Searching for stocks to buy for substantial capital gains this year? Here are a couple of brilliant bargains I think savvy investors should seriously consider.

Begbies Traynor

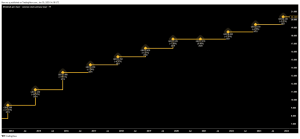

These are tough times for British business as costs rise and consumer spending slumps. In this climate, Begbies Traynor (LSE:BEG) could experience strong and sustained demand for its services, driving its share price higher.

This AIM company provides insolvency services and other support for troubled companies. Its latest research released on Friday (24 January) showed “[an] historic jump in the number of firms in critical financial distress“.

According to Begbies, the number of UK firms in ‘critical’ financial distress leapt 50.2% between quarters three and four, to 46,853.

The £146m cap firm has proved itself adept at capturing business in difficult climates like this. Half-year financials released last month showed revenues up 16% year on year between April and September, at £76.3m, and pre-tax profit 57% higher at £4.7m.

I don’t currently think this reflected in the company’s valuation, which leaves scope for substantial share price gains in my view. It trades on a forward price-to-earnings (P/E) ratio of just 8.8 times.

Begbies’ share price could head in the opposite direction if Britain’s economy perks up. But on balance, I think the profits outlook here is pretty robust, helped by the company’s ongoing commitment to acquisitions.

Warehouse REIT

Property stocks like Warehouse REIT (LSE:WHR) have slumped in this era of higher-than-normal interest rates. There’s a danger, too, that this may persist into 2025 and beyond if inflationary pressures remain stubborn.

Greater interest rates are problematic by raising firms’ borrowing costs and depressing their net asset values (NAVs).

Yet I believe this threat is more than baked into the ultra-low valuations of many of these stocks. In the case of Warehouse REIT, the trust’s share price, at 78.2p, sits at a near-40% discount to a NAV per share of 127.6p.

Besides, the prospect of multiple interest rate reductions in the current economic and inflationary landscape remains a very realistic one. On Friday, Lloyds Bank chief executive Charlie Nunn told Sky News he expects as many as three Bank of England rate cuts this year.

There are about 50 real estate investment trusts (REITs) listed in the UK. I like Warehouse REIT because it has multiple growth opportunities to exploit, like the steady rise of e-commerce, increasing onshoring, and the evolution of supply chain management.

With around 450 tenants on its books, its rental income should remain robust too even if one or two companies struggle in the current climate. This means shareholders can look forward to more market-beating dividends.

REIT rules state that at least 90% of annual rental profits must be distributed through dividends. As a result, the forward dividend yield at Warehouse REIT is a robust 8.1%.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

This post was originally published on Motley Fool