When looking through the list of the FTSE 250, I’m not just looking for the next hot investment. I also want to make sure that I get great value for my money. Thankfully, I don’t usually have to substantially sacrifice growth in the process.

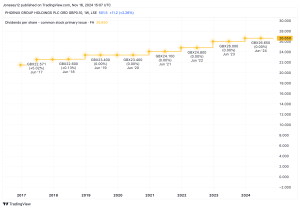

One company that has been on my mind for a while is Computacenter (LSE:CCC). Many top analysts rate it highly, and over the last decade, it has delivered price growth of 296.5%. That translates to a compound annual growth rate over the period of 14.8%.

Globally diversified technology business

Management has cleverly set this IT services company up to pull in revenue from all around the world. Its three core markets are the US, Germany and the UK, but it also operates in France and further afield.

Computacenter isn’t alone in its endeavour as a British business offering help with digital workflows. Other prominent competitors headquartered in the country include Kainos and Softcat. Arguably, Computacenter is the stalwart of the group, as it’s larger and was established the earliest of all three firms.

One great thing about investing in companies that are more established is that they often come with a better valuation. That’s nice because it means there’s slightly more security for new shareholders as a result.

Good value often means lower growth

I often regard value investments as less significant than the best growth investments over the long term. That’s because if something is amazingly valued, it’s likely that there’s a reason for this. Computacenter arguably has a price-to-earnings ratio of around 16, which is low for its industry, due to the fact most investors understand its future is not as bright as big tech companies developing AI and cloud computing infrastructure.

In fact, Computacenter needs to be careful moving forward. A heavy use of AI within workforces could mean many of its services become redundant, replaced by chatbots, automated management, and even AI consultants. Therefore, I’ll be monitoring management’s strategy carefully to see how it begins to adjust to these looming risks.

Investing is nothing without growth

I’m pleased to say that overall, I think the investment offers even better growth prospects than it does in value.

For example, it has managed to grow its earnings per share by roughly 11.5% per annum over the last three years. For comparison, the market-leading Kainos has only managed a growth rate of roughly 8% a year over the period.

That growth comparison is quite significant because Computacenter is older than Kainos. A big part of the reason it has managed to continue to prosper despite its size is its effective strategy of international expansion. If it can keep this up, shareholders could continue to be rewarded well.

It’s good, but not the best

In my opinion, Computacenter is a great potential investment at this time. However, I have to be honest, it doesn’t quite make the cut for my portfolio. I own portions of only 10 companies, and in the technology space, I consider Alphabet to be the strongest overall growth and value opportunity in the world right now. It’s my second largest holding, second only to LVMH.

This post was originally published on Motley Fool