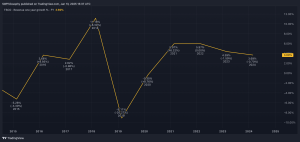

Shell’s (LSE: SHEL) share price is down 11% from its 13 May one-year traded high of £29.56. The fall echoes a similar decline in the benchmark Brent oil price over the same period.

I think this bearish performance is down to three factors. However, none of them are necessarily set to endure, in my view.

This means the currently reduced price of Shell’s shares may present me with a tremendous bargain-buying opportunity.

Why is the stock down?

I think the first reason for the fall in Shell’s share price and the oil price is simple supply and demand economics. Despite supply cuts from oil cartel OPEC, demand from the world’s biggest oil buyer – China – is down from historical averages.

However, as a former investment bank trader, I know that all markets’ supply and demand balance shifts constantly. I expect the oil market’s balance will tilt again, especially as reduced investment due to the energy transition hits supply.

The second reason behind the declines is the recent lowering of geopolitical tensions in the oil-rich Middle East. That said, I do not believe that Israel’s attacks against Iran’s proxies will continue to go unanswered. I also believe the situation in Syria after the removal of Bashar al-Assad as president looks extremely volatile.

And the final reason for the falls is President-elect Donald Trump’s promise to increase oil drilling in the US. This may well mean a lower price per barrel of oil. But his promise to speed up the approvals process for new projects should also means greater profits can be made by drilling more.

How undervalued are the shares?

I always begin my assessment of a stock’s value by comparing its pricing with competitor stocks on key measures.

For example, Shell trades on the key price-to-earnings ratio at just 12.8 compared to a peer average of 14.9. So, it looks a bargain on this basis.

The same is true on the price-to-book and price-to-sales ratios. On the former, Shell trades at 1.1 against a competitor average of 2.6. And on the latter, it is at 0.7 compared to a 2.2 peer average.

The next part of my evaluation looks at whether Shell’s stock is undervalued to where it should be, based on future cash flow forecasts. A discounted cash flow analysis shows the shares are 44% undervalued at their current £26.26 level.

Therefore, the fair value for them is technically £46.04, although market unpredictability may move them lower or higher.

How does the core business look?

A risk to Shell is that it fails to leverage its impressive US oil, gas and petrochemicals projects into even greater profits under Trump’s second presidency.

However, despite the lower oil price this year, the firm remains a profit powerhouse. Its latest (Q3 2024) results saw adjusted earnings (the firm’s net profit number) rise 12% year on year to $6.03bn (£4.76bn). This was also way ahead of analysts’ estimates of $5.36bn.

Over the same period it also reduced its net debt by 13% to the lowest level since 2015. Additionally positive was cash flow from operations jumping 19% to $14.68bn.

Given these strong figures and low share price valuation, I believe the stock is too good an opportunity to miss. So, I will buy more very soon.

This post was originally published on Motley Fool