When my Foolish colleagues and I were asked to select our best British stocks to buy for 2024 last December, I went for one that few were willing to touch. So far, I’m rather happy with how my choice is faring.

Contrarian stock

My pick was housebuilder Persimmon (LSE: PSN). I should mention from the outset that this was a stock that I already owned. So bias may have played a role.

Then again, my case for favouring the business wasn’t built on sand.

Sure, it was hard to find many people who were particularly positive about the property market. High interest rates (at least relative to what we’ve seen in the last decade or so) and a cost-of-living crisis in the wake of higher inflation were hammering demand.

However, the news coming out of the company wasn’t exactly the stuff of nightmares. A Q3 update in November saw Persimmon raise its completion target for the year. Margins were also expected to remain steady. More generally, there were signs that house prices were stabilising.

As someone willing to hold for the long term, this flicked my contrarian switch. I argued that any chink of light from the Bank of England, in terms of when it might begin cutting interest rates, could send the stock soaring.

Market beater!

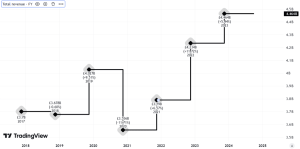

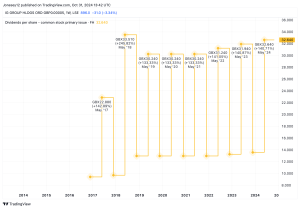

As I type this on 4 October, Persimmon stock’s climbed 22% since the beginning of 2024. That’s a very satisfying performance given that the FTSE 100 and FTSE 250 have both climbed around 7%. Oh, and there’s been a 40p per share dividend on top of this!

Quite a lot of this gain has come since July’s general election and the new government’s declaration that it would revise planning laws. Somewhat understandably, the prospect of 1.5 million homes being built in the next five years sent analysts running back to the calculators. It also likely pushed many private investors to take a fresh look at the company.

In August, the Bank of England made its first cut to interest rates, further fuelling speculation that the property market could be set for a great recovery as buyer demand rises. Oh, and inflation has now retreated back to a far-more-manageable 2.2%.

Taking all this into account, Persimmon’s resurgence seems more than justified.

What now?

Whether it lasts is another thing entirely. I don’t think a bounce in inflation at some point would necessarily shock the market. However, a larger-than-expected rise could put some pressure on stocks connected to the housing sector.

A lot will also depend on how investors react to the next trading update — due 6 November. There’s certainly an argument for saying that any encouraging news is already priced in. The stock currently changes hands on a forward P/E ratio of 20.

Fingers crossed

Press me to say which scenario is most likely and I’d probably go for more interest rate cuts and more gains ahead for Persimmon holders. But this is just speculation on my part. I’m certainly not about to go ‘all in’ on the company. That would be foolish, not Foolish. But am I tempted to increase my holding slightly if in a position to do so? You bet!

Here’s hoping I’ll be toasting an even better performance at the end of the year.

This post was originally published on Motley Fool