The best share to buy isn’t always a red hot momentum stock. Typically, I favour last year’s losers over the big winners. They’re usually cheap, have higher yields and bags of comeback potential. The potential rewards are high, but so are the risks.

With that in mind, I’ve been loading up on the single biggest FTSE 100 loser so far in 2024. Was this wise?

Shares in international luxury fashion chain Burberry Group (LSE: BRBY) are down 36.51% year date. Over 12 months, they’ve crashed a thumping 56.28%.

Profits after tax plunged from £492m in 2022 to £271m in 2023. The cost-of-living crisis and plunging demand in key market China are the main culprits.

Stock going cheap

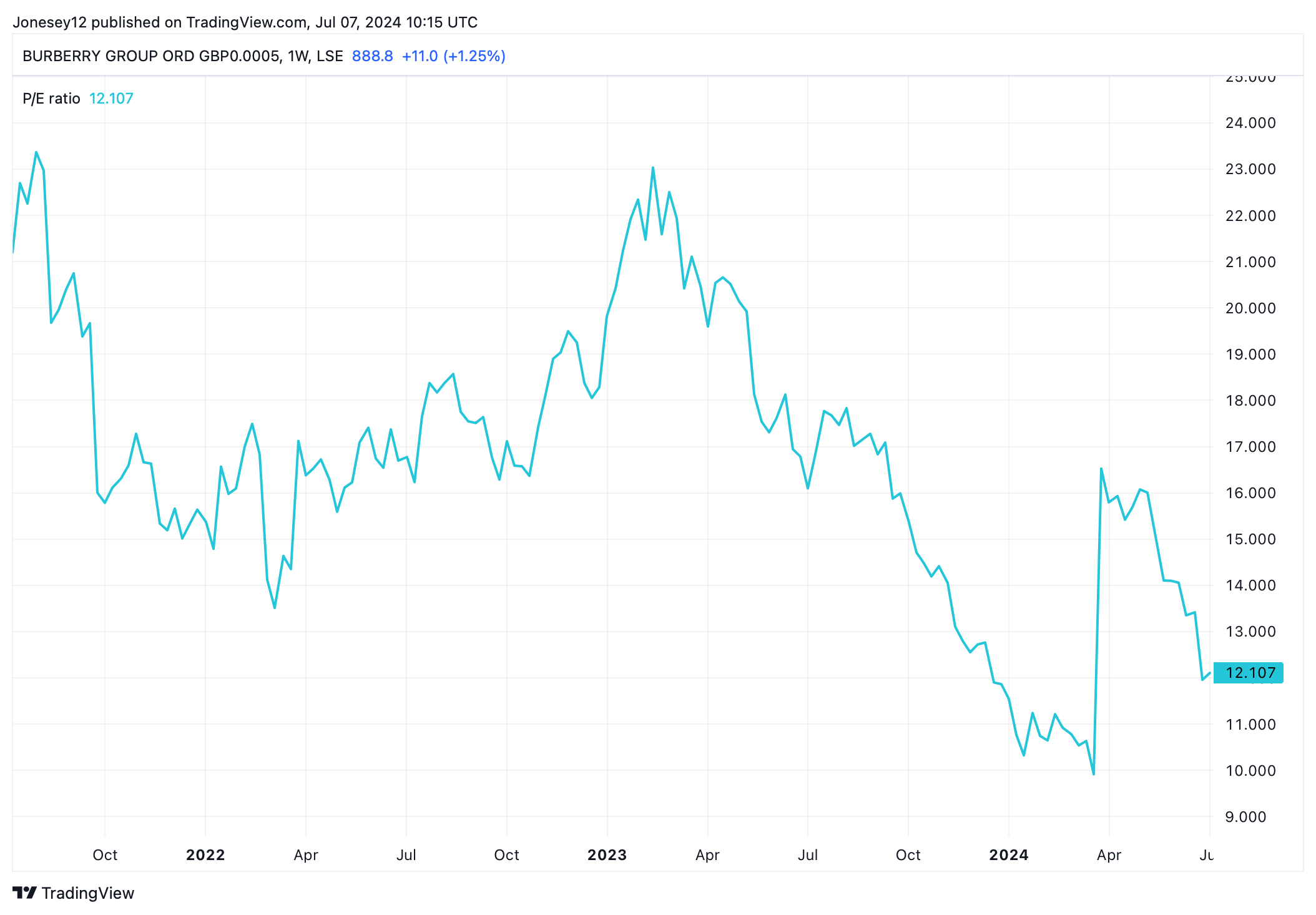

As a result, the shares are cheap. In February 2023, for example, they traded at just over 23 times earnings. Today, they’re roughly half that at around 12 times earnings. Let’s see what the charts say.

