that oil prices may rise further causing easyJet’s costs to spiral higher. Aviation fuel is one of the airline’s biggest expenses. Indeed, there are plenty of possibilities that may drive lower earnings ahead and a falling share price.

My view is that the ultra-cyclical airline businesses carry more than their fair share of risks for investors at the best of times. That’s one reason why billionaire investor Warren Buffett famously dumped his airline holdings when the pandemic struck. He just couldn’t get a handle on what might happen next.

On the other hand, he’s known for targeting stocks when short-term problems affect the underlying business. It’s at such times that the market marks down the shares and valuations creating a bargain for those with the vision to see beyond near-term challenges.

Meanwhile, easyJet’s July trading update was robust and the outlook statement upbeat. Chief executive Johan Lundgren said at the time easyJet was on track to deliver a “record-breaking summer”, taking the business closer to its medium-term targets.

Strong forecasts for earnings

Even now, City analysts are optimistic and have pencilled in an improvement in normalised earnings for 2024 of just over 31% with a further 13% uplift in 2025.

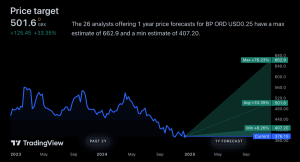

Set against those assumptions and with the share price near 494p, the forward-looking price-to-earnings — or P/E rating is undemanding at around seven. Meanwhile, the anticipated dividend yield’s just above 3%.

As always, there’s a great deal of uncertainty with easyJet. But I do see the stock as attractive now and I’m tempted to carry out further research with a view to adding some of the shares to a diversified portfolio.

However, because of the cyclical nature of the beast, I’d keep it on a short leash and be prepared to exit if the business deteriorates because of the Middle East or other factors.

This post was originally published on Motley Fool