FTSE 100 heavyweight British American Tobacco (LSE: BATS) has fallen out of favour over the past few years. Since its 6 June 2017 all-time traded high on the leading index of £56.39, it has dropped 47%.

This broadly aligns with the societal shift in many countries away from cigarette smoking. However, as a former heavy smoker, I see this as no reason not to buy the stock.

On the contrary, I regard the big dividend income it generates me as some payback for the enormous sums I spent on its products over the years!

Additionally, the huge decline in the share price since 2017 has left it looking extremely undervalued to me.

How does the core business look?

Ultimately, earnings growth powers a firm’s share price and dividend higher over time.

A risk here for British American Tobacco is any stalling in its ongoing switch to New Category products. These are focused on nicotine replacement items. Such a delay would allow its key competitors who are doing the same thing to gain an advantage.

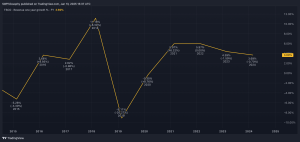

Nonetheless, analysts forecast the firm’s earnings will increase by a stunning 44.1% each year to the end of 2027.

How undervalued are the shares now?

My starting point in ascertaining whether a stock is undervalued is to look at how it compares to its competitors on key valuation measures.

On the price-to-sales ratio, British American Tobacco currently trades at 2.5 against a peer average of 3.2. So, it looks undervalued on this basis.

The same applies to the price-to-book ratio, on which it trades at only 1.1 compared to a 2.9 competitor average.

Next in this process, I look at how undervalued the firm seems based on its future forecast cash flows. Right now, this discounted cash flow (DCF) analysis shows British American Tobacco shares are 55% undervalued at their present price of £29.68.

So a fair value for them is technically £65.96, although they may go lower or higher, given market vagaries.

How much dividend income can be made?

Investors considering a £9,000 stake in British American Tobacco – the same as mine initially – would make £10,779 in dividends after 10 years. Over 30 years, this would rise to £86,532. Adding in the £9,000 first investment, the total value of the holding would be £95,532.

This would pay an annual dividend income by that point of £7,547, or £629 a month.

It is important to note that these figures are based on two assumptions. One is that the dividends paid are used to buy more of the firm’s shares – known as ‘dividend compounding’. The second is that the yield averages the same over the periods, but this is not guaranteed.

That said, analysts’ forecasts are that the dividends will rise to 246.3p in 2025, 257.3p in 2026 and 290.7p in 2027.

These would give respective yields based on current share price of 8.3%, 8.7% and 9.8%.

Will I buy more of the shares?

I am happy with the risk-reward balance of my present portfolio, which includes a sizeable stake in British American Tobacco.

However, if I did not have this, I would buy the stock today based on its huge earnings growth potential.

I think this is likely to propel its share price and dividend significantly higher over time.

This post was originally published on Motley Fool