Chart by TradingView

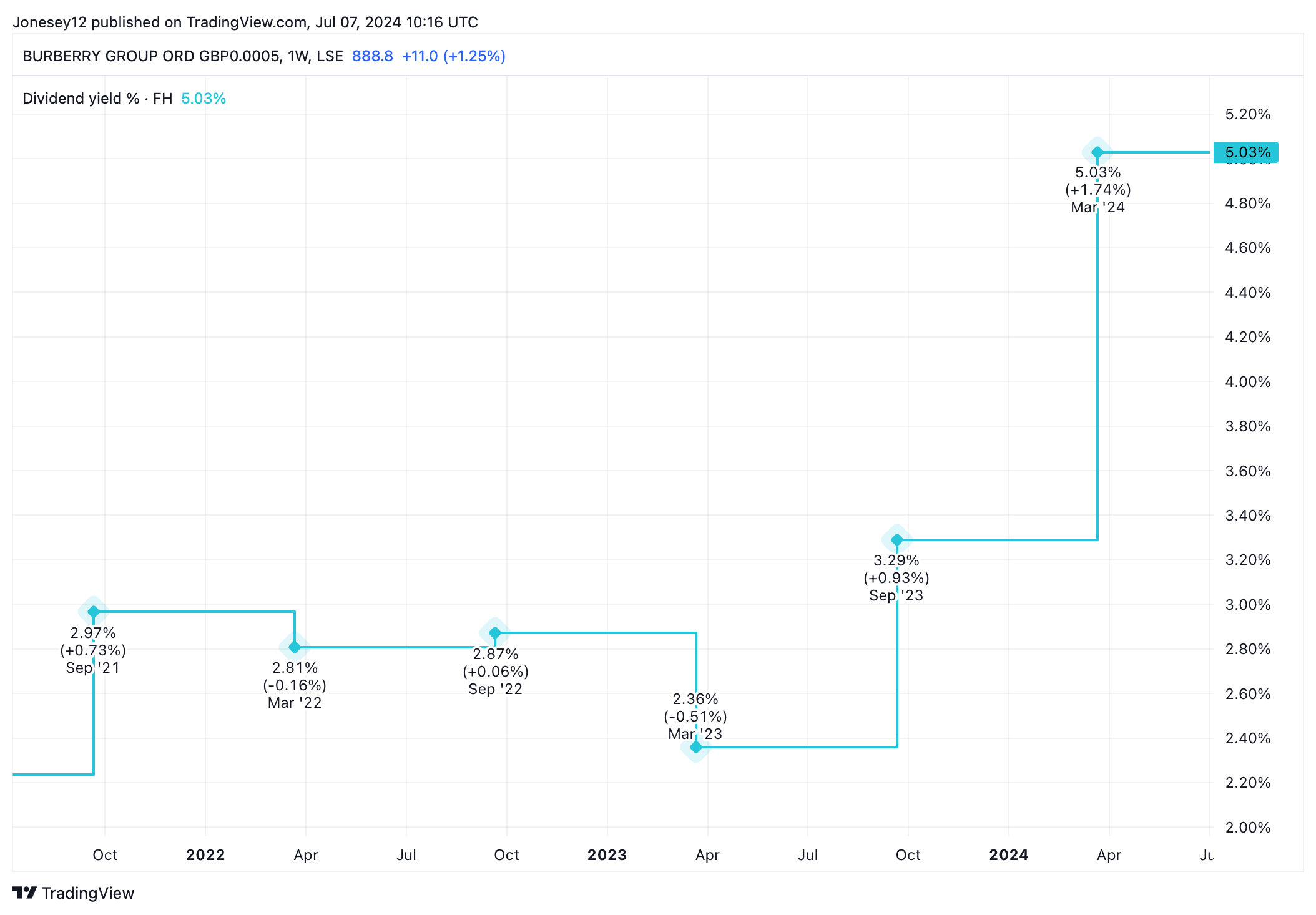

At the same time, the dividend yield has soared. From less than 3% Burberry is now offering income of more than 5% a year, as this chart shows.

Chart by TradingView

That yield was a key attraction, but I’m also concerned. AJ Bell has warned Burberry could cut its total dividend from 61p per share to 52p this year. Given the company’s troubles, that wouldn’t surprise me at all.

