Netflix (NASDAQ:NFLX) looks like it just keeps going from strength to strength. So should I be snapping it up in my Stocks and Shares ISA?

The latest earnings update shows impressive growth in revenues, profits, and subscribers. And there’s reason to think there could be more to come.

Returns

Netflix shares trade at a price-to-earnings (P/E) ratio of around 48. That’s high, but it doesn’t mean the stock is a bad investment – it was at 85 times earnings five years ago and it’s up 171% since then.

Netflix P/E ratio 2020-25

Created at TradingView

The reason it’s worked out so well is straightforward – the business makes a lot more money now than it did back then. Earnings per share have gone from $4.13 to $17.69, which is a 328% increase.

Even with the P/E ratio coming down, profit growth has pushed the stock higher. This has been driven by a combination of increasing revenues and widening margins.

The big question is whether it can sustain this going forward. And while the business is clearly in a strong position, there are a couple of charts I’m looking at that give me reason to hesitate.

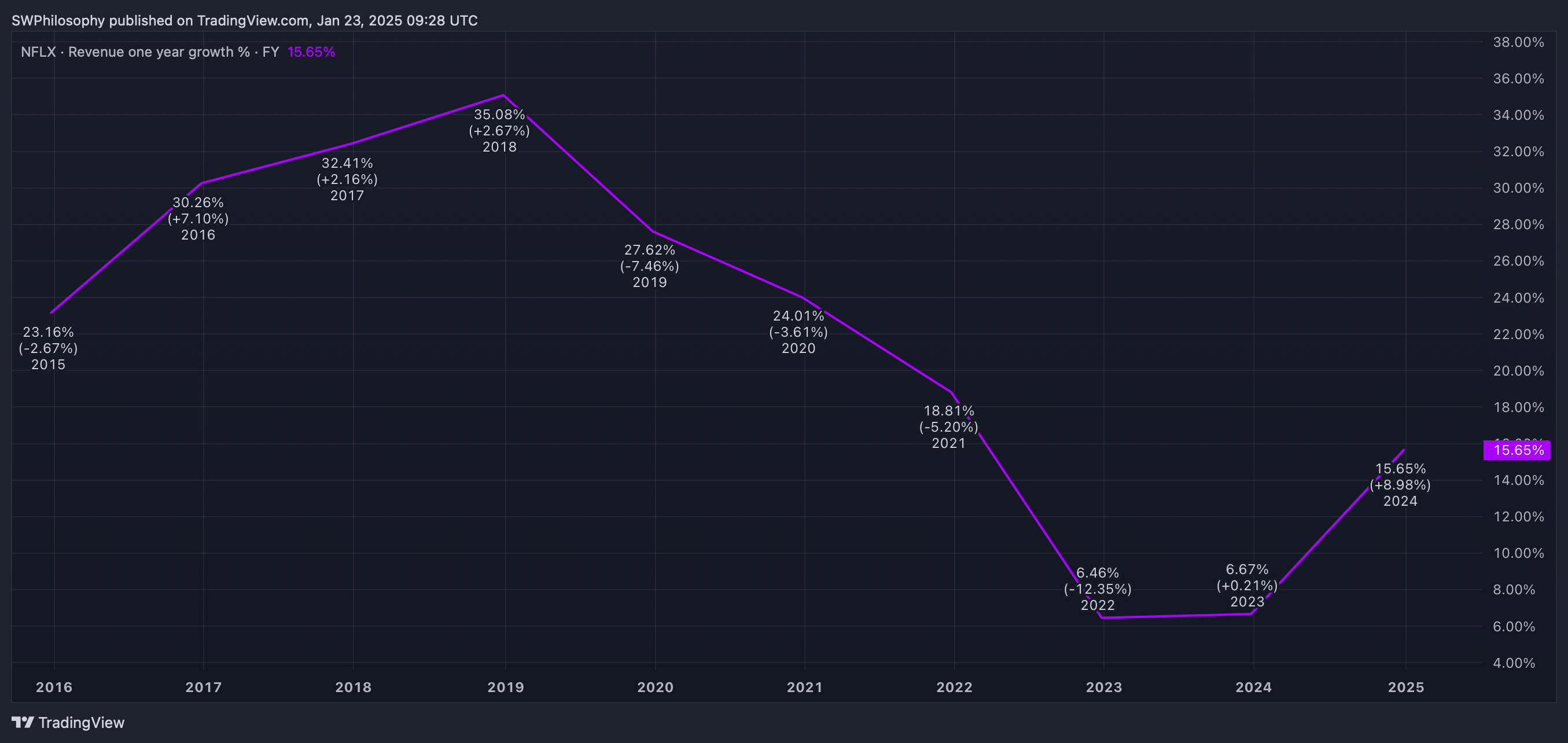

Revenues

Revenues were up 16% in the fourth quarter of 2024. That’s a good result, but it’s worth noting that before last year, the rate of sales growth had been slowing quite considerably over the last 10 years.

Netflix revenue growth 2015-24

Created at TradingView

Netflix has recently made a couple of big moves to boost revenues. This has included introducing an ad-supported tier and clamping down on password sharing between different households.

