It’s possible to earn a decent second income by investing just £5 a day in the stock market. All it takes is some time and dedication — and a well-balanced portfolio of shares, of course.

The FTSE 100 and FTSE 250 are great places to start looking for dividend shares that pay regular returns to shareholders. Across the pond, the S&P 500 is host to a wealth of high-growth stocks brimming with potential.

But pick the wrong stocks and it could lead to disaster. So how can investors ensure a safe and reliable average return?

Being realistic

Investing everything in parabolic stocks like Nvidia may work for a short while but that’s not a sustainable strategy. The high flyers come and go and when they crash, they often crash hard.

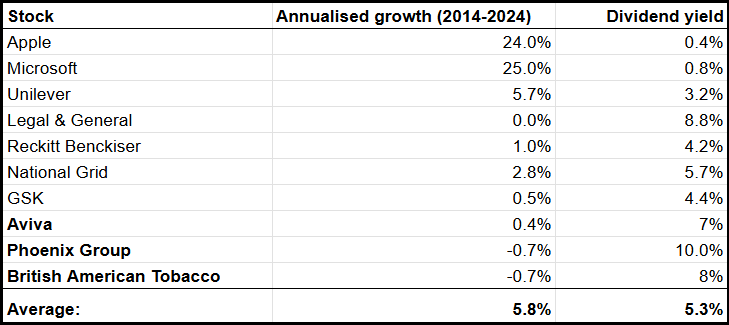

Of course, it doesn’t hurt to include some reliable US growth stocks like Apple or Microsoft.

But including a few safety parachutes on any investment voyage is equally important. These are cleverly known as defensive stocks. They are the well-grounded, realistically-priced foundation of any decent portfolio. Such stocks usually keep delivering a steady stream of income no matter what’s going on around them.

They’re that stable, reliable friend who’s always there when needed. Two of my favourites are Unilever and GSK.

To finish, investors might consider a few good dividend shares to achieve a higher-than-average yield. The FTSE 100 has a wealth of dividend gems like Legal & General, National Grid and Reckitt Benckiser (LSE: RKT).

A dedicated dividend payer

Reckitt’s long been a reliable dividend payer, consistently increasing dividends almost every year since 2004. With the share price slipping 13% this year, it’s currently trading at an estimated two-thirds of its fair value.

The price took a hit earlier this year after a lawsuit related to its Enfamil baby formula led to a costly fine. That issue appears to be resolved now but such risks are ever-present in health-related industries. Then, problems were compounded in July when a tornado hit one of its warehouses, causing supply chain issues – another perennial risk. The fallout wiped an estimated £100m off its balance sheet. Yikes!

Yet through it all, it has remained dedicated to delivering shareholder returns through dividends. And the stock looks to be recovering now and could do better next year, with earnings forecast to grow 10%.

A £10k second income

Some top S&P 500 stocks return 25% a year while the FTSE average is closer to 5%. Dividend shares usually have low growth but yield between 4% and 10%. Keeping in mind, past performance isn’t indicative of future results.

Altogether, an investor could realistically aim for around 6% growth with a 5% average yield. With that portfolio, a fiver a day can make a big difference. All it needs is the special ingredient — compounding returns.

By contributing daily and reinvesting the dividends for 25 years, a portfolio that maintained those averages could grow to £237,158!

A dividend yield of 6% on that amount equates to £10,790 a year. That’s a pretty decent chunk of spare change for retirement — and all it takes is just one less coffee or pint a day.

This post was originally published on Motley Fool