Shares in the FTSE 250’s abrdn (LSE: ABDN) are down 11% from their 12-month 31 January traded high of £1.70. Given that a stock’s yield rises as its price falls, its annual return is up to 9.7%.

However, analysts forecast its 2023 dividend of 14.6p will remain until the end of 2027. Indeed, it has been at this level since 2020.

To me, this makes it an unmissable passive income gem in my portfolio geared to generating such returns. These are derived from minimal effort on my part, aside from choosing the stocks and monitoring their progress.

How much passive income can be made?

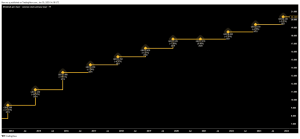

Investors considering a £10,000 stake in abrdn would make £970 in first-year dividends. If the yield averaged the same 9.7% over 10 years, this would rise to £9,700. And on the same basis it would increase to £29,100 after 30 years.

This is much more than could be made from any UK standard savings account. But vastly more could be made using a common investment technique known as ‘dividend compounding’.

The magic of dividend compounding

This process simply involves reinvesting the dividends paid by a stock right back into it. It is similar to leaving interest in a savings account to grow.

By utilising this method on an average 9.7% yield, annual dividends would be £16,277 after 10 years, not £9,700. And after 30 years on the same basis, these would be £171,433, rather than £29,100.

Adding in the initial £10,000 investment and the abrdn holding would be worth £181,433 by that point. If the 9.7% yield were still in place, the shares would pay £17,599 a year in dividend income.

What about the share valuation?

abrdn currently trades at a price-earnings (P/E) ratio of just 8.3. This is bottom of its group of competitors, which averages 33.8. These comprise RIT Capital Partners at 11.9, M&G at 29, Bridgepoint Group at 45.5, and Legal & General at 48.8.

So, it looks very undervalued on this basis.

The same can be said for its key price-to-book ratio of 0.5 against a peer average of 2.4. And it is also true of its price-to-sales ratio of 1.9 against the 4.9 average of its competitors.

I ran a discounted cash flow analysis to put all this into a share price context. Using other analysts’ figures and my own, this shows the stock is 18% undervalued at its present £1.51 price.

So its fair value is technically £1.84, although market vagaries may push it lower or higher than that.

The major reorganisation

abrdn is on a mission to reduce costs, improve its client offering, and increase profitability.

Its 21 January Q4 trading update showed it has cut £100m+ in costs so far. It is on track to hit its £150m target by the end of 2025.

Additionally positive was that net inflows of client cash jumped £1.2bn in the quarter. This means it now has £511.4bn in assets under management and administration.

I think the principal risk in the stock is if this ambitious reorganisation fails or simply falls short.

However, its H1 2024 results showed an IFRS post-tax profit of £171m compared to a £145m loss in H1 2023.

Consequently, I will be buying more shares of abrdn very soon.

This post was originally published on Motley Fool