Given the current state of world affairs, I am convinced the U.S. will be drawn into World War III within the next few years, regardless of who wins the election. Assuming this premise is accurate, what would be the best strategy to prepare for such circumstances financially? I believe this to be a legitimate concern. I would prefer a politically neutral answer, if possible.

Dear Pessimist,

Every investor has their own risk tolerance based on personal, economic and political factors. If you truly, madly, deeply believe that there is some type of storm approaching, I imagine you must be worried about your investments. Economists say CDs and high-yield savings accounts can offer some hedge against inflation and might also give you some peace of mind if you believe there’s a major geopolitical upheaval on the horizon that could affect the stock market.

Even if others don’t believe our civilization is as fragile as you do, your question is still instructive, because my answer applies to any major event that could lead to stock markets tumbling worldwide — and that is that every analyst has their own suggestions. Some say to diversify your portfolio, some recommend that you invest in defense stocks and consumer-staples stocks, while others advise maintaining a healthy emergency fund that will last you at least 12 months and paying off as many debts as you possibly can, particularly high-interest personal loans and credit cards.

First, a disclaimer: I’m not going to tell you what to do with your money or where to invest it. That’s your choice, and I take no responsibility for that. However, within the limits of my remit and duty of care as an advice columnist, I can give you a lay of the land, based on what financial analysts and economists say tends to happen during times of extreme market turbulence — and what has happened during past events that rocked global financial or political systems, such as wars and financial meltdowns.

Your question applies to any major event that could lead to stock markets tumbling worldwide.

Investors who share your worries and are seeking security could look at assets with a defined or predictable supply that would see a rise in demand, says Will McDonough, chair and founder of merchant bank Corestone Capital. He says critical minerals — gold, as well as energy commodities like oil and gas — “are all supplies whose access could be impeded through global conflict” and, as such, could see a sharp increase in demand.

Hopefully the cataclysmic turn of events you envision won’t come to pass, but I can understand your fears given the current instability in the Middle East and Russia’s ongoing war in Ukraine. I can’t speak to the shifts in the global geopolitical landscape, but I do know that anyone who predicted a global pandemic in 2019, a period of rising inflation, ultralow interest rates, a real-estate boom and subsequent stock-market volatility might have been seen as a Cassandra.

If what you fear comes to pass — and that’s a monumental “if” — some economists say to prepare for a period of heady inflation. In a 2021 study, the Center for Economic Policy Research said, “The economic consequences of COVID-19 are often compared to a war, prompting fears of rising inflation and high bond yields.” The study goes on to say: “However, historically, pandemics and wars have had diverging effects.” Looking at the world’s 12 largest wars and pandemics, it says, inflation and bond yields have typically risen during and after wars.

Related: From Pearl Harbor to Sept. 11, here’s how stocks typically react to the outbreak of wars

You are not alone in your fears. This report by the Commission on the National Defense Strategy, a bipartisan commission appointed by Congress, warned that China and Russia are major powers that seek to undermine U.S. influence. “The threats the United States faces are the most serious and most challenging the nation has encountered since 1945 and include the potential for near-term major war,” the report said. “The United States last fought a global conflict during World War II, which ended nearly 80 years ago. The nation was last prepared for such a fight during the Cold War, which ended 35 years ago. It is not prepared today.”

A review of federal spending after 9/11 looked at the impact of spending on the Iraq and Afghanistan wars and the national debt. “The increased military spending following 9/11 was financed almost entirely by borrowing,” researchers with the Watson Institute for International & Public Affairs at Brown University wrote. “Rising deficits have resulted in higher debt, a higher debt-to-GDP ratio and higher interest rates.”

And don’t bet the house on cryptocurrency. The North American Journal of Economics and Finance published an analysis of crypto and the geopolitical instability wrought by Russia’s invasion of Ukraine in 2022. It found that “crypto assets primarily show weak safe-haven properties for the commodity market and strong safe-haven properties for foreign exchange … but cannot be effectively used by investors to diversify their stock portfolios during times of war.”

All of these suggestions from economists add up to that boring D-word: diversification.

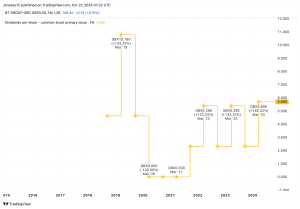

In the U.K.’s Telegraph newspaper, financial editor Tom Stevenson suggests old favorites like gold — which has risen by more than 20% this year and is a pretty liquid commodity compared with other asset classes — and developed-market bonds. “The risk of the U.S. or U.K. government defaulting on their debts is virtually nil because they print their own currencies,” he wrote in an August column on safe-haven assets. “Bonds typically deliver a smoother return than equities.”

“The attraction of cash today is that it still offers an attractive yield. Money market funds increase capital risk very marginally compared to a deposit account, but will help to prolong the yield premium once rates start to come down,” he added. “The main disadvantage of cash, historically, has been its failure to keep pace with rising prices. In the long run this problem is likely to re-emerge.” Gold is liquid, he noted, but its disadvantages include “lack of income, its volatility, and its sensitivity to the dollar.”

Some readers might ask: “Why am I reading advice to a man who believes we’re about to enter a period of major political instability when I live in one of the oldest democracies in the world?” The answer is simple: Because this advice applies in times of peace, too. All of these suggestions from economists add up to that boring D-word: diversification. You can try to hedge your bets by investing in shares of food, utilities, defense, consumer-staple and pharmaceutical companies, as some suggest, but your strategy for a global shock should leave plenty of room for error.

You can email The Moneyist with any financial and ethical questions at qfottrell@marketwatch.com, and follow Quentin Fottrell on X, the platform formerly known as Twitter.

The Moneyist regrets he cannot reply to questions individually.

More columns from Quentin Fottrell:

Check out The Moneyist’s private Facebook group, where members help answer life’s thorniest money issues. Post your questions, or weigh in on the latest Moneyist columns.

By emailing your questions to The Moneyist or posting your dilemmas on The Moneyist Facebook group, you agree to have them published anonymously on MarketWatch.

By submitting your story to Dow Jones & Co., the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

This post was originally published on Market Watch