Rolls-Royce’s (LSE: RR) share price has dropped 7% from its 21 June 12-month high of £4.88.

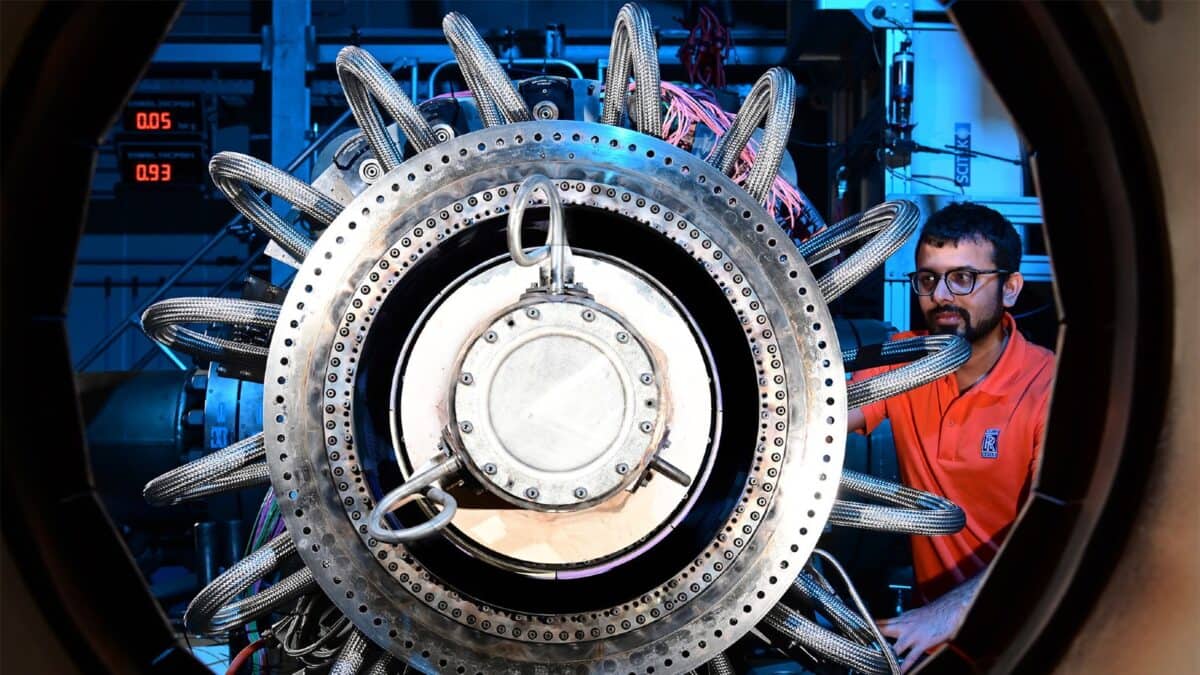

One reason for this I think was Airbus’s downgrade of its delivery plans on 25 June. The other was the aircraft manufacturer’s comment that Rolls-Royce engines for its A330neo were behind schedule.

So, how do the shares look now?

Undervalued against peers?

Rolls-Royce shares currently trade at just 15.7 on the key price-to-earnings (P/E) valuation measurement.

This is the lowest such valuation among its peers, the average P/E of which is 27.7. This group comprises BAE Systems (at 22.2), General Dynamics (24.3), Northrop Grumman (32.2), and RTX (40.1).

So, on this basis, the shares look very undervalued.

But how much a bargain is it? A discounted cash flow analysis shows the shares to be 52% undervalued at the present price of £4.55. So a fair value for the stock would be about £9.48.

The shares may go lower or higher than that, of course. However, this highlights just how cheap they look.

Strong growth ahead?

2023’s results showed strong business growth, with underlying operating profit increasing 144% to £1.59bn from £652m in 2022. Free cash flow rocketed 154% to £1.85bn from £505m, while return on capital more than doubled from 4.9% to 11.3%.

Looking ahead, 28 March saw major credit ratings agency Fitch upgrade Rolls-Royce to investment grade BBB-. This followed the same promotion to the firm’s rating from Standard & Poor’s, and Moody’s.

The elite grade gives any company greater and more preferential access to capital, which can then be used to drive growth.

To maintain this coveted ranking, Rolls-Royce upgraded key performance targets, all of which indicate significant expansion ahead.

By 2027, it targets an operating profit of £2.5bn-£2.8bn, an operating margin of 13%-15%, and a return on capital of 16%-18%. It also aims for free cash flow of £2.8bn-£3.1bn by that time.

A main risk for the firm is that the sales growth rate is not matched by increases in manufacturing capabilities. Airbus’s comment on 25 June that Rolls-Royce engines for the A330neo were behind schedule highlights this reputational risk.

So will I buy the shares?

After I turned 50 a while ago, my investment priorities changed. Previously, I had invested in shares geared for price growth and those positioned to pay high dividends.

Once I reached that milestone birthday, I sold nearly all my growth stocks and focused on high-yield shares.

The primary reason for this is that I want to increasingly live off the income and reduce my working commitments.

A secondary reason is that I do not want to wait for any growth stock to recover from a major price drop. At least if one of my high-yield shares falls in price, I will receive the scheduled dividends.

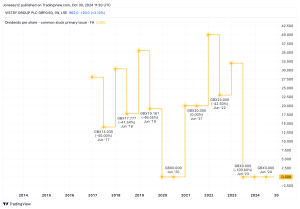

Currently, Rolls-Royce pays no dividend, so my only return from it would be from a price increase. However, to realise the profit, I would have to sell the stock first. Consequently, the stock is not for me at my stage of the investment cycle.

However, were I 10 years or more younger, then I would certainly buy it for its excellent growth prospects and its extreme share price undervaluation.

This post was originally published on Motley Fool