At £16.59, the GSK (LSE: GSK) share price is 8.6% off its 52-week high. Despite it still being up 12.1% in 2024, could the pharmaceutical giant be the biggest bargain that the FTSE 100 has to offer?

Potentially. There are a few ways to go about answering that question. Let’s delve in.

Valuation

Arguably the most important way to answer my question is to look at fundamentals such as valuation. There are multiple methods available for valuing a stock. One is the key price-to-earnings (P/E) ratio.

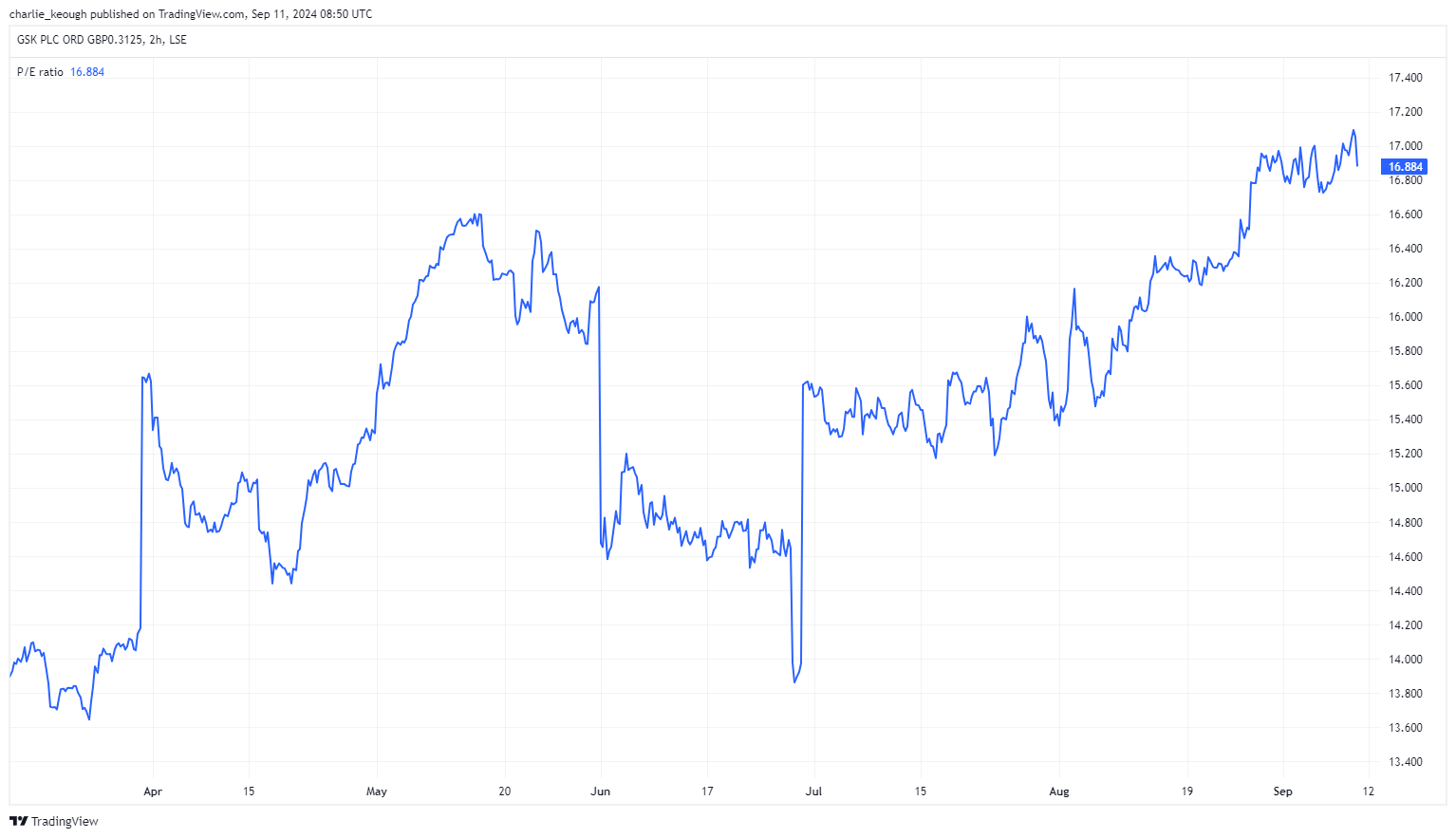

Assessing GSK’s P/E, the stock looks like good value for money. As seen below, it trades at a P/E of 16.9. Granted, that’s higher than the Footsie average of 11. Nonetheless, it’s significantly cheaper than a host of its peers including AstraZeneca (39.4) and Zoetis (37.5).

