BT‘s (LSE:BT.A) shot up since May’s bullish update and outlook statement from the company, but the stock still looks attractive for passive dividend income.

With the telecom company’s share price near 139p (26 June), the forward-looking dividend yield for the trading year to March 2026 is almost 5.8%.

That’s tempting in itself. But after chief executive Allison Kirkby’s assessment last month, I reckon there’s a good chance of incremental dividend growth in the coming years.

Recovery and growth

So shareholders may be able to lock in a decent and growing passive income from that dividend. But there’s the possibility of capital gains from a rising share price too.

It’s happened before. BT looked like it was on the floor in spring 2009 after the credit-crunch and during that decade’s ‘great’ recession. But between then and the end of 2015, the stock rose by more than 500%.

However, one of the ongoing worries is the company’s mountain of debt on the balance sheet. That’s been fuelled by the need to invest so much money into next-generation networks, including the massive full-fibre broadband rollout.

So Kirkby’s assertion that the firm has now passed peak capital expenditure (capex) on the fibre network came as a relief to the market. I reckon that’s what the strong rally in the shares has been all about.

Such sudden moves higher often put off value-oriented investors. That’s understandable. But one argument is the fundamentals and outlook of the business have improved. Therefore, the up-rating looks justified.

The company’s £3bn cost and service “transformation” programme was completed a year ahead of schedule. And the business has reached “the inflection point”, regarding its long-term strategy, Kirkby said.

Increasing free cash flow

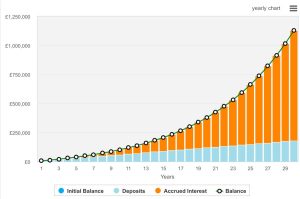

It’s been well reported, but now the firm reckons it can more than double its normalised free cash flow over the next five years.

Nothing’s guaranteed and the business may yet run into more unforeseen challenges along the way. For example, a down-turn in the economy would almost certainly sink the share price again.

Nevertheless, forecasts for better free cash flow strike me as a supportive factor for ongoing growth in the dividend – perhaps the most important factor of all.

After years of nose-wrinkling, I’m finally starting to believe that BT may be capable of passing my sniff test. Things feel different to me now. This turning business may be entering an enduring period of recovery and growth (I hope).

Looking ahead, Kirkby said the company’s sharpening its focus and “accelerating” the modernisation of its operations. It’s also aiming to optimise its global business operations.

Overall, Kirkby reckons BT’s now positioned to generate “significant” growth. And, on balance and despite the risks, I think the stock has the potential to deliver decent passive income for its shareholders via an ongoing stream of dividends.

However, despite my enthusiasm, I’d stop short of calling it a no-brainer because all stocks have the potential to disappoint as well as to delight. But I see it as worthy of further research.

This post was originally published on Motley Fool