Share this page:

Do you have an old pension pot that you don’t contribute to anymore? When was the last time you checked it? If you haven’t checked it in a while, now might a good time to do it.

That’s because, according to recent research, your old pension pot might provide declining value for money over time and leave you thousands of pounds worse off when it comes time to access it. Here’s how that could happen and what you can do about it.

Could your pension pot be declining in value?

The Institute for Fiscal Studies (IFS) conducted a study on defined contribution pension pots that people were no longer contributing to but had not yet started drawing money from.

They found out that many of the pots held by a sample of people in their 50s were in schemes with relatively high charges by current market standards.

According to the IFS, despite the fact that charges have decreased over time, most deferred pensions do not reflect these changes. Most pensions established a long time ago currently have relatively higher fees than those established recently.

For example, the average annual fee for deferred pensions started in the 1990s is above 1.1% of fund value. For those taken in the 2000s, it’s about 0.9%, while it’s even lower for those taken in the 2010s, at 0.8%.

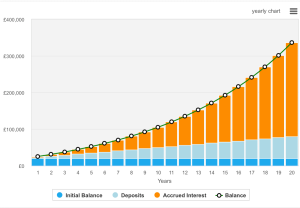

Though these are small differences, they can add up to a huge amount over time.

For example, the difference between 1.1% and 0.8% charge for a 50-year-old individual with a pot of £21,000 would be about £2,400 by the age of 67 at today’s prices.

It is important to note, however, that high fees do not always imply that a pension scheme is not good value for money.

The problem with most old pension schemes with high charges is that their investment performance is usually similar to schemes with lower charges.

Why else should savers check their old pensions?

Apart from the potentially high charges on their pension pots, pension savers’ old pensions may not be invested in the way they want.

For those nearing retirement, for example, their investments might not be matched to their current risk preferences. They might be invested in riskier investments, which could put their retirement prospects in jeopardy.

What can pensioners do to avoid losing money?

Pensioners can prevent their deferred old pension pots from losing value by engaging more with them and making active decisions on them. This might include moving an old pension pot to a new one that has lower charges and therefore better value for money.

Moving your pension to a new provider could come with other benefits in addition to lower costs. For example, it may give you access to a wider choice of investments. After all, many old pension schemes tend to offer a limited choice of funds.

Usually, you can move a defined contribution pension at any time before you start drawing from it. Some providers will allow you to do it even if you have started drawing from it.

If you have several old deferred pension pots, it also makes sense to consolidate them into a single pot. Having everything under one roof makes it easier to track performance and manage your money.

What else do you need to know about moving pension pots?

Some providers might apply an exit charge when you transfer your pension pot. Therefore, run the numbers first to ensure that any potential exit charges do not offset the potential benefits of the transfer.

Transferring an older pension pot also carries the risk of losing some special or protected benefits, such as a guaranteed annuity rate or even an option to take more than the standard 25% of your pension as tax-free cash.

Before you move your pension pot, make sure the benefits of the transfer outweigh any loss of special or protected features.

Was this article helpful?

YesNo

About the author

Sean is a personal finance writer with a strong passion for helping others become more financially literate and make better financial decisions. He covers everything from credit cards to savings to investing.

Share this page:

Some offers on The Motley Fool UK site are from our partners — it’s how we make money and keep this site going. But does that impact our ratings? Nope. Our commitment is to you. If a product isn’t any good, our rating will reflect that, or we won’t list it at all. Also, while we aim to feature the best products available, we do not review every product on the market. Learn more here. The statements above are The Motley Fool’s alone and have not been provided or endorsed by bank advertisers. John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. The Motley Fool UK has recommended Barclays, Hargreaves Lansdown, HSBC Holdings, Lloyds Banking Group, Mastercard, and Tesco.

This post was originally published on Motley Fool