Created with TradingView

Dividend yield

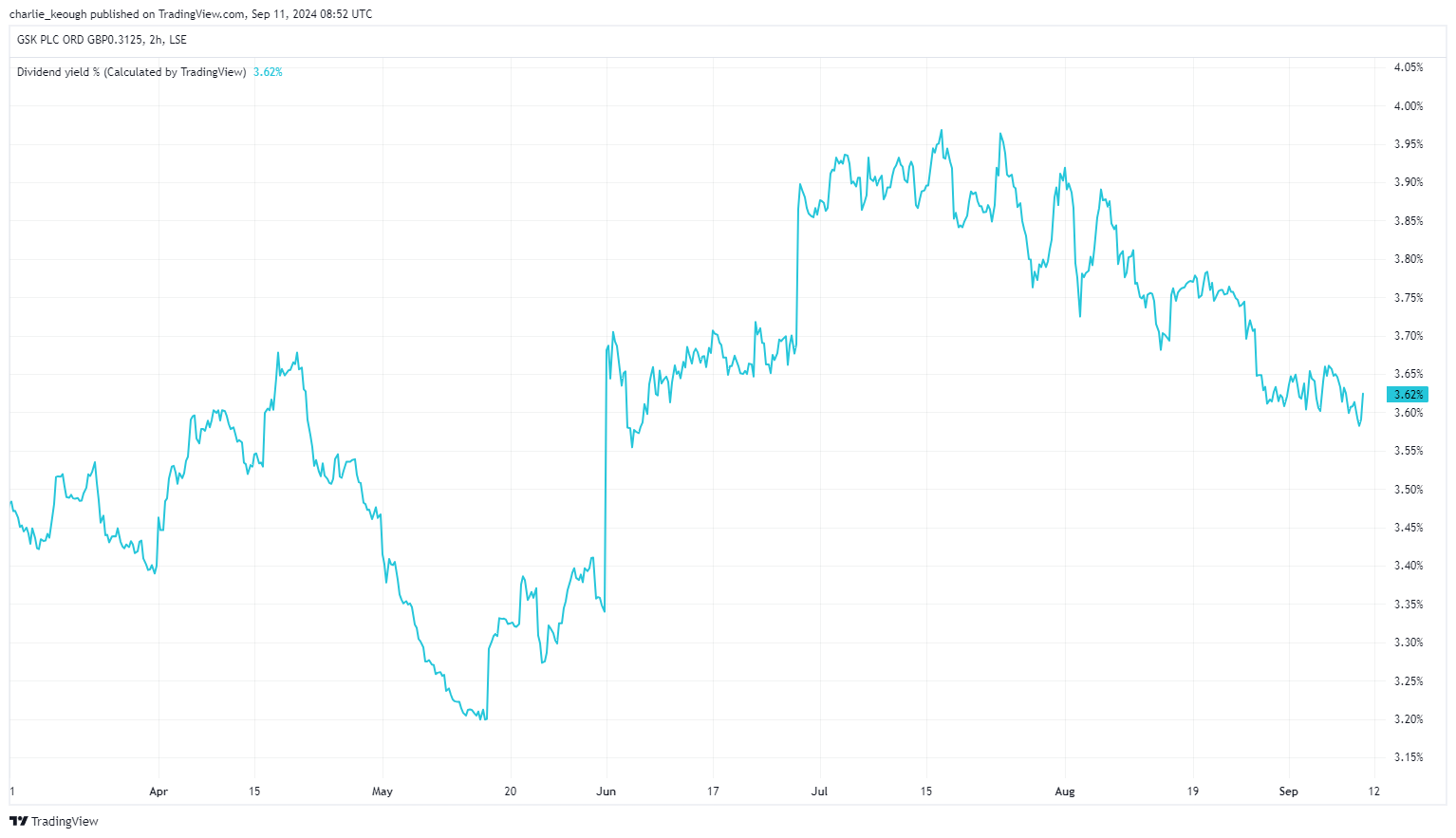

In tandem with its solid valuation, I also like the passive income on offer. As the chart below highlights, the stock yields a healthy 3.6% dividend.

That’s in line with the FTSE 100 average. Furthermore, it’s also higher than AstraZeneca’s 1.8% yield and Zoetis’ 0.9% payout. Looking ahead, it’s predicted that GSK’s dividend will rise to 4.1% by the end of 2026.

Created with TradingView

The risks

Based on the above, GSK looks like a stock well worthy of further investigation. But what’s been holding its share price back in the last couple of months?

The main factor is its potential litigation issues with Zantac. It’s a heartburn drug that was removed from the market in 2019 due to its links with causing cancer. While the firm had settled previous lawsuits related to the drug, in late May, a US court ruled that 72,000 new lawsuits could move forward.

GSK continues to state that there is no consistent evidence that Zantac provides any risk of cancer. That said, the ruling wiped £7bn off the stock’s value in a single day. It has also been predicted it could cost the firm up to £3bn in settlement fees.

Growing pipeline

Legal challenges are always a threat when investing in pharma stocks. So, I’ll be watching closely over the months ahead to see how it unfolds.

But even with this challenge, GSK continues to grow its pipeline, which I like to see. In its latest results, it stated it has now secured approvals or filings for 10 “major opportunities”. It’s for reasons such as this that it lifted its full-year guidance. Sales growth should now come in between 7% and 9%.

A bargain?

Right now, I think the FTSE 100 is full to the brim with bargains. So, would I say GSK is the biggest bargain on the index? I don’t think so.

However, that’s not to say I wouldn’t strongly consider buying the stock today if I had the cash. In fact, it’s a business I really like the look of.

GSK looks like it could face challenges in the months ahead. However, as a long-term buy, I think the stock could be a shrewd purchase today. I’m largely drawn in by its solid valuation, healthy passive income on offer, and growing pipeline.

This post was originally published on Motley Fool