FTSE 100 income stock M&G (LSE:MNG) hasn’t done quite as well as I’d hoped when I bought the shares on three occasions last year. Or rather, its share price hasn’t. The ultra-high dividend yield has more than compensated.

The wealth manager has had a bumpy ride since spinning off from FTSE 100 insurer Prudential in 2019. Its shares opened at 225.2p in October 2019. Today, they’re down 6.7% at 210p. I bought M&G to take advantage of that dip.

The share price is up 11.91% over 12 months but trails the FTSE 100 as a whole, which rose 13.7% over the same period. When it comes to income though, there’s no competition. M&G’s trailing yield is a blistering 9.36%. The index as a whole yields just 3.78%.

That lifts M&G’s total one-year return to 21.27% which isn’t too shabby if you ask me. Especially given recent stock market volatility.

High-yield FTSE 100 share

That’s the joy of ultra-high income stocks. It means a chunk of cash hits my portfolio each year, even if stock markets are volatile. Provided, of course, the company generates enough cash to maintain shareholder payouts (and hopefully increase them too).

M&G delivered its full-year 2023 results way back on 21 March, and they were pretty solid. Adjusted operating before tax jumped 27.52% to £797m, beating consensus forecasts of £750m. The group turned an IFRS loss of £2.1bn in 2022 to a profit of £309m.

That 2022 loss was a bit of a one off, triggered by short-term fluctuations in investment returns, but it’s good to see the back of it.

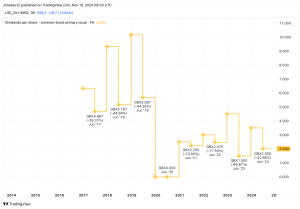

Net client flows and its shareholder Solvency II ratio both rose “materially”. Capital generation rose 20% to £996m, lifting the two-year total to £1.8bn. However, investors didn’t appreciate one piece of news. The total 2023 dividend payout increase was vanishingly small, up from 19.6p in 2022 to 19.7p

Long-term buy-and-hold

That’s an increase of just 0.51%, way below the previous year’s 7.1%. The board blandly stated that this was “in line with our policy of stable or increasing dividends”, but investors weren’t impressed. That was just too stable for their liking.

The shares fell sharply but I’m not too worried. I’m planning to hold the stock for a minimum five to 10 years, and ideally much longer, to give my super-juicy dividends time to compound and grow. At the current rate I should double my money in less than eight years, even if M&G shares don’t rise at all. I’ll treat any growth as a bonus.

Dividend stocks will attract more interest once central bankers starts slashing interest rates. At that point, returns on cash and bonds should fall. Over 12 months, five-year gilt yields have fallen from 4.75% to 3.73%. That makes M&G’s yield look relatively more attractive, despite the added risk involved.

One concern is that M&G is an active fund manager. The rise of passive investing may hit demand. Also, it’s always been a bond fund specialist, and sales could decline as yields fall.

I believe M&G’s sky-high yield will more than compensate and I’m keen to take advantage of recent turbulence to top up my stake and bag even more income.

This post was originally published on Motley Fool