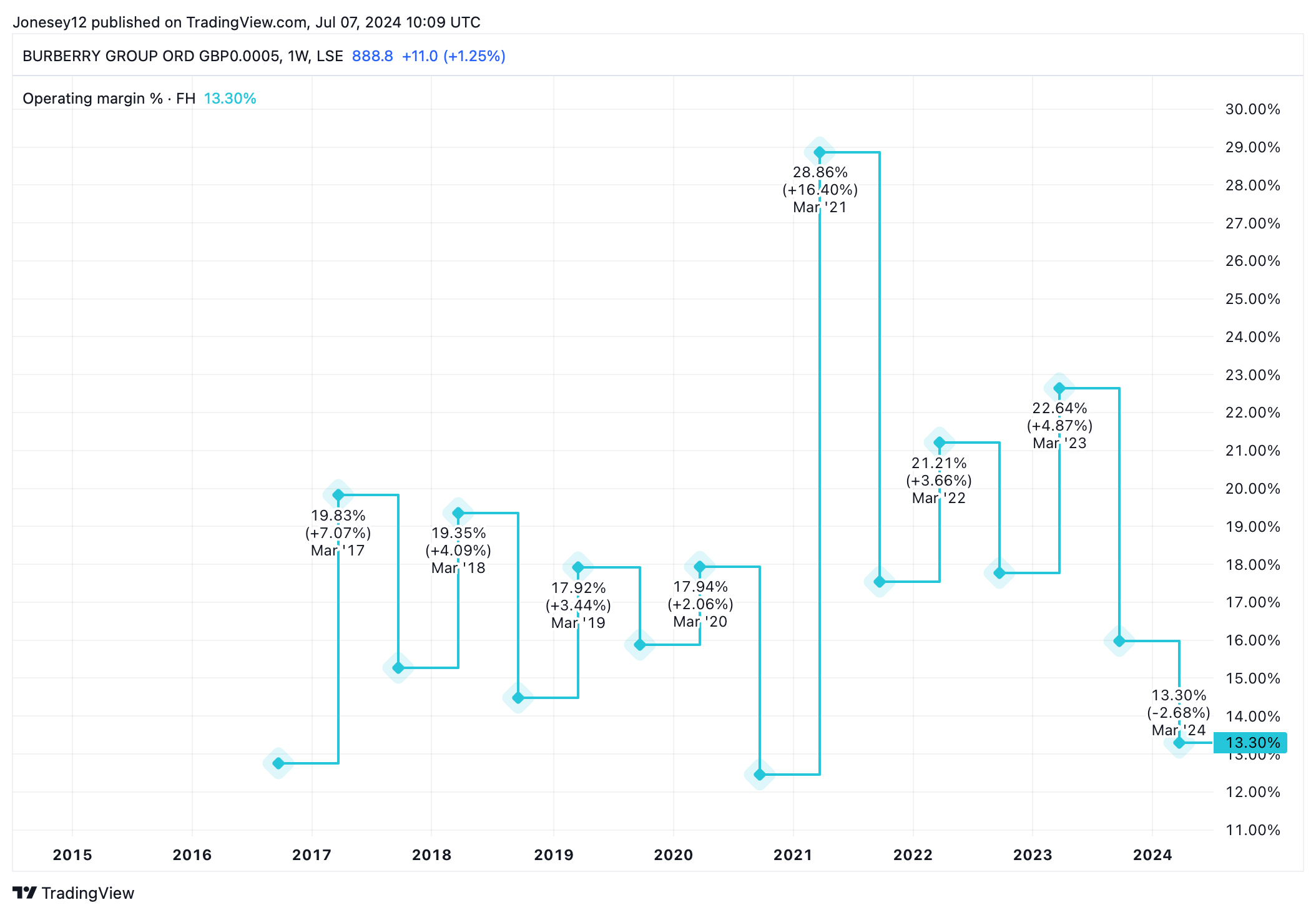

A turnaround for a struggling company isn’t an overnight job. It can take years. Burberry’s operating margins have plunged from 28.86% in March 2021 to just 13.3% at last count. Again, let’s see what the charts say.

Chart by TradingView

Just because a major company’s shares have fallen by half doesn’t mean they can’t fall further. I bought Burberry shares on 15 May, thinking the worst was over. They fell again. I averaged down on 30 May. They fell again. I bought more on 3 July. They’re up slightly, but I’m still down 18.84% overall.

Recovery play

That’s annoying but hardly the end of the world. Timing the very bottom of the market – or a stock – is almost impossible.

What no chart can tell me is where the Burberry share price goes next. Profits aren’t the only issue here. The brand needs a boost too. It’s just not as cool as it was. How can we measure something like that? Answer: we can’t. Effectively, I’m gambling on the fact that a fashion business founded in 1856 has bags of endurance.

CEO Jonathan Akeroyd says the board is working hard to refocus its brand image, evolve products and make operational improvements. He hopes to see the results in the second half of the financial year. We can expect more pain before then, with first half wholesale revenues likely to fall by 25%.

Burberry needs a good Christmas. Certainly better than last year’s. I’m willing to sit tight and wait. I’ll get my first dividend on 2 August, and will reinvest it straight back into the stock. I wouldn’t say Burberry is the very best share to buy today. But with a long-term view, I think it’s pretty good. I might even buy its shares again.

This post was originally published on Motley Fool