I think both of these are excellent moves. But they aren’t things that can be repeated – having stopped password sharing, there isn’t anything else to do on that front.

In its latest update, Netflix announced it’s going to increase prices. That should result in higher revenues, but whether that’s enough to justify the current share price is a more difficult question.

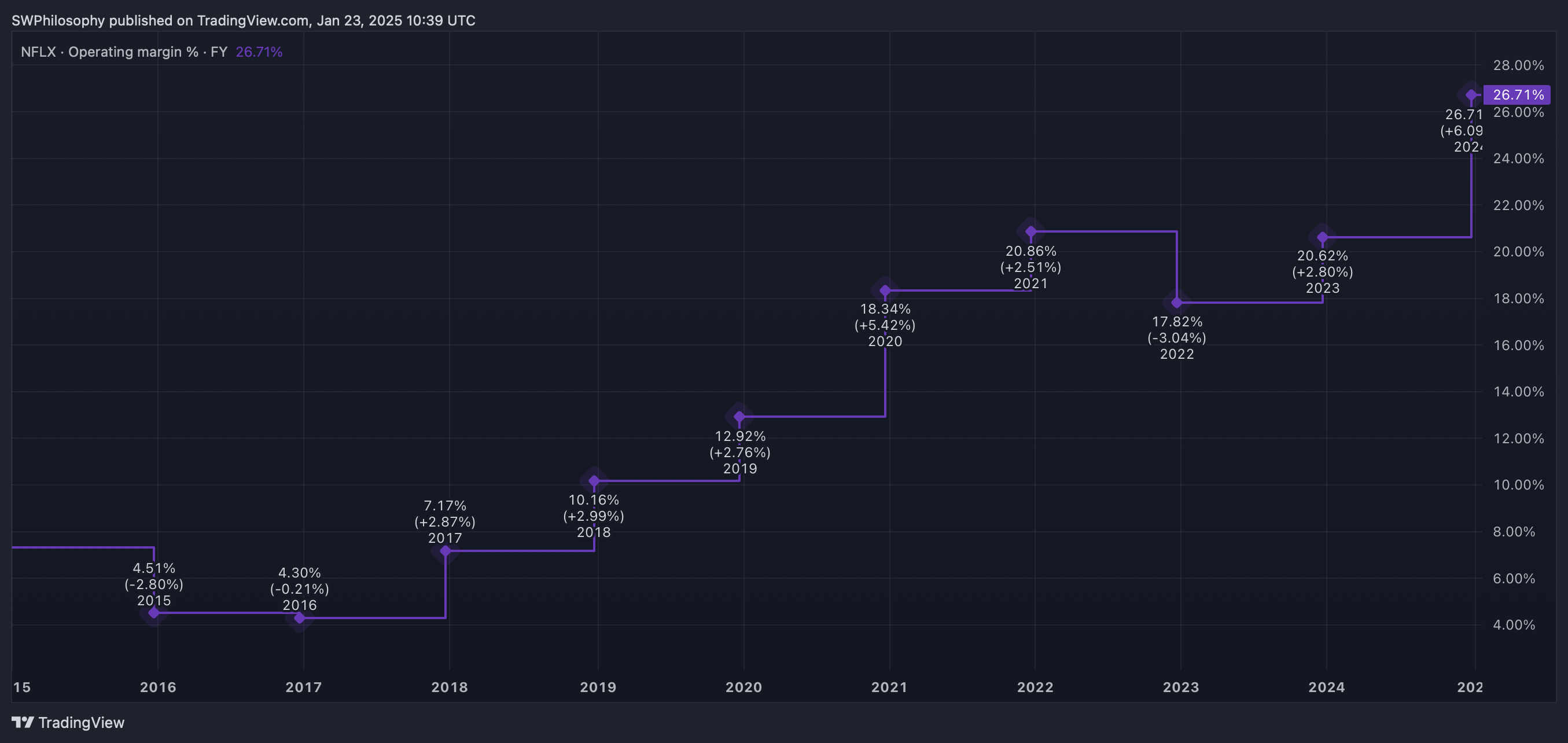

Profits

Operating margins have also increased significantly over the last 10 years. To some extent, this is to be expected as the business achieves greater scale, but the question is how much further they can go.

Netflix operating margins 2015-24

Created at TradingView

Netflix still has – and probably always will have – significant costs associated with creating and acquiring content. I don’t see a way around that over the long term.

The recent initiatives that have been boosting revenue, however, show how the firm can earn a very strong return on those investments. The associated costs are minimal, so margins have been widening.

It also doesn’t cost Netflix anything to raise prices, so there’s a chance margins could increase further. Once again, though, the question is how far and whether the stock is worth it at today’s prices.

Tough one

A couple of years ago, Netflix was in a position where the business didn’t need much to go right for the stock to be a bargain. That’s the kind of margin of safety I look for when I’m looking for shares to buy.

I don’t see that right now with the stock. So while I find it very tempting to just go for it and hope the company can grow enough to make that decision pay off, that’s just not my style as an investor.

This post was originally published on Motley Fool