Shell (LSE: SHEL) posted its third-quarter earnings this morning with profits from its gas business coming in higher than expected.

High demand meant the Integrated Gas and Upstream division drove profits, bolstered by favourable price and production conditions. However, the chemicals division reported lower utilisation, attributed to a slowdown in global demand. Refinery utilisation was relatively stable at 83%-91%.

Despite challenges in renewable segments, it has maintained a focus on strategic growth in sustainable energy solutions alongside traditional energy sources.

Overall, adjusted earnings were $6bn, down from $6.22bn in Q3 last year. The company also announced another $3.5bn in share buybacks, further highlighting its commitment to returning value to shareholders.

Net debt has been reduced to $35.2bn.

Oil price performance

Despite fluctuations in the energy market, Shell continues to deliver strong financial performance. This was particularly notable in early 2024 when quarterly earnings surpassed $7.7bn.

Shell’s commitment to cost control and operational efficiency may have partially boosted the growth, particularly within its traditional oil and gas sectors. However, as oil prices softened and refining margins tightened in the latter part of 2024, a downturn was to be expected.

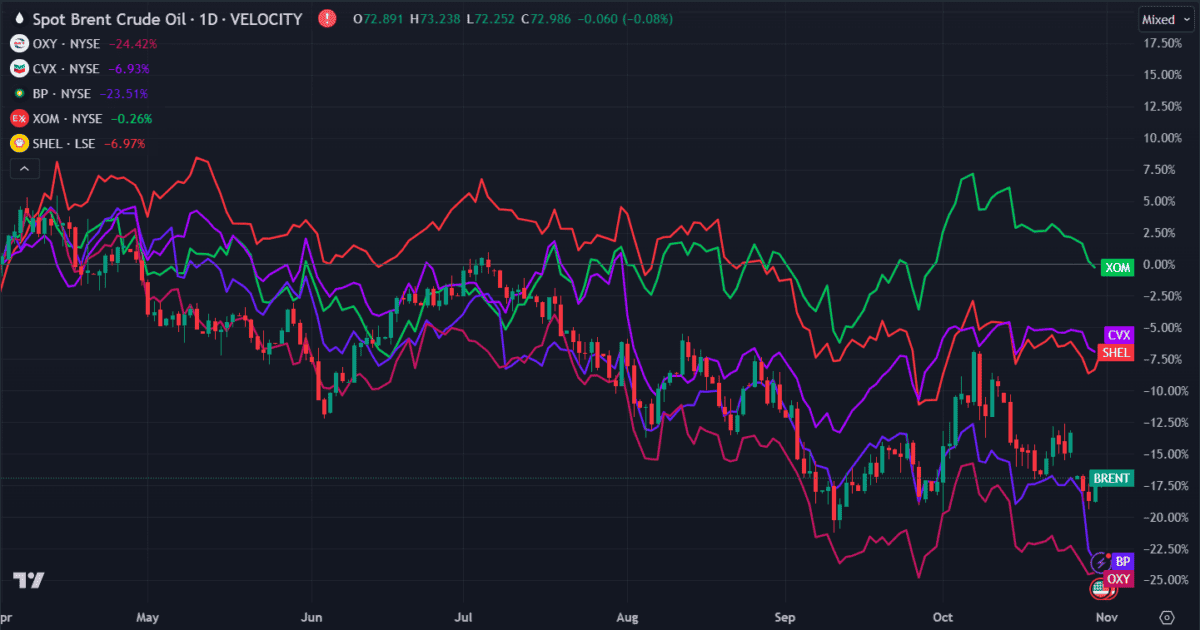

The share price has been declining since April, falling 11.7%, slightly less than the price of Brent crude, down 12%. Rival BP has suffered worse losses, falling 28% in the same period. Meanwhile in the US, Occidental Petroleum is down 24%, Chevron is down 8.2%, and Exxon has remained steady, with only 1.3% in losses.

Energy transition

Shell has made some effort to diversify its portfolio recently, driven largely by the need to meet energy transition goals.

Its initial energy transition strategy encountered significant challenges as it worked to balance investor demands, regulatory expectations, and internal goals. Originally, it committed to ambitious emission reduction targets, but was forced to scale back on some. While these have been noted as necessary and strategic pivots, they have sparked concern among environmental advocates and stakeholders.

Still, with $10bn to $15bn committed toward renewable projects from 2023 through 2025, it’s shifting towards low-carbon solutions and a greener future. It also offloaded some of its European retail energy assets, such as the December sale of its home energy business to Octopus Energy.

According to the company, the sale aims to streamline operations and strengthen its focus on high-return investments and core business areas.

A cautious approach

Ahead of its Q3 earnings, investors appeared cautious. Many anticipated lower profits from weaker refining margins and normalising trading revenues, mirroring trends seen in BP’s recent earnings.

In the face of fluctuating global demand and refining capacity limits, its resilience is notable. It’s managed to maintain a price slightly below its annual peak, reflecting investor confidence despite the external pressures.

Down 5% over the past year, the stock might not reflect short-term challenges yet, with its price-to-book (P/B) ratio sitting around historical mid-range levels. While some investors could see this as a buying opportunity, the current conditions and uncertain outlook suggest caution.

However, the 4.4% dividend yield certainly offers an added incentive, making the stock a worthwhile consideration.

This post was originally published on Motley Fool